Mini C-Arms is the fastest growing segment, North America is the largest regional market

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The increasing demand for minimally invasive surgical procedures significantly influences the global 3D mobile C-arm market, as these advanced imaging systems provide crucial intraoperative guidance necessary for these delicate interventions. Minimally invasive techniques, valued for their reduced patient trauma, decreased recovery times, and lower complication rates, are becoming standard across various medical specialties.For example, according to the *Research Journal of Medical Sciences* in July 2023, a comparative study on spinal fusion techniques found that minimally invasive procedures resulted in a mean blood loss of 150 mL, which was half the 300 mL observed in open surgery cases, illustrating a key patient benefit driving procedural adoption and the corresponding need for precise imaging tools. This procedural shift necessitates sophisticated real-time visualization, directly expanding the utility and adoption of 3D mobile C-arms within surgical suites.

Key Market Challenges

The substantial initial capital investment required for advanced 3D mobile C-arm systems directly impedes the growth of the global market. The high acquisition cost poses a significant barrier to widespread adoption, particularly for smaller healthcare providers and facilities operating with constrained budgets. Such organizations often struggle to allocate the considerable funds necessary for these sophisticated imaging devices, which offer enhanced anatomical visualization and procedural guidance.Key Market Trends

Hybrid Operating Room Integration and Interoperability is a critical trend for the Global 3D Mobile C-Arm Market, requiring seamless integration into complex surgical environments. These advanced suites merge traditional surgery with high-end imaging, demanding C-arms with sophisticated communication and spatial synchronization capabilities. This integration improves procedural efficiency and patient safety. Highlighting technological progression in the sector, AdvaMed's 2023 'Pulse of the Industry' report indicated that at least 91 new algorithms gained FDA approval in the first 10 months of 2022, impacting diagnostics and imaging diagnostics markets. A study published in *Vasa* in September 2025, found that implementing a hybrid operating room in a vascular surgery center was associated with a 125% increase in treated cases, boosting monthly case volume compared to using a mobile C-arm alone.Key Market Players Profiled:

- ATON GmbH

- Siemens Healthineers AG

- Koninklijke Philips N.V.

- GE HealthCare Technologies Inc.

- Canon Medical Systems Corporation

- Shimadzu Corporation

- DMS Imaging

- Eurocolumbus srl.

- Ziehm Imaging GmbH

- FUJIFILM Holdings Corporation

Report Scope:

In this report, the Global 3D Mobile C-Arm Market has been segmented into the following categories:By Product Type:

- Mini C-arms

- Full-Size C-arms

- Others

By Application:

- Cardiology

- Gastroenterology

- Neurology

- Orthopedics and Trauma

- Oncology

- Other

By Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global 3D Mobile C-Arm Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The companies profiled in this 3D Mobile C-Arm market report include:- ATON GmbH

- Siemens Healthineers AG

- Koninklijke Philips N.V.

- GE HealthCare Technologies Inc.

- Canon Medical Systems Corporation

- Shimadzu Corporation

- DMS Imaging

- Eurocolumbus srl.

- Ziehm Imaging GmbH

- FUJIFILM Holdings Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | November 2025 |

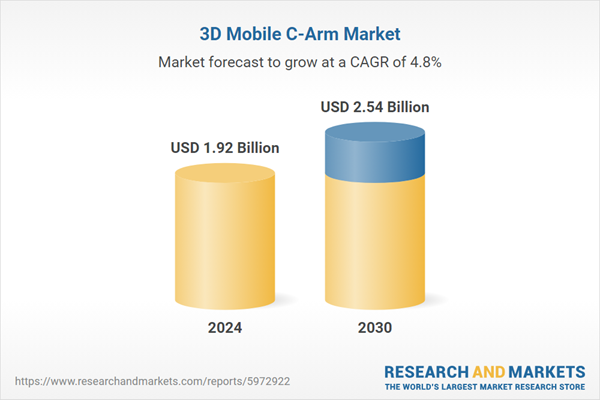

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.92 Billion |

| Forecasted Market Value ( USD | $ 2.54 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |