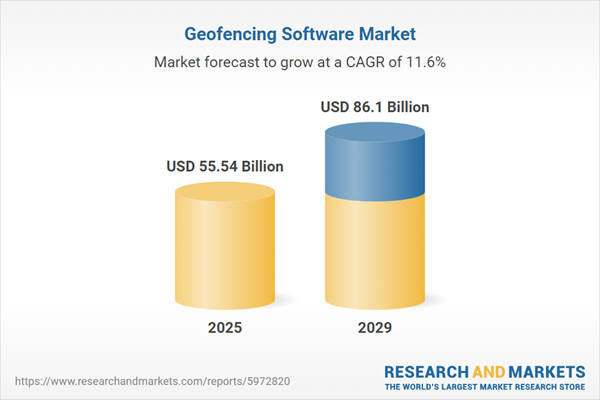

The geofencing software market size has grown rapidly in recent years. It will grow from $49.63 billion in 2024 to $55.54 billion in 2025 at a compound annual growth rate (CAGR) of 11.9%. The growth in the historic period can be attributed to increasing smartphone penetration, rising demand for location-based marketing, growing adoption of internet of things (IoT), emergence of smart city initiatives, and improvements in data privacy regulations.

The geofencing software market size is expected to see rapid growth in the next few years. It will grow to $86.1 billion in 2029 at a compound annual growth rate (CAGR) of 11.6%. The growth in the forecast period can be attributed to proliferation of 5G networks, expansion of e-commerce and online retail, rise of autonomous vehicles and delivery drones, growing focus on real-time location tracking, and surge in demand for personalized user experiences. Major trends in the forecast period include dynamic geofencing for flexible boundaries, rise of privacy-centric geofencing solutions, integration of geofencing with wearables and smart devices, and environmental monitoring and conservation efforts.

The demand for the Internet of Things (IoT) is accelerating, significantly contributing to the growth of the geofencing software market. IoT involves a network of interconnected devices equipped with sensors and software, which communicate data over the internet. Factors such as increased high-speed internet availability, the need for data analytics, and initiatives in digital transformation and Industry 4 have fueled this demand. When integrated with geofencing software, IoT technology allows companies to offer more sophisticated, reactive, and customized location-based services. According to a report by Akamai Technologies Inc., a prominent internet company in the US, IoT connections are anticipated to grow from 15.1 billion in 2021 to 23.3 billion by 2025. Therefore, the demand for the Internet of Things (IoT) is drives the geofencing software market.

Leading firms in the geofencing software sector are strategically partnering to co-develop innovative solutions such as self-served geofence advertising platforms, thereby securing a competitive advantage. These partnerships enable access to complementary technologies, expand market presence, and enhance the functionality and efficiency of their geofencing offerings. For example, in July 2023, Ethic Advertising Agency, a digital advertising firm based in the US, teamed up with Simpli.fi, a digital advertising platform, to introduce Qujam. This platform marks the first self-served geofence advertising platform designed to empower small businesses and agencies with various advertising tools including mobile app banner ads, OTT CTV advertising, and video pre-rolls. Qujam specifically addresses hurdles such as prohibitive costs, lack of manageable options, and insufficient reporting capabilities for small businesses by providing a user-friendly, fully autonomous platform with immediate reporting features.

In July 2023, Radar Labs Inc., a US-based company specializing in geofencing software, joined forces with Cordial. This partnership aims to strengthen brands' marketing strategies by combining Radar's geofencing capabilities with Cordial's powerful data-driven marketing solutions. The collaboration enables businesses to design highly personalized, location-based marketing campaigns that boost customer engagement and enhance operational efficiency. Cordial Experiences Inc., a US-based marketing automation software company, focuses on optimizing marketing processes and improving customer engagement through its automation tools.

Major companies operating in the geofencing software market are Apple Inc., Google LLC (Alphabet Inc.), Samsung Electronics Co., Infosys Ltd., Environmental Systems Research Institute Inc. (Esri), XebiaLabs Inc., HERE Global B.V., GitLab Inc., MoEngage Inc., CloudBees Inc., CollabNet VersionOne Inc. (CollabNet), WebEngage, Mobstac, ConnectALL, GroundTruth, Bluedot Innovation Pty Ltd., Radar Labs Inc., Pulsate Ltd., The Mobile Majority, Leantegra, Plutora, Bleesk, Skyhook Wireless, Logitrack, PlotProjects.

North America was the largest region in the geofencing software market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the geofencing software market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the geofencing software market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The geofencing software market includes revenues earned by entities by providing services such as fleet management, asset tracking, attendance tracking, and analytics and reporting. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

Geofencing software involves applications or computer programs designed to allow users to establish virtual perimeters or geographic zones using GPS (Global Positioning System) or other location-based technologies. These virtual boundaries are set to initiate specific actions, alerts, or notifications when a mobile device or asset crosses into or out of the designated area.

The primary product categories in geofencing software include cloud-based and on-premise solutions. Cloud-based geofencing software is hosted remotely and accessible via the internet, facilitating various applications across industries such as transportation and logistics, retail, healthcare and life sciences, industrial manufacturing, media and entertainment, government and defense, and banking, financial services and insurance (BFSI). These solutions cater to a broad range of end-users, from small and medium enterprises to large enterprises.

The geofencing software market research report is one of a series of new reports that provides geofencing software market statistics, including geofencing software industry global market size, regional shares, competitors with a geofencing software market share, detailed geofencing software market segments, market trends and opportunities, and any further data you may need to thrive in the geofencing software industry. This geofencing software market research report delivers a complete perspective on everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Geofencing Software Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on geofencing software market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for geofencing software? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The geofencing software market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product Or Type: Cloud-Based; On-Premise2) By Application: Transportation And Logistics; Retail; Healthcare And Life Sciences; Industrial Manufacturing; Media And Entertainment; Government And Defense; Banking, Financial Services, And Insurance (BFSI); Other Applications

3) By End-User: Small And Medium Enterprises; Large Enterprises

Subsegments:

1) By Cloud-Based: SaaS (Software-As-A-Service) Solutions; Managed Cloud Services; Multi-Tenant Cloud Platforms2) By On-Premise: Enterprise-Installed Software; Custom On-Premise Solutions; Single-Tenant On-Premise Platforms

Key Companies Mentioned: Apple Inc.; Google LLC (Alphabet Inc.); Samsung Electronics Co.; Infosys Ltd.; Environmental Systems Research Institute Inc. (Esri)

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Geofencing Software market report include:- Apple Inc.

- Google LLC (Alphabet Inc.)

- Samsung Electronics Co.

- Infosys Ltd.

- Environmental Systems Research Institute Inc. (Esri)

- XebiaLabs Inc.

- HERE Global B.V.

- GitLab Inc.

- MoEngage Inc.

- CloudBees Inc.

- CollabNet VersionOne Inc. (CollabNet)

- WebEngage

- Mobstac

- ConnectALL

- GroundTruth

- Bluedot Innovation Pty Ltd

- Radar Labs Inc.

- Pulsate Ltd.

- The Mobile Majority

- Leantegra

- Plutora

- Bleesk

- Skyhook Wireless

- Logitrack

- PlotProjects

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 55.54 Billion |

| Forecasted Market Value ( USD | $ 86.1 Billion |

| Compound Annual Growth Rate | 11.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |