The home sequential compression devices market size has grown strongly in recent years. It will grow from $1.09 billion in 2024 to $1.18 billion in 2025 at a compound annual growth rate (CAGR) of 8%. The growth in the historic period can be attributed to rise in the incidence rates of diabetes, growth in the aging population, rise in healthcare costs, post-surgical recovery, shift towards home healthcare.

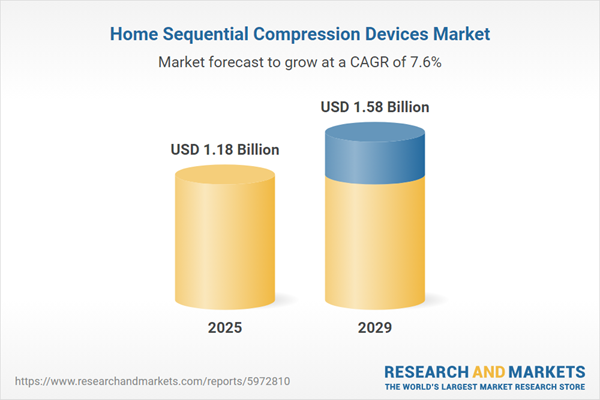

The home sequential compression devices market size is expected to see strong growth in the next few years. It will grow to $1.58 billion in 2029 at a compound annual growth rate (CAGR) of 7.6%. The growth in the forecast period can be attributed to the rising global health awareness, government initiatives and policies, expansion of distribution channels, patient preference for non-invasive treatments, aging population. Major trends in the forecast period include technological advancements, growing adoption of telemedicine, personalized healthcare solutions, remote work trends, smart device integration.

The increasing rates of diabetes are expected to drive the growth of the home sequential compression device market in the coming years. Diabetes is a chronic metabolic disorder marked by elevated blood sugar levels resulting from insufficient insulin production or poor insulin utilization. Rising diabetes rates are attributed to factors such as unhealthy diets, sedentary lifestyles, an aging population, stress, and mental health challenges. Home sequential compression devices assist in managing diabetes-related complications by improving blood flow, reducing the risk of ulcers and infections, and promoting overall limb health. These devices offer the convenience of regular use without frequent healthcare visits. For example, in July 2024, the World Health Organization (WHO), a Switzerland-based global public health authority, projected that by 2045, 1 in 10 Europeans could be affected by diabetes. Thus, the rising incidence of diabetes is fueling growth in the home sequential compression device market.

Key players in the home sequential compression devices market are directing their efforts towards the development of innovative products such as sequential compression devices and compression garments to maintain a competitive edge. Sequential compression devices (SCDs) serve as an effective method for preventing deep vein thrombosis (DVT) by enhancing blood flow in the legs, while compression garments target various areas including the lower legs, back, abdomen, pelvic, and hip regions, particularly beneficial for patients with lymphedema. For instance, in September 2023, AIROS Medical Inc., a US-based medical equipment manufacturer, introduced the AIROS 6P and compression pants, offering versatility with its compatibility across different voltage specifications worldwide. These advancements cater to the evolving needs of lymphedema patients, with the lower truncal pants garments addressing swelling in additional areas such as the legs and abdomen.

The rising prevalence of obesity is anticipated to drive growth in the home sequential compression devices market in the future. Obesity is a medical condition defined by excessive body fat accumulation, which poses health risks to individuals. Home sequential compression devices assist in addressing the increasing rates of obesity by enhancing circulation and lowering the risk of venous thromboembolism in people with limited mobility or sedentary lifestyles. These devices support better blood flow, reduce swelling, and may improve metabolic function, aiding in weight management efforts. For example, data from 2022 published by the Centers for Disease Control and Prevention (CDC), a U.S. government agency, show that 22 states now report an adult obesity prevalence of 35% or more, up from 19 states in 2021. Consequently, the rising rates of obesity are fueling the demand for home sequential compression devices.

Major companies operating in the home sequential compression devices market are Cardinal Health Inc., Medtronic plc, Essity Health & Medical, DJO LLC, Arjo Medical Devices, BTL Corporate, Tactile Medical, Amoena Medical, Performance Health Supply Inc., Sigvaris Group, Huntleigh Healthcare Limited, Breg Inc., NormaTec, Abigo Medical AB, Medcom Group, BIOCOMPRESSION SYSTEMS, Precision Medical Products, Devon Medical Inc., AIROS Medical Inc., Mego Afek ltd., Remark Medical Services.

North America was the largest region in the home sequential compression devices market in 2024. The regions covered in the home sequential compression devices market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the home sequential compression devices market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The home sequential compression devices market consists of sales of compression pump, compression garments, leg compression sleeves and power adapter. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

Home sequential compression devices are medical apparatuses utilized in domestic settings to administer therapeutic compression to limbs. Leveraging pneumatic technology, these devices deliver intermittent pressure, enhancing circulation and addressing conditions such as lymphedema and venous insufficiency.

The primary categories of home sequential compression devices exist such as standard and portable. Standard variants, typically larger, are suitable for clinical or home use, delivering effective compression therapy for conditions such as lymphedema, thereby fostering better patient outcomes. These encompass various device types, including simultaneous sequential compression devices (SSCD) and alternate sequential compression devices (ASCD), catering to diverse applications such as deep vein thrombosis (DVT), lymphedema management, and chronic venous insufficiency (CVI).

The home sequential compression devices market research report is one of a series of new reports that provides home sequential compression devices market statistics, including the home sequential compression devices industry global market size, regional shares, competitors with home sequential compression devices market share, detailed home sequential compression devices market segments, market trends, and opportunities, and any further data you may need to thrive in the home sequential compression devices industry. This home sequential compression devices market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Home Sequential Compression Devices Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on home sequential compression devices market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for home sequential compression devices? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The home sequential compression devices market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Standard; Portable2) By Device Type: Simultaneous Sequential Compression Device (SSCD); Alternate Sequential Compression Device (ASCD)

3) By Application: Deep Vein Thrombosis (DVT); Lymphedema Management; Chronic Venous Insufficiency (CVI); Other Applications

Subsegments:

1) By Standard: Non-Portable Models; Tabletop Models; Clinical-Grade Devices2) By Portable: Battery-Operated Models; Wearable Models; Rechargeable Portable Devices

Key Companies Mentioned: Cardinal Health Inc.; Medtronic plc; Essity Health & Medical; DJO LLC; Arjo Medical Devices

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Home Sequential Compression Devices market report include:- Cardinal Health Inc.

- Medtronic plc

- Essity Health & Medical

- DJO LLC

- Arjo Medical Devices

- BTL Corporate

- Tactile Medical

- Amoena Medical

- Performance Health Supply Inc

- Sigvaris Group

- Huntleigh Healthcare Limited

- Breg Inc

- NormaTec

- Abigo Medical AB

- Medcom Group

- BIOCOMPRESSION SYSTEMS

- Precision Medical Products

- Devon Medical Inc.

- AIROS Medical Inc.

- Mego Afek ltd.

- Remark Medical Services

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.18 Billion |

| Forecasted Market Value ( USD | $ 1.58 Billion |

| Compound Annual Growth Rate | 7.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |