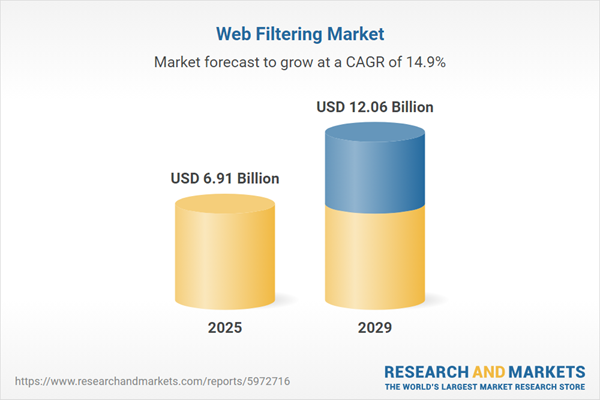

The web filtering market size has grown rapidly in recent years. It will grow from $6 billion in 2024 to $6.91 billion in 2025 at a compound annual growth rate (CAGR) of 15.3%. The growth in the historic period can be attributed to strict government regulations and the need for compliance, growing online malware, increasing refinement levels of web attacks, surge in malicious online activity throughout the world, increase in need of strong security service.

The web filtering market size is expected to see rapid growth in the next few years. It will grow to $12.06 billion in 2029 at a compound annual growth rate (CAGR) of 14.9%. The growth in the forecast period can be attributed to rising cybersecurity threats and data privacy concerns, rise in the need for a better control over employees in organizations, increased employee productivity, rise in BYOD trend among organizations, increasing internet usage. Major trends in the forecast period include technology developments, adoption of web filtering, implementation of web filtering in BFSI segment to ensure data security, integration of cloud-based services, adoption of advanced technologies.

The escalating cybersecurity threats are anticipated to drive the growth of web filtering solutions in the foreseeable future. These threats, posing risks to computer systems, networks, and data, encompass unauthorized access, data breaches, and information loss. The surge in cybersecurity threats is attributed to factors such as increased connectivity, data monetization, remote work arrangements, sophisticated attack methodologies, and a lack of cybersecurity awareness. Web filtering, a pivotal component of cybersecurity, empowers organizations with precise control over internet access, thereby mitigating the risk of cyber threats and enforcing security protocols to safeguard against data breaches and regulatory non-compliance. Notably, in November 2022, the Australian Cyber Security Centre reported a significant rise in cybercrime reports, reaching 76,000, marking a 13% increase from the previous year, highlighting the imperative for enhanced web filtering measures to counteract escalating cybersecurity risks.

Leading companies in the web filtering market are innovating AI-driven solutions, such as advanced URL filtering, to deliver real-time protection against sophisticated web-based threats. Advanced URL filtering leverages artificial intelligence to perform real-time URL analysis, addressing inherent coverage gaps present in conventional database-driven solutions and safeguarding against malicious URLs. For example, in June 2023, Palo Alto Networks, Inc., a prominent cybersecurity firm based in the US, introduced artificial intelligence-powered advanced URL filtering. This solution complements Palo Alto Networks' existing App-ID solution, enabling organizations to configure their firewall to identify and manage access to web traffic (HTTP and HTTPS), fortifying their network defenses against cyberattacks.

In March 2022, Linewize Limited, a cloud-based firewall platform provider headquartered in New Zealand, acquired Cipafilter for $4.5 million. This strategic acquisition bolstered Linewize's position as a leading provider of K-12 digital safety solutions by expanding its suite of capabilities and client base. Cipafilter, based in the US, specializes in offering web filtering and firewall solutions tailored for educators, network professionals, students, and consumers.

Major companies operating in the web filtering market are Cisco systems Inc., Broadcom Corporation, Palo Alto Networks Inc., Fortinet Inc., Titan HQ, McAfee Corp., Trend Micro Incorporated, Zscaler Inc., Kaspersky Lab, Sophos Group plc, Forcepoint LLC, Barracuda Networks Inc., Trustwave Holdings Inc., Webroot Inc., Clearswift Ltd., GFI Software Ltd., Netskope Inc., Cyren Ltd., Iboss Inc., Virtela Technology Services Inc., ContentKeeper Technologies Pty. Ltd., CensorNet Ltd., Symantec Corporation, Untangle Inc., Wavecrest Computing Inc., Interoute, Kaspersky, International Submarine Engineering (ISE) Ltd.

North America was the largest region in the web filtering market in 2024. Asia Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the web filtering market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the web filtering market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The web filtering market consists of revenues earned by entities by providing services such as cloud-based management, integration services, behavioral analysis, consulting and assessment, customization and policy development, and policy review and optimization. The market value includes the value of related goods sold by the service provider or included within the service offering. The web filtering market also includes sales of URL filtering, keyword filtering, reputation-based filtering, cloud-based filtering, and integration with the security ecosystem. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

Web filtering involves the regulation and management of website and online content access, employing predetermined criteria to control user access. It utilizes software or hardware solutions to monitor and restrict internet browsing, ensuring a safer, more productive, and compliant online environment for organizations and individuals.

The primary components of web filtering include solutions and services. Solutions encompass software-based tools and technologies facilitating web filtering and content control on networks. These tools assist organizations in managing and restricting access to specified websites or content categories. Deployments may vary, including cloud-based and on-premises solutions. Filtering types encompass domain name system (DNS) filtering, keyword filtering, uniform resource locator (URL) filtering, and others. Web filtering serves various industry verticals, including government, banking, financial services, and insurance (BFSI), manufacturing, information technology (IT) and telecom, education, healthcare, retail, among others.

The web filtering market research report is one of a series of new reports that provides web filtering market statistics, including web filtering industry global market size, regional shares, competitors with a web filtering market share, detailed web filtering market segments, market trends and opportunities, and any further data you may need to thrive in the web filtering industry. This web filtering market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Web Filtering Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on web filtering market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for web filtering? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The web filtering market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Component: Solution; Services2) By Deployment Mode: Cloud; On-Premises

3) By Filtering Type: Domain Name System (DNS) Filtering; Keyword Filtering; Uniform Resource Locator (URL) Filtering; Other Filtering Types

4) By Industry Vertical: Government Banking; Financial Services, And Insurance (BFSI); Manufacturing; Information Technology (IT) And Telecom; Education; Healthcare; Retail; Other Industry Verticals

Subsegments:

1) By Solution: Web Filtering Software; Cloud-Based Web Filtering Solutions; On-premises Web Filtering Solutions2) By Services: Consulting Services; Implementation Services; Managed Services; Support And Maintenance Services

Key Companies Mentioned: Cisco systems Inc.; Broadcom Corporation; Palo Alto Networks Inc.; Fortinet Inc.; Titan HQ

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Web Filtering market report include:- Cisco systems Inc.

- Broadcom Corporation

- Palo Alto Networks Inc.

- Fortinet Inc.

- Titan HQ

- McAfee Corp.

- Trend Micro Incorporated

- Zscaler Inc.

- Kaspersky Lab

- Sophos Group plc

- Forcepoint LLC

- Barracuda Networks Inc.

- Trustwave Holdings Inc.

- Webroot Inc.

- Clearswift Ltd.

- GFI Software Ltd.

- Netskope Inc.

- Cyren Ltd.

- Iboss Inc.

- Virtela Technology Services Inc.

- ContentKeeper Technologies Pty. Ltd.

- CensorNet Ltd.

- Symantec Corporation

- Untangle Inc.

- Wavecrest Computing Inc.

- Interoute

- Kaspersky

- International Submarine Engineering (ISE) Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 6.91 Billion |

| Forecasted Market Value ( USD | $ 12.06 Billion |

| Compound Annual Growth Rate | 14.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 29 |