Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite favorable market conditions, the industry encounters significant hurdles regarding the environmental sensitivity and restricted shelf life of living microbial strains, which can lead to variable field performance under harsh weather conditions. To ensure viability during application and storage, manufacturers are actively working to resolve these limitations. Reflecting a robust increase in grower reliance on these biological solutions, CropLife Brazil reported in 2024 that the average adoption rate of bioinoculants among major crops reached 63 percent.

Market Drivers

The accelerating worldwide movement toward organic and sustainable agricultural practices is fundamentally transforming the Global Agricultural Inoculants Market. With regulatory bodies enforcing stricter limitations on synthetic chemicals and consumers insisting on cleaner food systems, cultivators are increasingly adopting biological inputs to ensure compliance and preserve soil vitality. This shift is further driven by the resistance management capabilities offered by biologicals, establishing inoculants as crucial elements of modern agronomy rather than mere niche additives. Consequently, major agricultural providers report a surge in demand as farmers supplement or replace conventional chemistries; for instance, Corteva Agriscience noted in its 'Fourth Quarter 2024 Results' from February 2025 that crop protection volumes rose by 16 percent year-over-year, largely due to increased demand for spinosyns and new biological products in Latin America.Concurrently, government initiatives and subsidies supporting biological inputs offer essential financial incentives that reduce risks for manufacturers and farmers alike. Acknowledging the strategic need for domestic supply chain resilience and the price volatility of chemical fertilizers, public funding is actively targeting bio-based production capacities to decrease dependence on imported synthetics. As stated by the U.S. Department of Agriculture in the December 2024 press release 'USDA Makes Investments to Strengthen American Farms', the agency allocated over $116 million to bolster domestic fertilizer production, including specific grants for biological and organic nutrient alternatives. This support facilitates broader industry growth, evidenced by Syngenta Group's March 2025 'Full Year 2024 Financial Results', which highlighted that its biologicals business achieved robust growth in emerging markets such as China and Brazil despite general sector challenges.

Market Challenges

The intrinsic physiological fragility of living microbial strains poses a significant barrier to the Global Agricultural Inoculants Market, resulting in inconsistent field performance and restricted shelf stability. In contrast to stable chemical inputs, these biological formulations typically demand rigorously controlled storage environments to prevent the mortality of active microorganisms prior to use. Moreover, even viable strains may struggle to successfully colonize plant roots when subjected to environmental stressors like drought, extreme temperatures, or fluctuating soil pH levels, creating unpredictability that complicates supply chain logistics and erodes grower confidence as manufacturers strive to ensure efficacy across varied climatic regions.This gap in reliability establishes a tangible obstacle to commercial scaling, inducing hesitation among end-users and distributors who value consistent yields over regenerative possibilities. The consequences of this skepticism are highlighted in recent industry evaluations of adoption barriers; according to the CropLife Biologicals Survey released in 2025, 14 percent of agricultural retailers explicitly identified the belief that conventional products deliver superior field performance as a primary reason for restricting their adoption. As a result, this performance volatility directly hampers market growth by reinforcing a continued reliance on synthetic fertilizers, despite the wider industry momentum toward sustainability.

Market Trends

The extension of nitrogen-fixing solutions to non-legume crops and cereals is rapidly reshaping the technical boundaries of the Global Agricultural Inoculants Market. While historically limited to legumes such as soybeans, inoculation technology has evolved through microbial selection and genomic editing to permit diazotrophs to colonize the roots of extensive grass crops like wheat and corn. This transition enables manufacturers to target a vastly larger total addressable market by providing growers with a practical means to maintain yield stability while reducing synthetic nitrogen dependence; for example, Pivot Bio reported in its '2024 Impact Report' from June 2025 that its microbial nitrogen technology was successfully applied to 1.4 million enrolled acres within its sustainability program, demonstrating the commercial scalability of these advanced formulations in cereal production.Simultaneously, the market is witnessing a wave of strategic acquisitions of biological companies by agrochemical giants, motivated by the need to diversify portfolios and consolidate intellectual property. Instead of depending exclusively on internal discovery, major agricultural input providers are aggressively acquiring specialized biotech innovators to secure fermentation capabilities and proprietary strain banks. This trend of consolidation allows large incumbents to rapidly integrate established biostimulants and bio-fungicides into their global supply chains, effectively circumventing the protracted development cycles typical of biological R&D. According to the February 2025 press release 'Syngenta Strengthens Global Leadership in Agricultural Biologicals', Syngenta substantially augmented its research assets by purchasing the Novartis repository of genetic strains and natural compounds to power future product development.

Key Players Profiled in the Agricultural Inoculants Market

- Agrauxine SA

- BASF SE

- Bayer AG

- Brett-Young Seeds Ltd.

- Novozymes A/S

- Verdesian Life Sciences LLC

- XiteBio Technologies Inc.

- Precision Laboratories, LLC

Report Scope

In this report, the Global Agricultural Inoculants Market has been segmented into the following categories:Agricultural Inoculants Market, by Type:

- Plant Growth-promoting Microorganisms

- Biocontrol Agents

- Plant-resistant Stimulants

Agricultural Inoculants Market, by Crop Type:

- Commercial Crops

- Pulses & Oil Seeds

- Grains & Cereals

- Fruits & Vegetables

- Others

Agricultural Inoculants Market, by Microbes:

- Bacterial

- Fungal

- others

Agricultural Inoculants Market, by Mode of Application:

- Seed Inoculation

- Soil Inoculation

- Others

Agricultural Inoculants Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Agricultural Inoculants Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Agricultural Inoculants market report include:- Agrauxine SA

- BASF SE

- Bayer AG

- Brett-Young Seeds Ltd

- Novozymes A/S

- Verdesian Life Sciences LLC

- XiteBio Technologies Inc.

- Precision Laboratories, LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | January 2026 |

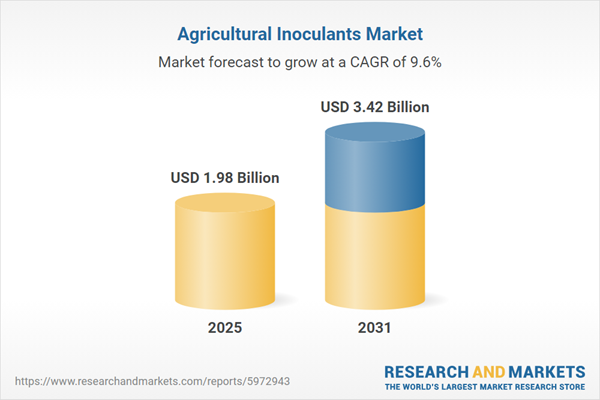

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 1.98 Billion |

| Forecasted Market Value ( USD | $ 3.42 Billion |

| Compound Annual Growth Rate | 9.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |