The Asia-Pacific region witnessed robust industrial expansion, particularly in sectors such as pharmaceuticals, agrochemicals, electronics, and specialty chemicals, major consumers of acetonitrile. Consequently, the Asia-Pacific market captured nearly half of the revenue share of the market in 2023. In term of volume, Japan utilized 166.48 hundred Tonnes of Acetonitrile in the market in 2023. The region’s growing population, rising disposable incomes, and urbanization fueled demand for pharmaceuticals, crop protection chemicals, electronic products, and specialty chemicals, driving the need for acetonitrile as a key chemical intermediate and solvent.

Acetonitrile is a primary solvent and intermediate in synthesizing various pesticides that control agricultural crops’ pests, diseases, and weeds. Pesticide formulations often require precise chemical reactions and purification steps, for which acetonitrile provides an ideal medium. Its ability to dissolve a wide range of organic compounds and facilitate synthesis processes makes it indispensable for manufacturing pesticides tailored to address specific agricultural challenges. Therefore, these factors can help in the expansion of the market.

Additionally, Research and development activities in life sciences, particularly in biotechnology and biochemistry, are pivotal in driving the demand for acetonitrile. Peptides are vital molecules in biological research, pharmaceuticals, and biotechnology. Acetonitrile is frequently used as a solvent in peptide synthesis processes, where it helps dissolve and react with peptide-building blocks, facilitating the formation of peptide bonds. Hence, owing to these factors, there will be enhanced demand for acetonitrile in the coming years.

However, as sustainability becomes a focal point for industries worldwide, there’s a growing preference for solvents and processes with minimal environmental impact. This shift is primarily driven by sustainability initiatives implemented by governments, businesses, and consumers, as well as increasingly stringent regulatory requirements to reduce pollution and promote eco-friendly practices. Alternative solvents, such as ethanol, ethyl acetate, and dimethyl carbonate, are gaining traction due to their lower toxicity, reduced environmental footprint, and often comparable performance to acetonitrile in various applications. Therefore, these factors can reduce demand for acetonitrile in the coming years.

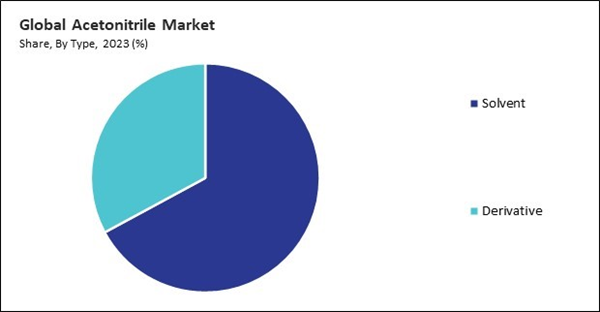

Type Outlook

Based on type, the market is bifurcated into derivative and solvent. In 2023, the solvent segment garnered 61% revenue share in the market. Also, the Russia market utilized 70.08 hundred Tonnes of acetonitrile in the market in 2023. Acetonitrile’s excellent solvating properties, low viscosity, and high chemical stability make it an ideal solvent for dissolving and recrystallizing organic compounds, facilitating chemical reactions, and purifying reaction mixtures. Thus, these aspects will drive the expansion of the segment.Application Outlook

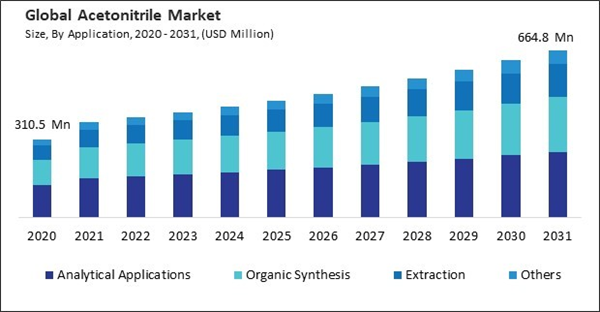

On the basis of application, the market is divided into organic synthesis, analytical applications, extraction, and others. The organic synthesis segment recorded a 32.5% revenue share in the market in 2023. Additionally, the Spain market utilized 16.95 hundred Tonnes of acetonitrile as solvent in 2023. Acetonitrile is crucial in synthesizing specialty chemicals, including solvents, polymer precursors, and performance additives. Therefore, the segment will expand rapidly in the coming years.End-user Outlook

Based on end-user, the market is divided into pharmaceutical, analytical industry, agrochemical, and others. In 2023, the pharmaceutical segment witnessed 38.8% revenue share in the market. Also, the Italy market utilized 10.26 hundred Tonnes of acetonitrile in the pharmaceutical market in 2023. The pharmaceutical industry’s focus on research and development (R&D) activities to discover and develop new drugs, biologics, and specialty pharmaceuticals has driven demand for acetonitrile-based products. Thus, these aspects will lead to enhanced demand in the segment.Regional Outlook

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. The North America segment procured a 22.5% revenue share in the market in 2023. Also, the Mexico market utilized 32.1 hundred Tonnes of acetonitrile in the market in 2023. With North America being home to numerous pharmaceutical companies, research institutions, and academic centers, there has been a consistent demand for acetonitrile for drug development, formulation, and quality control. Hence, owing to these factors, the segment will witness increased demand in the coming years.List of Key Companies Profiled

- Honeywell International, Inc

- Thermo Fisher Scientific, Inc.

- INEOS Group Holdings S.A

- Asahi Kasei Corporation

- PetroChina Company Limited (China National Petroleum Corporation)

- Formosa Plastics Group

- Avantor, Inc.

- Nantong Acetic Acid Chemical Co., Ltd.

- Neuchem Inc.

- Nova Molecular Technologies, Inc.

Market Report Segmentation

By Type (Volume, Hundred Tonnes, USD Million, 2020-2031)- Solvent

- Derivative

- Analytical Applications

- Organic Synthesis

- Extraction

- Others

- Pharmaceutical

- Analytical Industry

- Agrochemical

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Honeywell International, Inc

- Thermo Fisher Scientific, Inc.

- INEOS Group Holdings S.A

- Asahi Kasei Corporation

- PetroChina Company Limited (China National Petroleum Corporation)

- Formosa Plastics Group

- Avantor, Inc.

- Nantong Acetic Acid Chemical Co., Ltd.

- Neuchem Inc.

- Nova Molecular Technologies, Inc.