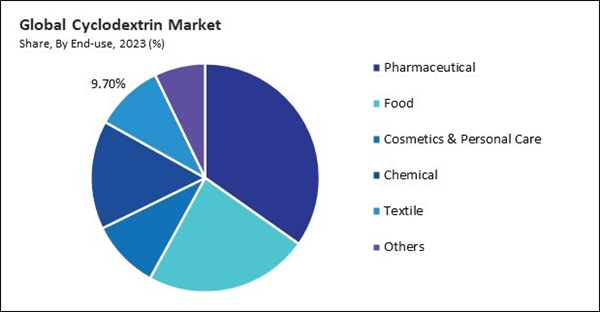

Cyclodextrins are well-known for improving the solubility and bioavailability of poorly soluble drugs. Therefore, the pharmaceutical segment would acquire 34.8% revenue share by 2031. Moreover, the pharmaceutical segment utilized 289.62 Tonnes of Cyclodextrin in 2023. Many active pharmaceutical ingredients (APIs) have limited solubility in aqueous solutions, hindering their absorption and efficacy in pharmaceutical formulations.

Many drugs used to treat infectious diseases face challenges related to poor solubility, which can hinder their effectiveness. Cyclodextrins, with their ability to form inclusion complexes, can improve the solubility of these drugs. In addition, these increase their aqueous solubility by encapsulating poorly soluble drugs within their hydrophobic cavity, making them more bioavailable and efficacious. Thus, increasing drug formulation for infectious diseases drives the market’s growth.

Additionally, as urbanization progresses and incomes rise, there’s a notable shift in dietary preferences towards convenience and processed foods. These find extensive applications in the food and beverage industry as encapsulants for flavors, fragrances, and other functional ingredients. Therefore, the growing middle-class population and urbanization propel the market’s growth.

However, these can uniquely form inclusion complexes with poorly soluble drugs, improving their solubility and bioavailability. This property is particularly valuable in drug delivery systems were increasing the solubility and bioavailability of active pharmaceutical ingredients (APIs) can enhance drug efficacy and therapeutic outcomes. Thus, drug delivery system innovations are propelling the market’s growth.

End-use Outlook

On the basis of end-use, the market is segmented into food, pharmaceutical, cosmetics & personal care, chemical, textile, and others. The chemical segment held 15.4% growth rate in the market in 2023. These have a wide range of applications in the chemical industry. They are utilized as complex agents, solubilizers, stabilizers, and carriers for various chemical compounds. Moreover, in terms of volume, the chemical segment utilized 138.44 Tonnes of Cyclodextrin in 2023.Type Outlook

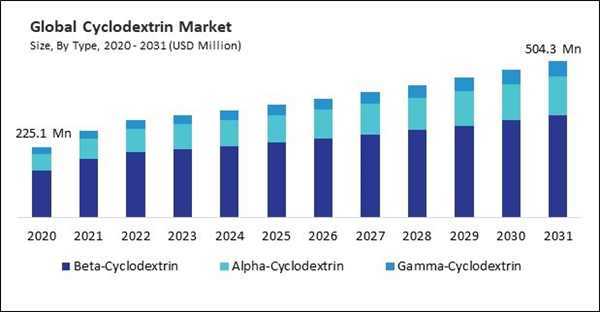

Based on type, the market is divided into alpha-cyclodextrin, beta-cyclodextrin, and gamma-cyclodextrin. The alpha-cyclodextrin segment attained 24.3% revenue share in the market in 2023. Alpha-cyclodextrin offers unique properties that make it particularly suitable for certain applications. Moreover, in terms of volume, the alpha-variant segment utilized 72.57 tonnes of Cyclodextrin in 2023.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2023, the Asia Pacific region generated 27.1% revenue share in the market. Consumers in the Asia Pacific region is becoming increasingly aware of health and wellness trends, leading to a surge in demand for functional foods, dietary supplements, and personal care products with added health benefits. In terms of volume, the Asia Pacific region would utilize 1,22,154.38 tonnes of Cyclodextrin by 2031.List of Key Companies Profiled

- Midas Pharma Gmbh

- Wacker Chemie AG

- Roquette Freres SA

- Cambrex Corporation

- Wellona Pharma

- Cayman Chemical Company, Inc.

- Cyclolab Kft.

- Ligand Pharmaceuticals Incorporated

- Tocopharm Co. Limited

- Merck KGaA

Market Report Segmentation

By Type (Volume, Tonnes, USD Million, 2020-2031)- Beta-Cyclodextrin

- Alpha-Cyclodextrin

- Gamma-Cyclodextrin

- Pharmaceutical

- Food

- Cosmetics & Personal Care

- Chemical

- Textile

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Midas Pharma Gmbh

- Wacker Chemie AG

- Roquette Freres SA

- Cambrex Corporation

- Wellona Pharma

- Cayman Chemical Company, Inc.

- Cyclolab Kft.

- Ligand Pharmaceuticals Incorporated

- Tocopharm Co. Limited

- Merck KGaA