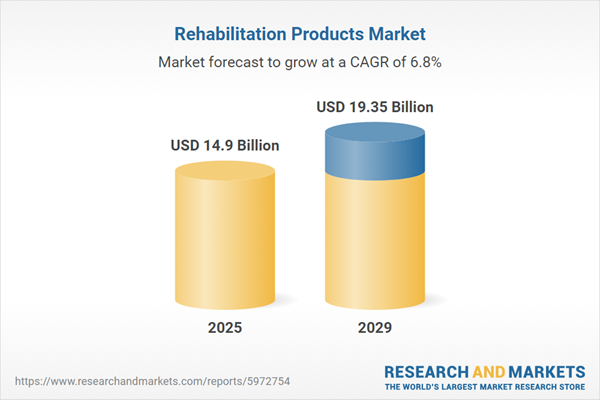

The rehabilitation products market size has grown strongly in recent years. It will grow from $13.92 billion in 2024 to $14.9 billion in 2025 at a compound annual growth rate (CAGR) of 7.1%. The growth in the historic period can be attributed to the increasing prevalence of chronic diseases and disabilities, the growing aging population worldwide, rising awareness about the importance of rehabilitation, expanding insurance coverage for rehabilitation services, and rising healthcare expenditure globally.

The rehabilitation products market size is expected to see strong growth in the next few years. It will grow to $19.35 billion in 2029 at a compound annual growth rate (CAGR) of 6.8%. The growth in the forecast period can be attributed to government initiatives and policies, a shift towards home-based rehabilitation, a focus on early intervention and preventive care, and expansion of healthcare infrastructure in emerging markets. Major trends in the forecast period include the adoption of telerehabilitation solutions, integration of artificial intelligence (AI) and Virtual Reality (VR), emphasis on mobility and accessibility, and utilization of sustainable and eco-friendly solutions.

The growing elderly population is expected to drive the rehabilitation products market in the future. This demographic, typically individuals aged 65 and older, faces unique health challenges and requirements linked to aging. The rise in the elderly population can be attributed to longer life expectancy, thanks to advances in healthcare, alongside declining birth rates. Rehabilitation products play a key role in supporting functional independence, mobility, and general well-being for older adults, helping them maintain active and fulfilling lives. Products like walking aids and mobility scooters offer vital assistance, allowing seniors to navigate safely and independently. For example, data from the Population Reference Bureau (PRB), a U.S.-based nonprofit, projects that by 2050, the number of Americans aged 65 and above will grow from 58 million in 2022 to 82 million - an increase of 47%. Their share of the total population is expected to rise from 17% to 23%. As a result, the expanding elderly population is fueling the demand for rehabilitation products.

Key players in the rehabilitation products market are focusing on innovation to meet the evolving needs of the aging population. One notable trend is the development of advanced virtual reality-based platforms designed to enhance therapy outcomes and patient engagement. These platforms provide immersive and interactive experiences for patients undergoing rehabilitation, leveraging technology to optimize therapy sessions and motivate individuals to actively participate in their recovery journey. For example, Penumbra Inc. introduced the REAL y-Series, a non-tethered immersive healthcare offering for rehabilitation that utilizes upper and lower body sensors to track full-body movement and progress in real-time. By customizing exercises and activities to challenge and engage patients, this technology aims to maximize therapy benefits and improve patient outcomes.

In December 2022, Johnson & Johnson, a pharmaceutical company based in the U.S., acquired Abiomed, Inc. for $16.6 billion. This acquisition allowed Johnson & Johnson to accelerate its expansion in the Medtech sector. Abiomed, Inc. is a U.S.-based medical device company specializing in temporary internal and external support devices.

Major companies operating in the rehabilitation products market are Medline Industries Inc., Stryker Corporation, Zimmer Biomet Holdings, Smith & Nephew plc, Ottobock SE & Co. KGaA, DJO Global Inc., Sunrise Medical Inc., Össur (OSSR.Co), Drive DeVilbiss Healthcare (Medical Depot Inc.), Joerns Healthcare, Invacare Corporation IVC, Caremax Rehabilitation Equipment Co. Ltd., Etac AB, GF Health Products Inc., Prism Medical UK, Dynatronics Corporation, Biodex Medical Systems Inc., Carex Health Brands Inc., Roma Medical, Hocoma AG, Ekso Bionics, EZ Way Inc., Proxomed Medizintechnik, Hill-Rom Services Inc., Klinik Medifit.

North America was the largest region in the rehabilitation products market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the rehabilitation products market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the rehabilitation products market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The rehabilitation products market consists of sales of prosthetics and orthotics, crutches, wheelchairs, exercise balls, resistance bands, and balance boards. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

Rehabilitation products encompass specialized tools and equipment tailored to aid individuals in reclaiming physical functionality and independence following injury, illness, or surgical procedures. These products include a diverse array of aids, from mobility devices to assistive technologies, all aimed at supporting various aspects of rehabilitation such as enhancing mobility, strength, coordination, and overall quality of life.

Key types of rehabilitation products include medical beds, mobility scooters, walkers, canes, patient lifts, slings, and others. Medical beds are designed with adjustable features and supportive surfaces to cater to patients with specific medical requirements in healthcare settings. These products find application across a range of scenarios including physical rehabilitation and training, pain reduction, and occupational rehabilitation and training. They are utilized by various healthcare professionals including physiotherapists, orthopedists, rehabilitation centers, occupational therapists, speech therapists, and others.

The rehabilitation products market research report is one of a series of new reports that provides rehabilitation products market statistics, including rehabilitation products industry global market size, regional shares, competitors with a rehabilitation products market share, detailed rehabilitation products market segments, market trends and opportunities, and any further data you may need to thrive in the rehabilitation products industry. This rehabilitation products market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Rehabilitation Products Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on rehabilitation products market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for rehabilitation products? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The rehabilitation products market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product Type: Medical Bed; Mobility Scooter; Walker; Cane; Patient Lift; Sling; Other Product Types2) By Application: Physical Rehabilitation And Training; Strength, Endurance, And Pain Reduction; Occupational Rehabilitation And Training

3) By End User: Physiotherapist; Orthopedists; Rehab Centers; Occupational Therapists; Speech Therapists; Other End Users

Subsegments:

1) By Medical Bed: Electric Medical Bed; Manual Medical Bed; Bariatric Medical Bed; Other Medical Beds2) By Mobility Scooter: 3-Wheel Mobility Scooter; 4-Wheel Mobility Scooter; Heavy Duty Mobility Scooter; Compact Mobility Scooter

3) By Walker: Standard Walker; Folding Walker; Rollator Walker; Knee Walker

4) By Cane: Standard Cane; Quad Cane; Folding Cane; Walking Stick

5) By Patient Lift: Manual Patient Lift; Electric Patient Lift; Ceiling Lift; Standing Patient Lift

6) By Sling: Patient Transfer Sling; Hammock Sling; Universal Sling; Other Slings

7) By Other Product Types: Wheelchairs; Crutches; Orthopedic Braces; Other Rehabilitation Products

Key Companies Mentioned: Medline Industries Inc.; Stryker Corporation; Zimmer Biomet Holdings; Smith & Nephew plc; Ottobock SE & Co. KGaA

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Rehabilitation Products market report include:- Medline Industries Inc.

- Stryker Corporation

- Zimmer Biomet Holdings

- Smith & Nephew plc

- Ottobock SE & Co. KGaA

- DJO Global Inc.

- Sunrise Medical Inc.

- Össur (OSSR.Co)

- Drive DeVilbiss Healthcare (Medical Depot Inc.)

- Joerns Healthcare

- Invacare Corporation IVC

- Caremax Rehabilitation Equipment Co. Ltd.

- Etac AB

- GF Health Products Inc.

- Prism Medical UK

- Dynatronics Corporation

- Biodex Medical Systems Inc.

- Carex Health Brands Inc.

- Roma Medical

- Hocoma AG

- Ekso Bionics

- EZ Way Inc.

- Proxomed Medizintechnik

- Hill-Rom Services Inc.

- Klinik Medifit

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 14.9 Billion |

| Forecasted Market Value ( USD | $ 19.35 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |