The expanding medical sector worldwide presents significant opportunities for the growth and expansion of polyglycolic acid applications. As per the data provided in 2023 by the Government of Canada, to enhance health care services for Canadians, the government announced an investment of $196.1 billion over ten years, including $46.2 billion in new funding, for provinces and territories. Polyglycolic acid (PGA) is widely used in manufacturing absorbable sutures used in surgical procedures to stitch wounds or incisions. Consequently, the medical segment would utilize 38,334.1 tonnes of Polyglycolic Acid by 2031. Unlike traditional sutures made from non-absorbable materials like nylon or silk, PGA sutures are designed to degrade over time within the body, eliminating the need for suture removal and reducing the risk of complications.

The escalating environmental concerns and tightening regulations regarding plastic pollution have become pivotal drivers pushing industries towards adopting eco-friendly packaging materials like polyglycolic acid (PGA). As global awareness of environmental issues continues to rise, businesses are increasingly pressured to mitigate their environmental footprint, particularly in the packaging sector, which historically has been a significant contributor to plastic waste. Additionally, Biotechnology offers scalable production platforms that can be easily adapted to meet growing market demands for PGA. By leveraging bioreactor systems with higher capacities and implementing robust downstream processing techniques, manufacturers can scale up PGA production while maintaining cost efficiency and product quality. Thus, these factors will drive the expansion of the market.

However, the competition from alternative biodegradable polymers like polylactic acid (PLA) and polyhydroxyalkanoates (PHA) presents a significant challenge to the market. PLA and PHA, like PGA, offer environmental benefits such as biodegradability and renewable sourcing. However, if end users perceive PLA or PHA as more environmentally friendly or sustainable due to marketing efforts or misconceptions, they may preferentially choose these alternatives over PGA despite PGA's comparable environmental credentials. Therefore, these factors can cause a downturn in the market.

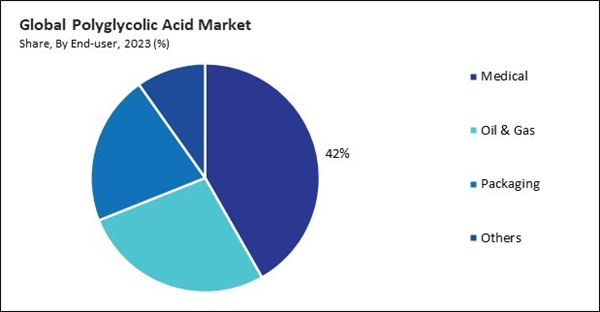

End User Outlook

On the basis of end-user, the market is divided into medical, oil & gas, packaging, and others. The medical segment recorded the maximum 42% revenue share in the market in 2023. In terms of volume, the medical segment would utilize 38,334.1 tonnes of Polyglycolic Acid by 2031. One of the primary applications of PGA in the medical sector is producing absorbable sutures. PGA sutures gradually degrade in the body over time, eliminating the need for suture removal surgeries and reducing patient discomfort. Therefore, these factors can boost the demand in the segment.Form Outlook

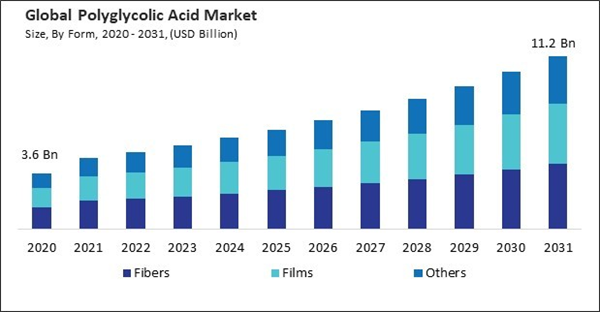

Based on form, the market is segmented into fibers, films, and others. In 2023, the films segment garnered a significant 34.2% revenue share in the market. In terms of volume, the films segment would utilize 33,458.4 tonnes of by 2031. PGA films offer a biodegradable alternative to conventional petroleum-based plastics, allowing end-users to reduce their carbon footprint and mitigate environmental impact. Thus, the segment will expand rapidly in the upcoming years.Regional Outlook

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. The North America segment procured a 46% revenue share in the market in 2023. In terms of volume, the North America region would utilize 42,308.4 tonnes of Polyglycolic Acid by 2031. Over the years, significant investments have been made in research and development to enhance PGA production processes, improve material properties, and explore new applications.List of Key Companies Profiled

- BMG Incorporated

- Huizhou Foryou Medical Devices Co., Ltd. (GL Capital Group)

- Unisur Lifecare Pvt Ltd

- Orion Sutures India Pvt Ltd

- Kureha Corporation

- Shenzhen Polymtek Biomaterial Co., Ltd

- Haihang Industry Co., Ltd. (Haihang Group)

- Polysciences, Inc.

- Teleflex Incorporated

- Merck KGaA

Market Report Segmentation

By Form (Volume, Tonnes, USD Billion, 2020-2031)- Fibers

- Films

- Others

- Medical

- Oil & Gas

- Packaging

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- BMG Incorporated

- Huizhou Foryou Medical Devices Co., Ltd. (GL Capital Group)

- Unisur Lifecare Pvt Ltd

- Orion Sutures India Pvt Ltd

- Kureha Corporation

- Shenzhen Polymtek Biomaterial Co., Ltd

- Haihang Industry Co., Ltd. (Haihang Group)

- Polysciences, Inc.

- Teleflex Incorporated

- Merck KGaA