The trend towards urbanization in Europe has led to smaller living spaces and increased indoor living for pets. The Europe region would acquire 29.75% revenue share in 2031. Also, the Europe region would utilize 2,51,772.26 thousand units of Pet Toys by 2031. As a result, there is a growing demand for indoor pet toys suitable for apartment living and providing opportunities for exercise and enrichment in confined spaces. Hence, owing to these factors, the segment will witness increased demand in the upcoming years.

With rising disposable incomes and evolving lifestyles worldwide, there has been a notable increase in pet ownership rates across various demographics. Pet owners seek toys that accommodate indoor play, address behavioral needs, and promote bonding activities between pets and their human companions. Thus, owing to these factors, there will be enhanced demand in the market.

Additionally, in today’s pet-centric culture, pet owners prioritize their furry companions’ physical and mental health as integral to their overall well-being. By combining playtime with dental care, these toys offer a convenient and enjoyable way for pet owners to address their pets’ oral hygiene needs. Hence, the market will grow rapidly in the coming years.

However, as pet ownership costs rise due to veterinary care, food, grooming, and pet insurance, pet owners may prioritize essential expenses over discretionary purchases like toys. DIY toys offer a cost-effective alternative to store-bought toys, allowing pet owners to provide enrichment and stimulation for their pets at minimal cost, thereby reducing the demand for commercially manufactured toys. Hence, these factors will decrease demand for toys in the coming years.

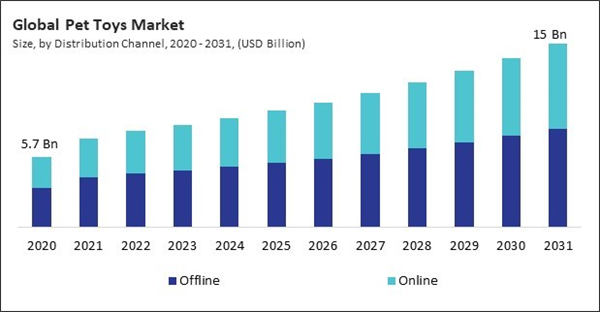

Distribution Channel Outlook

Based on distribution channel, the market is bifurcated into online and offline. In 2023, the online segment witnessed 44.4% substantial revenue share in the market. In terms of volume, the online segment consumed 2,09,879.19 thousand units in 2023. Online retailers offer a vast selection of toys providing consumers with unparalleled choice and flexibility. As per the State Council of China, the nation’s e-commerce transaction volume totaled 43.83 trillion yuan (about 6.17 trillion U.S. dollars) in 2022, up from 31.63 trillion yuan in 2018. Therefore, these factors will pose lucrative growth prospects for the segment.Type Outlook

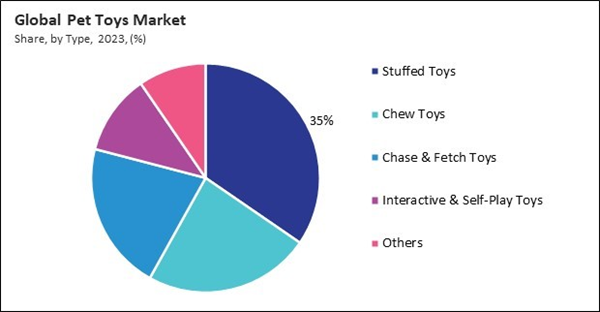

Based on type, the market is segmented into interactive & self-play toys, stuffed toys, chew toys, chase & fetch toys, and others. In 2023, the chew toys segment garnered 23.5% significant revenue share in the market. In terms of volume the chew toys segment consumed 97,908.10 thousand units in 2023. The chew toys promote chewing and gnawing, help remove plaque and tartar buildup, prevent gum disease, and maintain healthy teeth and gums. Veterinarians emphasize the importance of supporting their pets’ dental health. Hence, these factors can boost the demand in the segment.Pet Outlook

Based on pets, the market is divided into dogs, cats, birds, and others. In 2023, the cat segment witnessed 32.58% substantial revenue share in the market. In terms of volume the cat segment consumed 1,44,990.66 thousand units in 2023. The number of cat owners has been steadily increasing, with cats ranking among the most popular pets globally. As more households’ welcome cats into their homes, there is a corresponding rise in demand for toys that provide enrichment, stimulation, and entertainment for them. Thus, owing to these factors, there will be enhanced demand in the segment.By Regional Outlook

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. The North America segment procured 38.87%, the highest revenue share in the market in 2023. In terms of volume the North America region consumed 1,70,651.92 thousand units in 2023. North America has a strong culture of pet ownership, with a large percentage of households welcoming pets into their homes. Dogs, cats, and other companion animals are considered valued family members, leading to increased spending on pet care products, including toys. Thus, these factors will fuel the demand in the segment.Recent Strategies Deployed in the Market

- Nov-2023: Central Garden & Pet Company completed the acquisition of TDBBS, LLC, a company engaged in manufacturing pet related products. Through this acquisition, Central Garden & Pet Company incorporated bully and collagen sticks, bones, and jerky, into its product portfolio. Additionally, this acquisition assisted Central Garden & Pet Company in expansion and market diversification.

- Aug-2023: Spectrum Brands Holdings, Inc. introduced Meowee! cat treats, offering a range of textures and delicious flavors to make treat time enjoyable for both cats and their owners. The new product is designed to strengthen the bond between pet parents and their feline companions, providing a delightful way to express affection and nurture closeness.

- Aug-2023: Benebone LLC introduced its latest chew offering, the Benebone Ring. The new product has the irresistible taste of 100% real bacon and a circular design with a smart pocket that ensures the Ring remains elevated from the ground for convenient handling. Additionally, the new product incorporates textured ridges designed to promote dental health by assisting in the cleaning of the dog's teeth.

- Jan-2021: Central Garden & Pet Company completed the acquisition of DoMyOwn.com, an online retailer of professional-grade control products. Through this acquisition, Central Garden & Pet Company incorporated DoMyOwn's professional-grade control business augments into its portfolio while also introducing a state-of-the-art eCommerce fulfilment platform and advanced digital capabilities. Additionally, this acquisition helped Central Garden & Pet Company in establishing its position in the control product segment.

- Nov-2020: Pets at Home Group Plc completed the acquisition of The Vet Connection, a leading provider of veterinary telehealth services. Through this acquisition, Pets at Home Group enhanced its digital offerings and streamlined pet care services for their customers.

List of Key Companies Profiled

- Unicharm Corporation

- Benebone LLC

- The Kyjen Company, LLC (J.W. Childs Associates, L.P.)

- Doskocil Manufacturing Company, Inc.

- Pets at Home Group Plc

- Spectrum Brands Holdings, Inc.

- KONG Company

- Chewy, Inc.

- Central Garden & Pet Company

- Coastal Pet Products, Inc.

Market Report Segmentation

By Distribution Channel (Volume, Thousand Units, USD Billion, 2020-2031)- Offline

- Online

- Stuffed Toys

- Chew Toys

- Chase & Fetch Toys

- Interactive & Self-Play Toys

- Others

- Dog

- Cat

- Bird

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Unicharm Corporation

- Benebone LLC

- The Kyjen Company, LLC (J.W. Childs Associates, L.P.)

- Doskocil Manufacturing Company, Inc.

- Pets at Home Group Plc

- Spectrum Brands Holdings, Inc.

- KONG Company

- Chewy, Inc.

- Central Garden & Pet Company

- Coastal Pet Products, Inc.