Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Technological Advancements: The fighter aircraft market is witnessing significant technological advancements, including the integration of fifth-generation capabilities that offer enhanced situational awareness, stealth features, and interoperability. Innovations in radar systems, electronic warfare suites, and communication systems contribute to the development of highly sophisticated and versatile fighter platforms. The incorporation of artificial intelligence and autonomous systems is becoming increasingly prevalent, further shaping the landscape of modern fighter aircraft.

Geopolitical Considerations: Geopolitical tensions and security concerns continue to be pivotal factors influencing the global fighter aircraft market. Nations worldwide invest in advanced fighter capabilities to secure their airspace and address evolving threats. The strategic importance of air superiority remains a driving force behind procurement decisions, leading to the development and acquisition of next-generation fighter aircraft. The market dynamics are often shaped by regional conflicts, strategic alliances, and the pursuit of military dominance.

Market Competition and International Collaboration: Intense competition among aerospace and defense companies defines the global fighter aircraft market. Major players, including Lockheed Martin, Boeing, and Dassault Aviation, engage in continuous research and development to offer cutting-edge fighter platforms. International collaborations and joint ventures are becoming prevalent, allowing nations to pool resources and expertise to develop and sustain advanced fighter fleets. These partnerships contribute to the cross-border exchange of technology and strengthen diplomatic ties.

Focus on Affordability and Lifecycle Costs: Amid the pursuit of advanced capabilities, there is a growing emphasis on affordability and lifecycle costs in the fighter aircraft market. Nations seek platforms that balance performance with cost-effectiveness, considering acquisition, operation, and maintenance expenses. The evolution of procurement strategies, such as performance-based logistics and multi-year contracts, reflects the industry's commitment to delivering cost-efficient solutions without compromising on technological superiority.

Shift Toward Unmanned Systems: The market is witnessing a gradual shift toward the integration of unmanned systems in the fighter aircraft domain. Unmanned combat aerial vehicles (UCAVs) and autonomous technologies are being explored to augment existing fleets and enhance mission capabilities. This shift reflects the industry's response to the changing nature of warfare and the potential for unmanned platforms to operate in high-threat environments.

Key Market Drivers

Military Modernization Programs

The foremost driver of the global fighter aircraft market is the ongoing military modernization programs undertaken by nations worldwide. As geopolitical tensions evolve and security threats become more complex, countries prioritize the acquisition of advanced fighter aircraft to enhance their defense capabilities. Military modernization initiatives focus on equipping air forces with cutting-edge technologies, superior performance, and interoperability, driving the demand for next-generation fighter platforms.Strategic Focus on Air Superiority

The strategic imperative of achieving and maintaining air superiority remains a significant driver for the fighter aircraft market. Nations recognize the pivotal role of fighter aircraft in controlling the airspace and protecting national interests. The continuous development of platforms with advanced avionics, stealth capabilities, and air-to-air combat capabilities aligns with the strategic goal of establishing dominance in contested environments, fostering sustained demand for high-performance fighter jets.Rising Geopolitical Tensions

Escalating geopolitical tensions globally contribute significantly to the demand for advanced fighter aircraft. As nations seek to assert their influence and protect their sovereignty, the need for robust airpower becomes paramount. Geopolitical considerations drive procurement decisions, with countries investing in modern and versatile fighter platforms to address regional conflicts, territorial disputes, and potential threats from adversarial nations.Technological Advancements

Continuous technological advancements play a crucial role in driving the fighter aircraft market. The integration of fifth-generation capabilities, including advanced radar systems, electronic warfare suites, and sensor fusion technologies, enhances the overall effectiveness of fighter platforms. Innovations such as artificial intelligence, data analytics, and connectivity solutions contribute to the development of more agile, survivable, and mission-ready fighter aircraft.Increasing Threats and Evolving Security Challenges

The evolving nature of security challenges, including asymmetric warfare, cyber threats, and the proliferation of advanced air defense systems, prompts nations to invest in fighter aircraft with capabilities to address diverse threats. Flexibility in mission profiles, precision strike capabilities, and adaptability to changing threat landscapes are key considerations that drive the development and acquisition of fighter aircraft with multi-role capabilities.Global Arms Race and Competitiveness

The global arms race and the competitive landscape in the defense industry drive innovation and influence procurement decisions in the fighter aircraft market. Major aerospace and defense companies engage in intense competition to offer state-of-the-art fighter platforms with superior performance, reduced lifecycle costs, and advanced mission capabilities. The pursuit of technological supremacy and market competitiveness propels the continuous evolution of fighter aircraft.Strategic Alliances and International Collaboration

Nations increasingly engage in strategic alliances and international collaboration to develop and sustain advanced fighter aircraft programs. Joint ventures and partnerships allow countries to share technological expertise, pool resources, and reduce development costs. Collaborative efforts contribute to the creation of interoperable fighter fleets, fostering diplomatic ties and supporting the global aerospace and defense industry's drive for innovation and efficiency.Shift Toward Unmanned Systems

The exploration and integration of unmanned systems, including unmanned combat aerial vehicles (UCAVs), represent a significant driver in the fighter aircraft market. The shift toward unmanned platforms is driven by the potential for increased persistence, reduced pilot risk, and the ability to operate in high-threat environments. Nations recognize the advantages of incorporating unmanned capabilities alongside traditional fighter fleets, influencing research and development efforts in this direction.Key Market Challenges

Rising Development Costs

One of the primary challenges facing the global fighter aircraft market is the escalating cost of developing and producing advanced platforms. The integration of cutting-edge technologies, such as stealth capabilities, advanced avionics, and high-performance materials, significantly increases research and development expenses. This challenge is exacerbated by the complex nature of modern fighter requirements, leading to cost overruns and financial pressures on both manufacturers and procurement agencies.Budgetary Constraints and Affordability

Many nations encounter challenges in balancing the imperative for advanced fighter capabilities with constrained defense budgets. Affordability concerns arise as the cost of procuring and sustaining sophisticated fighter fleets competes with other defense priorities. Governments face the difficult task of optimizing their defense investments while ensuring the availability of cost-effective fighter solutions that meet operational requirements.Extended Development Timelines

The prolonged development timelines associated with designing and manufacturing advanced fighter aircraft pose a significant challenge. Delays in research and development, testing, and certification processes can impact the timely delivery of platforms to end-users. Extended timelines may result from technical complexities, evolving requirements, or setbacks in the integration of new technologies, potentially affecting a nation's ability to address immediate security needs.Technological Risks and Integration Challenges

The pursuit of cutting-edge technologies in fighter aircraft introduces inherent risks and challenges related to integration. The complexity of integrating advanced avionics, sensor systems, and software may lead to technical hurdles and unforeseen issues. Ensuring seamless interoperability and overcoming integration challenges without compromising performance or safety is an ongoing challenge for manufacturers and defense organizations.Geopolitical Export Controls and Regulations

The global nature of the fighter aircraft market is subject to geopolitical export controls and regulations, posing challenges for manufacturers and potential buyers. Restrictive export policies, compliance issues, and the need for approvals can impede international cooperation and limit the market access for certain nations. These geopolitical factors add complexity to cross-border collaborations and impact the global flow of fighter technologies.Adaptive Threat Environments

The evolving nature of threats, including advancements in anti-access/area denial (A2/AD) capabilities and emerging technologies, presents challenges for fighter aircraft. Adapting to new threat environments requires continuous upgrades and modifications to existing platforms. The need for rapid technological innovation to stay ahead of potential adversaries poses a challenge, as fighter aircraft must evolve to address the spectrum of modern threats effectively.Sustainability and Environmental Concerns

Fighter aircraft development and operations are increasingly scrutinized for their environmental impact, contributing to challenges related to sustainability. Striking a balance between the performance demands of military aviation and environmental considerations is an ongoing challenge. Manufacturers face pressure to develop more fuel-efficient and environmentally friendly platforms, while military organizations seek to minimize the ecological footprint of their fleets.Transition to Unmanned Systems

The transition to unmanned systems, including unmanned combat aerial vehicles (UCAVs), introduces challenges for the traditional fighter aircraft market. Incorporating unmanned capabilities alongside manned platforms requires addressing issues related to autonomy, command and control, and the integration of artificial intelligence. Additionally, there are considerations surrounding the ethical and legal aspects of deploying unmanned systems in combat scenarios, influencing the pace and nature of this transition.Key Market Trends

Transition to Next-Generation Platforms

A prominent trend in the global fighter aircraft market is the transition to next-generation platforms characterized by fifth-generation capabilities. Manufacturers are focusing on developing and delivering advanced fighter aircraft that possess stealth features, enhanced situational awareness, and integrated sensor fusion. These platforms, exemplified by aircraft like the F-35 Lightning II, represent a paradigm shift in airpower, offering unparalleled versatility and effectiveness in addressing contemporary and future threats.Emphasis on Multirole Capabilities

Fighter aircraft trends underscore a growing emphasis on multirole capabilities, allowing platforms to perform a variety of missions beyond traditional air-to-air combat. Modern fighters are designed to excel in air-to-ground and electronic warfare missions, showcasing versatility and adaptability. This trend responds to the evolving nature of conflicts, where the ability to perform a spectrum of roles enhances operational flexibility and efficiency.Integration of Artificial Intelligence (AI)

The integration of artificial intelligence (AI) is a transformative trend in the fighter aircraft market. AI applications, including machine learning algorithms and autonomous systems, are being incorporated to enhance decision-making, improve mission planning, and optimize aircraft performance. This trend reflects a shift toward more adaptive and intelligent fighter platforms capable of processing vast amounts of data in real-time.Advanced Avionics and Sensor Fusion

Fighter aircraft are incorporating advanced avionics and sensor fusion technologies to provide pilots with comprehensive and real-time situational awareness. Integrated radar systems, electronic warfare suites, and communication systems contribute to enhanced mission effectiveness. The trend towards sensor fusion aims to streamline information for pilots, reducing cognitive workload and improving overall operational efficiency.Unmanned Combat Aerial Vehicles (UCAVs)

The rise of unmanned combat aerial vehicles (UCAVs) is a notable trend in the fighter aircraft market. Nations are exploring and investing in autonomous platforms capable of performing combat missions alongside manned fighters. UCAVs offer unique advantages in terms of persistence, reduced pilot risk, and the ability to operate in high-threat environments. This trend signifies a shift toward a more blended and complementary approach to airpower.Sustainability Initiatives

Sustainability is emerging as a trend in the fighter aircraft market, driven by environmental considerations and the desire to reduce the ecological footprint of military aviation. Manufacturers are exploring technologies that enhance fuel efficiency, reduce emissions, and incorporate sustainable materials in aircraft construction. This trend aligns with broader global efforts to address climate concerns and promotes responsible practices in the defense industry.Electrification and Hybrid Propulsion

Fighter aircraft trends include the exploration of electrification and hybrid propulsion systems. Manufacturers are investigating ways to integrate electric and hybrid technologies to enhance the performance and efficiency of fighter platforms. These innovations aim to reduce dependence on traditional fuel sources, improve operational range, and contribute to a more sustainable and technologically advanced fleet of fighter aircraft.Global Collaboration and Joint Development

A growing trend in the fighter aircraft market is global collaboration and joint development programs. Countries are increasingly forming partnerships to share technological expertise, reduce development costs, and enhance interoperability. Collaborative efforts result in joint ventures and consortiums, fostering international cooperation and contributing to the creation of standardized, interoperable fighter fleets that can respond effectively to global security challenges.Segmental Insights

By Type

Light attack aircraft is the fastest growing segment in the fighter aircraft market, designed for lower-intensity conflicts and counterinsurgency operations. These aircraft prioritize affordability, versatility, and ease of maintenance. Typically equipped with precision-guided munitions, they excel in providing air support for ground forces and conducting close air support missions. The growing demand for cost-effective platforms capable of addressing asymmetrical threats contributes to the prominence of light attack aircraft in military modernization programs.Electronic warfare aircraft is the dominating and plays a vital role in disrupting and countering enemy radar and communication systems. This specialized segment focuses on electronic countermeasures, electronic support, and electronic attack capabilities. These aircraft, often equipped with advanced jamming systems, contribute to the suppression of enemy air defenses and the protection of friendly forces. The increasing reliance on sophisticated electronic systems in modern warfare underscores the importance of electronic warfare aircraft in strategic planning and air superiority efforts.

Multi-role fighter aircraft represent the backbone of air forces globally, designed to excel in a variety of roles, including air-to-air combat, air-to-ground strike, and reconnaissance. These versatile platforms, exemplified by aircraft like the F-16 Fighting Falcon and F/A-18 Hornet, integrate advanced avionics and weapon systems to adapt to diverse mission profiles. The trend in military aviation emphasizes the development of multi-role fighters that can seamlessly switch between roles, providing flexibility and efficiency in dynamic operational environments.

Trainer aircraft serve a dual purpose in the fighter aircraft market, providing a platform for pilot training and skill development. These aircraft, often derived from existing fighter designs, allow trainee pilots to hone their flying and operational skills before transitioning to frontline combat aircraft. The trainer segment encompasses both basic and advanced training platforms, contributing to the development of skilled and proficient fighter pilots who can effectively operate sophisticated fighter jets.

Regional Insights

North America stands as a dominant region in the global fighter aircraft market, driven by the United States' robust defense industry and military modernization initiatives. The U.S. Air Force, Navy, and Marine Corps operate a diverse fleet of fighter aircraft, including advanced platforms like the F-35 Lightning II and F-22 Raptor. The region is characterized by continuous technological innovation, with major aerospace companies, including Lockheed Martin and Boeing, playing pivotal roles. The demand for next-generation capabilities and the replacement of aging fighter fleets contribute to a dynamic and competitive market landscape in North America.Europe represents a significant market for fighter aircraft, with various nations investing in modernization efforts to maintain air superiority. Countries such as the United Kingdom, France, Germany, and Sweden operate advanced fighters like the Eurofighter Typhoon, Rafale, and Gripen. European collaboration is evident in joint development programs, such as the Eurofighter consortium. The region also focuses on addressing geopolitical challenges, contributing to the demand for versatile and interoperable fighter platforms. European nations actively participate in international arms trade agreements, influencing regional dynamics and shaping the market.

The Asia-Pacific region is a dynamic and rapidly evolving market for fighter aircraft. Nations like China, India, Japan, and South Korea are actively modernizing their air forces, driving demand for advanced platforms. The geopolitical landscape, territorial disputes, and the pursuit of regional influence contribute to heightened competition. China's emergence as a major player in the market, with platforms like the J-20, adds complexity to the regional dynamics. The Asia-Pacific market reflects a mix of indigenous developments, strategic partnerships, and efforts to balance airpower capabilities.

The Middle East and Africa witness a demand for fighter aircraft shaped by regional conflicts, security challenges, and military modernization initiatives. Nations like Israel, Saudi Arabia, and the United Arab Emirates invest in advanced platforms to address regional threats. Geopolitical tensions, combined with the need for air superiority, contribute to a robust market for cutting-edge fighter technologies. Additionally, African nations seek solutions that align with their defense requirements, often focusing on platforms suitable for a range of operational environments.

Key Market Players

- Lockheed Martin Corporation

- Saab AB

- The Boeing Company

- Airbus SE

- United Aircraft Corporation

- Aviation Industry Chengdu Aircraft Industry (Group) Co., Ltd.

- Hindustan Aeronautics Limited

- BAE Systems plc

Report Scope:

In this report, the Global Fighter Aircraft Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Fighter Aircraft Market, By Type:

- Light Attack

- Electronic Warfare

- Multi-Role Fighter

- Trainer

- Others

Fighter Aircraft Market, By Take-Off and Landing:

- Conventional Take-Off Landing

- Short Take-Off and Landing

- Vertical Take-Off and Landing

Fighter Aircraft Market, By Aircraft Type:

- Fixed-Wing

- Rotorcraft

Fighter Aircraft Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe & CIS

- Germany

- Spain

- France

- Russia

- Italy

- United Kingdom

- Belgium

- Asia-Pacific

- China

- India

- Japan

- Indonesia

- Thailand

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- Turkey

- Iran

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the Global Fighter Aircraft Market.Available Customizations:

Global Fighter Aircraft Market report with the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Lockheed Martin Corporation

- Saab AB

- The Boeing Company

- Airbus SE

- United Aircraft Corporation

- Aviation Industry Chengdu Aircraft Industry (Group) Co., Ltd.

- Hindustan Aeronautics Limited

- BAE Systems plc

Table Information

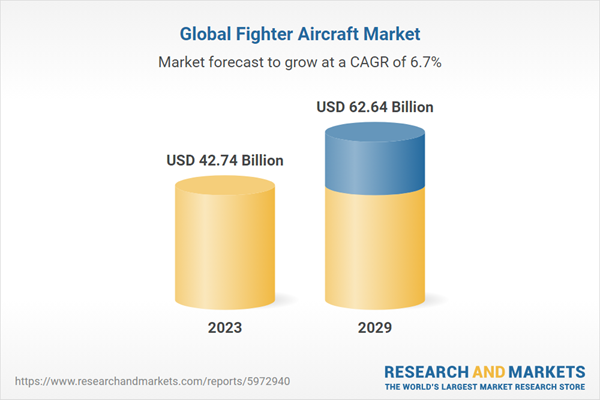

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | May 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 42.74 Billion |

| Forecasted Market Value ( USD | $ 62.64 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |