In 2023, the Europe segment acquired a considerable revenue share in the nasal splints market. Europe is home to some of the world’s leading medical device manufacturers and innovators, contributing to developing advanced nasal splint technologies and solutions. Therefore, the segment generated 28.73% revenue share in 2031. Also, Germany would consume 3,227.40 thousand units of Malleable splints by 2031. Companies in the region have invested in research and development efforts to enhance the design, materials, and functionality of nose splints, resulting in the introduction of more effective and patient-friendly splint solutions. Therefore, these aspects can boost the expansion of the segment.

The prevalence of nasal conditions such as deviated septum, nasal fractures, and nasal valve collapse contributes significantly to the demand for nose splints. Surgical procedures or interventions such as nasal valve reconstruction may be performed to address this issue. Nasal can be used post-surgery to support the reconstructed nasal valves and maintain airflow. Hence, these factors can increase demand. Additionally, Rhinoplasty has become increasingly popular worldwide, driven by cosmetic and functional motivations. Rhinoplasty surgery often results in swelling and edema (fluid retention) around the nasal area. Hence, these factors can boost the growth of the nose splints market.

However, Nasal surgeries can be expensive procedures, often involving costs related to surgeon fees, hospitalization, anesthesia, and postoperative care. Nose splints, being relatively inexpensive compared to surgical interventions, may be viewed favorably in terms of cost-effectiveness, particularly for conditions where splint therapy can provide adequate support, stabilization, or postoperative care without invasive surgery. Thus, these aspects can lead to a downturn in the demand for nose splints in the upcoming years.

Healthcare providers and facilities prioritized COVID-19 testing, treatment, and vaccination efforts, diverting attention and resources from non-COVID-19-related medical interventions, including nasal splint therapy. This reluctance to seek medical attention for nasal conditions contributed to a decline in the demand for nose splints and other related treatments. Therefore, the COVID-19 pandemic had a negative impact on the market.

Mechanism Outlook

Based on mechanism, the market is divided into intranasal and external. In 2023, the external segment witnessed 44.37% revenue share in the market. External splints offer a nonsurgical approach to addressing these conditions, providing mechanical support, and improving nasal airflow without the need for internal manipulation or invasive procedures. The noninvasive nature of external nose splints appeals to patients seeking alternatives to surgery or nasal packing. Hence, these factors will fuel the demand in the segment.Application Outlook

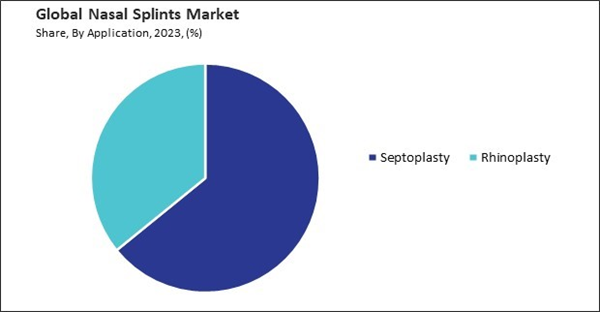

Based on application, the market is divided into rhinoplasty and septoplasty. The rhinoplasty segment recorded 35.85% significant revenue share in the market in 2023. In terms of volume the segment consumed 20,796.4 thousand units in 2023. An emerging pattern exists wherein minimally invasive and functional rhinoplasty techniques take precedence over aesthetic enhancement, respiratory improvement, and nasal function. Functional rhinoplasty procedures addressing nasal obstruction, septal deviation, or nasal valve collapse often involve surgical interventions to improve airflow and nasal function. Thus, these aspects can pose lucrative growth prospects for the segment.Type Outlook

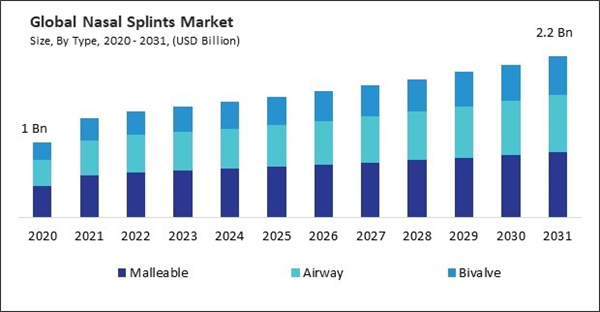

Based on type, the market is segmented into malleable, airway, and bivalve. In 2023, the airway segment garnered 34.90% revenue share in the market. The applications of airway nose splints have expanded beyond traditional indications such as nasal surgery and trauma management to encompass a broader range of clinical scenarios where airway support and stabilization are beneficial. In addition to postoperative splinting following septoplasty or rhinoplasty procedures, airway nose splints are increasingly utilized to manage obstructive sleep apnea (OSA), chronic nasal congestion, allergic rhinitis, and other airway-related conditions.End-user Outlook

Based on end-user, the market is bifurcated into hospitals and outpatients. The hospitals segment held 46.67% significant revenue share in the market in 2023. In terms of volume the segment consumed 25,673.5 thousand units in 2023. As hospitals invest in upgrading their facilities, acquiring advanced medical equipment, and expanding their specialist services, they can increasingly provide comprehensive care for a diverse range of medical conditions, including nasal disorders requiring splint therapy.Material Type Outlook

Based on material type, the market is divided into plastic splints, metal splints, silicon splints, and others. In 2023, the plastic splints segment witnessed 32.79% substantial revenue share in the market. Plastic splints provide a stable and supportive framework for the nasal airway while minimizing tissue irritation and discomfort, making them well-suited for prolonged use in postoperative and post-traumatic settings. The versatility of plastic materials allows for the development of customizable splinting solutions tailored to individual patient anatomy and treatment needs. Hence, the segment will expand rapidly in the coming years.Regional Outlook

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. The North America segment procured 36.80% highest revenue share in the market in 2023. North America has a significant prevalence of nasal conditions such as deviated septum, nasal valve collapse, chronic rhinosinusitis, and nasal trauma, among others. These conditions often require medical or surgical interventions, including nose splints for postoperative support and stabilization. Thus, these factors can contribute to increased growth of the segment.List of Key Companies Profiled

- Olympus Corporation

- Medtronic PLC

- Smith & Nephew PLC

- Surgiform Technology Ltd. (STL Group, Inc.)

- Teleflex Incorporated

- ENTPROMED Healthcare Products Inc.

- E.Benson Hood Laboratories, Inc.

- Audio Technologies SRL (Innovative-RFK Spa)

- Anthony Products Inc.

- Boston Medical Products, Inc. (Bess AG)

Market Report Segmentation

By Mechanism (Volume, Thousand Units, USD Billion, 2020-31)- Intranasal

- External

- Septoplasty

- Rhinoplasty

- Malleable

- Airway

- Bivalve

- Outpatients

- Hospitals

- Silicon Splints

- Plastic Splints

- Metal Splints

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Olympus Corporation

- Medtronic PLC

- Smith & Nephew PLC

- Surgiform Technology Ltd. (STL Group, Inc.)

- Teleflex Incorporated

- ENTPROMED Healthcare Products Inc.

- E. Benson Hood Laboratories, Inc.

- Audio Technologies SRL (Innovative-RFK Spa)

- Anthony Products Inc.

- Boston Medical Products, Inc. (Bess AG)