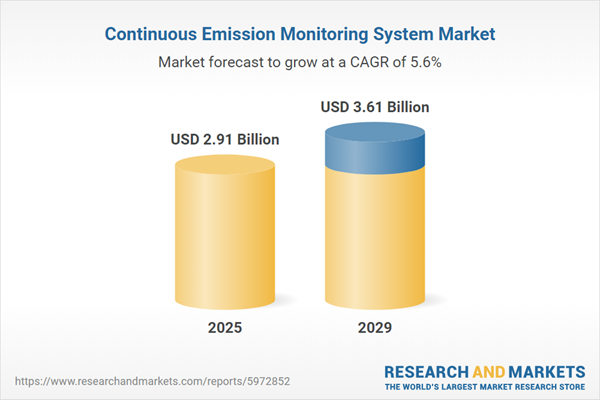

The continuous emission monitoring system market size has grown strongly in recent years. It will grow from $2.74 billion in 2024 to $2.91 billion in 2025 at a compound annual growth rate (CAGR) of 5.9%. The growth in the historic period can be attributed to focus on corporate social responsibility (CSR), cost reduction, and operational efficiency, growing awareness of environmental impact, increasing regulatory pressure.

The continuous emission monitoring system market size is expected to see strong growth in the next few years. It will grow to $3.61 billion in 2029 at a compound annual growth rate (CAGR) of 5.6%. The growth in the forecast period can be attributed to industry expansion, increasing penalties for non-compliance, and focus on health and safety. Major trends in the forecast period include advancements in technology, stricter environmental regulations, a shift towards real-time monitoring, increasing awareness of climate change, expansion of end-user industries, and integration of data analytics and artificial intelligence.

The continuous emission monitoring system (CEMS) market is poised for growth, propelled by rapid industrialization. Industrialization, characterized by economic and social transformation through industrial development and mass production, is accelerated by global trade opportunities and interconnectedness. This phenomenon enables countries to specialize in specific manufacturing sectors and integrate into global value chains. CEMS plays a crucial role in assisting industries in monitoring and mitigating their environmental impact, aligning with the demands of rapid industrialization. By providing valuable data on emission levels, CEMS enables industries to identify pollution sources and evaluate the effectiveness of pollution control measures. For example, in March 2024, manufacturing output surged by 0.8% in the United States compared to January of the same year, as reported by the Federal Reserve Bank. Similarly, Eurostat noted a 0.2% increase in industrial output in the European area in July 2023, with a 0.1% rise reported in the European Union between May and April 2023. Thus, rapid industrialization acts as a driving force for the continuous emission monitoring system market.

Leading countries in the continuous emission monitoring system market are focusing on developing cutting-edge solutions, such as blockchain-based systems, to strengthen their competitive advantage. Blockchain-based systems are decentralized digital platforms that use blockchain technology to securely record, store, and manage data across a distributed network, providing transparency, immutability, and traceability for various applications. For example, in July 2023, Hyundai Motor Company and Kia Corporation, both based in South Korea, launched the blockchain-based Supplier CO2 Emission Monitoring System (SCEMS). This system leverages AI to enable accurate emissions tracking and data transparency, enhancing sustainability within the supply chain. The initiative supports climate action by helping suppliers manage carbon emissions effectively and adhere to environmental regulations.

In May 2023, ENVEA bolstered its market presence by acquiring California Analytical Instruments (CAI), enhancing its portfolio and market penetration, particularly in sectors such as process industries and the emerging hydrogen economy. This strategic move enables ENVEA to tap into CAI's established market verticals and proficient local team, strengthening its position in the vital US market. California Analytical Instruments, a US-based company specializing in continuous emission monitoring systems, including gas analyzers, brings expertise in environmental monitoring applications, further enriching ENVEA's offerings.

Major companies operating in the continuous emission monitoring system market are Siemens AG, Thermo Fisher Scientific Inc., Honeywell International Inc., ABB Ltd., Parker-Hannifin Corporation, Emerson Electric Co., AMETEK Inc., Teledyne API, Yokogawa Electric Corporation, Endress+Hauser AG, Horiba Ltd., SICK AG, Testo SE & Co. KGaA, Fuji Electric Co. Ltd., Durag GROUP, Opsis AB, Gasmet Technologies Oy, ENOTEC GmbH, ENVEA Group, CODEL International Ltd., Unisearch Associates Inc., M&C TechGroup, Nova Analytical Systems Inc., Chromatotec Group, Ecotech Pty Ltd.

North America was the largest region in the continuous emission monitoring system market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the continuous emission monitoring system market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the continuous emission monitoring system market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The continuous emission monitoring system market consists of revenues earned by entities by providing services such as real-time monitoring, compliance assurance, data analysis and reporting, and optimization of processes. The market value includes the value of related goods sold by the service provider or included within the service offering. The continuous emission monitoring system market also includes sales of particulate monitors, flow meters, and calibration equipment. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

Continuous emission monitoring systems (CEMS) are sophisticated technological solutions engineered to monitor and analyze emissions of pollutants from industrial sources in real-time. They play a crucial role in environmental protection by aiding industries in adhering to emission regulations, thereby minimizing environmental impact and ensuring public health and safety. CEMS offer real-time data for prompt decision-making, empower industries to implement proactive emission control measures, and facilitate efficient resource management.

The core components of a continuous emission monitoring system (CEMS) encompass gas analyzers, sample probes, data acquisition systems, software solutions, and additional elements. Gas analyzers are pivotal devices tasked with measuring the composition of gases within an environment, discerning various components such as carbon dioxide, oxygen, and nitrogen. These systems employ diverse technologies, including extractive CEMS, dilution CEMS, and in-situ CEMS, catering to a spectrum of end-use industries such as power generation, oil and gas, chemical, manufacturing, cement, and others.

The continuous emission monitoring system market research report is one of a series of new reports that provides continuous emission monitoring system market statistics, including continuous emission monitoring system industry global market size, regional shares, competitors with a continuous emission monitoring system market share, detailed continuous emission monitoring system market segments, market trends and opportunities, and any further data you may need to thrive in the continuous emission monitoring system industry. This continuous emission monitoring system market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Continuous Emission Monitoring System Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on continuous emission monitoring system market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for continuous emission monitoring system? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The continuous emission monitoring system market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Component: Gas Analyzers; Sample Probes; Data Acquisition System; Software Solutions; Other Components2) By Technology: Extractive Continuous Emission Monitoring System (CEMS); Dilution Continuous Emission Monitoring System (CEMS); In-Situ Continuous Emission Monitoring System (CEMS)

3) By End-Use Industry: Power Generation; Oil And Gas; Chemical; Manufacturing; Cement; Other End Use Industries

Subsegments:

1) By Gas Analyzers: Non-Dispersive Infrared (NDIR) Analyzers; Chemiluminescence Analyzers; Paramagnetic Analyzers; Zirconia Oxygen Analyzers; Other Gas Analyzers2) By Sample Probes: Heated Probes; Unheated Probes; Dilution Probes; High-Temperature Probes; Standard Probes

3) By Data Acquisition System (DAS): Data Logging Systems; Real-Time Monitoring Systems; Data Communication Systems; Cloud-Based Data Systems

4) By Software Solutions: Emission Monitoring Software; Data Management Software; Compliance Reporting Software; Predictive Maintenance Software; Process Control Software

5) By Other Components: Calibration Equipment; Sample Conditioning Units; Pumps And Valves; Filters And Scrubbers; Flow Meters

Key Companies Mentioned: Siemens AG; Thermo Fisher Scientific Inc.; Honeywell International Inc.; ABB Ltd.; Parker-Hannifin Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Continuous Emission Monitoring System market report include:- Siemens AG

- Thermo Fisher Scientific Inc.

- Honeywell International Inc.

- ABB Ltd.

- Parker-Hannifin Corporation

- Emerson Electric Co.

- AMETEK Inc.

- Teledyne API

- Yokogawa Electric Corporation

- Endress+Hauser AG

- Horiba Ltd.

- SICK AG

- Testo SE & Co. KGaA

- Fuji Electric Co. Ltd.

- Durag GROUP

- Opsis AB

- Gasmet Technologies Oy

- ENOTEC GmbH

- ENVEA Group

- CODEL International Ltd.

- Unisearch Associates Inc.

- M&C TechGroup

- Nova Analytical Systems Inc.

- Chromatotec Group

- Ecotech Pty Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.91 Billion |

| Forecasted Market Value ( USD | $ 3.61 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |