Free Webex Call

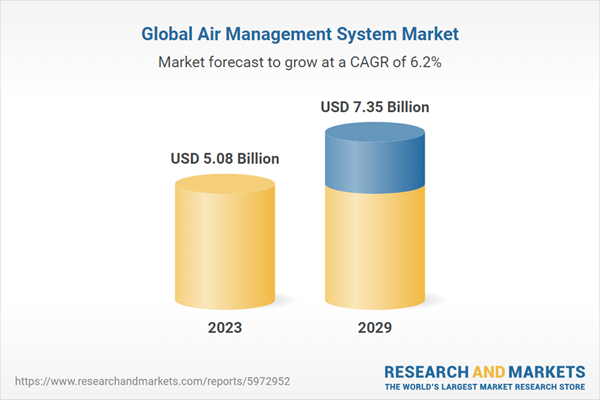

Global Air Management System Market was valued at USD 5.08 billion in 2023 and is anticipated to project robust growth in the forecast period with a CAGR of 6.19% through 2029. The Air Management System (AMS) market refers to the global industry that encompasses the design, manufacturing, and implementation of systems crucial for regulating and optimizing air-related functions within aircraft. This comprehensive market includes a range of components and technologies designed to ensure the efficient management of air quality, cabin pressurization, and temperature control within an aircraft's environment. AMS plays a pivotal role in enhancing the safety, comfort, and overall performance of airborne vehicles, addressing factors such as passenger well-being and the operational efficiency of aircraft systems. Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key components of the Air Management System market include air conditioning systems, environmental control systems, and related sensors and control mechanisms. The market is driven by factors such as advancements in technology, evolving regulatory standards, and the increasing demand for fuel-efficient and environmentally sustainable aviation solutions. Aerospace manufacturers, suppliers, and technology developers contribute to the growth of the AMS market by continually innovating to meet the dynamic requirements of the aviation industry, ensuring the optimal functioning of these systems for both commercial and military aircraft applications.

Key Market Drivers

Stringent Environmental Regulations and Emission Standards

The global Air Management System market is significantly influenced by stringent environmental regulations and emission standards imposed by governments and international bodies. As concerns about climate change and air quality continue to escalate, governments worldwide are implementing strict guidelines to reduce aircraft emissions. This regulatory environment is pushing aerospace manufacturers to invest in advanced Air Management Systems that enhance fuel efficiency, minimize emissions, and comply with evolving environmental standards.The International Civil Aviation Organization (ICAO) and the European Aviation Safety Agency (EASA) are at the forefront of setting emission standards for the aviation industry. Compliance with these regulations has become a pivotal driver for the adoption of sophisticated Air Management Systems, fostering innovation and technological advancements in the market.

Increasing Air Travel and Passenger Traffic

The booming aviation industry, marked by a surge in air travel and passenger traffic, is a significant driver for the global Air Management System market. The rising middle-class population, especially in emerging economies, has led to increased air travel demand. As airlines strive to meet this growing demand, they are investing in modern aircraft equipped with state-of-the-art Air Management Systems.Efficient air conditioning, cabin pressure control, and air quality management are essential for passenger comfort and well-being during long-haul flights. Airlines are, therefore, seeking advanced Air Management Systems that not only ensure a comfortable in-flight experience but also contribute to operational efficiency and cost savings.

Technological Advancements in Air Management Systems

The relentless pursuit of innovation and technological advancements is a critical driver for the global Air Management System market. Aerospace manufacturers and suppliers are continuously investing in research and development to enhance the efficiency, reliability, and intelligence of Air Management Systems.The integration of smart sensors, advanced materials, and sophisticated control algorithms is revolutionizing the capabilities of Air Management Systems. These advancements not only contribute to fuel efficiency but also enable real-time monitoring and predictive maintenance, reducing downtime and operational costs for airlines.

Focus on Fuel Efficiency and Operational Cost Reduction

Fuel efficiency has become a top priority for airlines as they strive to reduce operational costs and enhance sustainability. The Air Management System plays a pivotal role in achieving these objectives by optimizing engine performance, managing cabin air circulation, and regulating overall aircraft systems.Airlines are increasingly investing in fuel-efficient aircraft equipped with advanced Air Management Systems to achieve better operational economics. These systems contribute to the overall weight reduction of the aircraft, improve aerodynamics, and ensure optimal fuel combustion, thereby positively impacting the airline's bottom line.

Growing Demand for Lightweight and Compact Systems

The aviation industry's emphasis on lightweight and compact systems is propelling the demand for advanced Air Management Systems. Manufacturers are focusing on developing systems that are not only space-efficient but also lightweight, as every kilogram saved directly translates into fuel savings and increased payload capacity.The drive towards lightweight materials, such as composite structures and advanced alloys, is influencing the design and manufacturing of Air Management Systems. This shift towards compact and lightweight systems is particularly crucial for next-generation aircraft, including regional jets and unmanned aerial vehicles (UAVs), where weight and space constraints are paramount.

Increasing Focus on Passenger Health and Well-being

With a heightened awareness of health and well-being, especially in the wake of the COVID-19 pandemic, there is an increasing focus on Air Management Systems to ensure the health and comfort of passengers. Proper cabin air filtration, ventilation, and circulation have become critical aspects of passenger safety.Airlines and aircraft manufacturers are investing in advanced Air Management Systems equipped with high-efficiency particulate air (HEPA) filters and advanced air purification technologies. These systems not only enhance passenger health but also contribute to the overall perception of safety and well-being, thereby influencing the purchasing decisions of both airlines and passengers.

In conclusion, the global Air Management System market is being driven by a combination of regulatory, economic, and technological factors. The continuous evolution of these drivers is shaping the landscape of the aviation industry, with a focus on sustainability, efficiency, and passenger experience.

Government Policies are Likely to Propel the Market

Emission Reduction Targets and Aviation Sustainability

Governments worldwide are implementing ambitious policies to address climate change, and the aviation sector is a key focus due to its significant carbon footprint. One crucial government policy shaping the global Air Management System market is the establishment of emission reduction targets and sustainability initiatives.In response to international agreements such as the Paris Agreement, governments are setting specific emission reduction goals for the aviation industry. These policies are driving aerospace manufacturers to develop and implement advanced Air Management Systems that contribute to lower fuel consumption, reduced greenhouse gas emissions, and overall sustainability.

To meet these targets, governments are incentivizing the adoption of innovative technologies and practices within the aviation sector. Financial incentives, tax breaks, and research grants are being provided to companies that invest in and deploy Air Management Systems that align with the industry's sustainability objectives.

Aviation Safety and Certification Standards

Ensuring the safety of air travel is a top priority for governments, leading to the establishment of stringent aviation safety and certification standards. These standards encompass various aspects of aircraft systems, including Air Management Systems, to guarantee the reliability and performance of these critical components.Government aviation authorities, such as the Federal Aviation Administration (FAA) in the United States and the European Union Aviation Safety Agency (EASA) in Europe, set and enforce regulations related to the certification and operation of Air Management Systems. Compliance with these standards is mandatory for aircraft manufacturers and operators.

These policies create a framework that promotes the development of technologically advanced and reliable Air Management Systems. Companies must adhere to strict testing, validation, and certification processes to ensure that their systems meet the highest safety standards set by regulatory authorities.

Research and Development Funding for Aerospace Innovation

Governments recognize the importance of fostering innovation in the aerospace industry, including the development of advanced Air Management Systems. To support research and development (R&D) initiatives, governments implement policies that provide funding and incentives to aerospace companies engaged in innovative projects.Government grants, subsidies, and tax credits are often allocated to companies investing in the research and development of cutting-edge Air Management Systems. These financial incentives aim to accelerate technological advancements, improve system efficiency, and maintain the global competitiveness of the domestic aerospace industry.

By promoting R&D in the field of Air Management Systems, governments contribute to the growth of a knowledge-based economy, enhance the capabilities of the aerospace sector, and ensure that the industry remains at the forefront of global technological innovation.

Trade and Export Controls for Aerospace Technologies

Governments play a crucial role in regulating the export of aerospace technologies, including Air Management Systems, to ensure national security and prevent unauthorized use of sensitive technologies. Policies related to trade and export controls govern the international transfer of aerospace products and technologies.Aerospace companies must comply with these policies, which often involve obtaining export licenses and adhering to strict regulations on the dissemination of certain technologies. Governments implement these measures to safeguard critical aerospace technologies and prevent them from falling into the wrong hands, particularly in regions of geopolitical concern.

These policies can influence the global distribution and accessibility of advanced Air Management Systems, as companies navigate the regulatory landscape to engage in international trade while complying with export control requirements.

Infrastructure Development for Aviation

Governments recognize that a robust aviation infrastructure is essential for the growth and sustainability of the aerospace industry. Policies related to infrastructure development encompass the construction and maintenance of airports, air traffic management systems, and other facilities critical to the functioning of the aviation sector.Effective Air Management Systems rely on well-established airport infrastructure and air traffic control systems. Governments invest in the expansion and modernization of airports, as well as the implementation of advanced air traffic management technologies, to accommodate the increasing demand for air travel and ensure the seamless integration of sophisticated Air Management Systems.

By fostering the development of aviation infrastructure, governments contribute to the overall efficiency, safety, and reliability of air transportation, thereby creating an environment conducive to the adoption of state-of-the-art Air Management Systems.

International Collaboration and Regulatory Alignment

Given the global nature of the aviation industry, governments recognize the importance of international collaboration and regulatory alignment. Harmonizing regulations and standards on a global scale facilitates the seamless integration of Air Management Systems into aircraft manufactured by different companies and ensures consistency in safety and performance requirements.International aviation organizations, such as the International Civil Aviation Organization (ICAO), provide a platform for governments to collaborate on the development of common standards and regulations. Policies supporting international cooperation help create a level playing field for aerospace manufacturers, enabling them to design and produce Air Management Systems that can be readily adopted by the global aviation community.

Governments actively engage in diplomatic efforts to align regulatory frameworks, negotiate international agreements, and participate in forums that promote standardization in the aerospace industry. These policies contribute to the interoperability of Air Management Systems and foster a more efficient and interconnected global aviation network.

In conclusion, government policies significantly shape the landscape of the global Air Management System market by influencing environmental sustainability, safety standards, research and development, trade controls, infrastructure development, and international collaboration. The interplay of these policies reflects a commitment to ensuring the growth and competitiveness of the aerospace industry while addressing global challenges and opportunities.

Key Market Challenges

Evolving Regulatory Landscape and Certification Complexity

One of the primary challenges facing the global Air Management System (AMS) market is the constantly evolving regulatory landscape and the increasing complexity of certification requirements. Governments and aviation authorities worldwide continuously update and tighten regulations to enhance safety, environmental sustainability, and overall industry standards.The challenge lies in the ability of aerospace manufacturers to keep pace with these regulatory changes and ensure that their Air Management Systems comply with the latest standards. Certification processes are rigorous and involve thorough testing, documentation, and validation to demonstrate adherence to safety and performance criteria. The complexity of these processes often leads to extended timelines and increased development costs.

The International Civil Aviation Organization (ICAO), the Federal Aviation Administration (FAA) in the United States, and the European Union Aviation Safety Agency (EASA) in Europe, among others, set stringent requirements for aircraft systems, including Air Management Systems. Manufacturers must navigate a complex web of regulations, each with its own set of specifications, making it challenging to achieve a harmonized, globally accepted certification.

Furthermore, the introduction of new technologies and innovative features in Air Management Systems may outpace the development of corresponding regulatory frameworks. This creates uncertainty for manufacturers, as they may encounter delays in obtaining necessary certifications or face the risk of investing in technologies that later require costly modifications to meet regulatory compliance.

To address this challenge, collaboration between industry stakeholders and regulatory bodies is essential. Establishing clear communication channels and proactive engagement can help align certification processes with technological advancements, ensuring that the global Air Management System market remains agile and responsive to evolving regulatory demands.

Cost Sensitivity and Profit Margins in a Competitive Market

Another significant challenge confronting the global Air Management System market is the delicate balance between cost sensitivity and maintaining competitive profit margins. The aerospace industry is known for its high development and manufacturing costs, driven by the need for cutting-edge technologies, stringent safety standards, and rigorous testing protocols.Airline operators, facing their own economic pressures, are increasingly price-sensitive when selecting aircraft and associated systems, including Air Management Systems. This heightened cost sensitivity puts pressure on aerospace manufacturers to control production costs while delivering innovative and high-performance systems.

The challenge is amplified by the competitive nature of the market, with several global players vying for contracts and market share. As a result, manufacturers often face the dilemma of reducing prices to remain competitive or maintaining higher prices to preserve profit margins. This balance is crucial for sustaining research and development efforts and ensuring the long-term viability of the Air Management System market.

Additionally, economic downturns, such as the global financial crisis of 2008 or the challenges posed by events like the COVID-19 pandemic, can lead to reduced airline budgets and delayed fleet expansions. In such scenarios, aerospace manufacturers may experience fluctuations in demand and increased pressure to offer cost-effective solutions without compromising quality.

To overcome this challenge, companies in the Air Management System market need to focus on operational efficiency, lean manufacturing processes, and strategic cost management. Collaborating with suppliers, leveraging economies of scale, and exploring innovative business models can also contribute to maintaining a competitive edge in a market where cost sensitivity is a persistent concern.

In conclusion, navigating the challenges of the global Air Management System market requires a strategic approach that addresses the evolving regulatory landscape and certification complexity while effectively managing costs and maintaining competitive profit margins. Proactive collaboration, technological innovation, and a commitment to operational efficiency are key elements in overcoming these challenges and ensuring the continued growth and success of the Air Management System market.

Key Market Trends

Integration of IoT and Automation in Air Management Systems

In recent years, the Global Air Management System market has witnessed a significant trend towards the integration of Internet of Things (IoT) and automation technologies. This trend is driven by the growing demand for smarter, more efficient, and data-driven solutions across various industries. IoT-enabled Air Management Systems offer advanced functionalities such as remote monitoring, real-time data analytics, and predictive maintenance capabilities. By leveraging sensors, actuators, and connectivity features, these systems can collect and analyze vast amounts of data regarding air quality, pressure, temperature, and flow rates.One key aspect of this trend is the adoption of automation in air management processes. Automated systems can regulate air flow, pressure, and distribution more precisely and efficiently than traditional manual methods. This not only optimizes energy consumption but also enhances operational performance and consistency. Automation also enables seamless integration with other systems such as HVAC (Heating, Ventilation, and Air Conditioning) and building management systems, enabling holistic control and optimization of indoor air quality and environmental conditions.

IoT integration enables remote monitoring and control of air management systems, allowing operators to access real-time data and make informed decisions from anywhere. This enhances operational flexibility and efficiency, particularly in large-scale facilities or multi-site operations. Additionally, IoT-enabled Air Management Systems can facilitate predictive maintenance by monitoring equipment performance and detecting potential issues before they escalate into costly failures. This proactive approach minimizes downtime, reduces maintenance costs, and extends the lifespan of air management assets.

The integration of IoT and automation technologies in Air Management Systems represents a significant market trend with wide-ranging implications for various industries. Manufacturers are increasingly investing in research and development to enhance the intelligence and connectivity of their air management solutions, catering to the evolving needs of customers for smarter, more efficient, and sustainable air management solutions.

Segmental Insights

Platform Insights

The Rotary wing segment held the largest Market share in 2023. Rotary-wing aircraft, primarily helicopters, are used across a wide range of applications, including civilian transport, emergency medical services, search and rescue, law enforcement, and military operations. The varied missions and operating environments of helicopters necessitate sophisticated Air Management Systems to ensure optimal performance and safety in different scenarios.The operational requirements of rotary-wing aircraft can be highly specialized compared to fixed-wing aircraft. For example, helicopters often operate at lower altitudes and in more challenging environments, requiring advanced Air Management Systems to manage factors such as cabin pressurization, thermal management, and oxygen systems tailored to specific mission needs.

Helicopters are frequently employed in search and rescue missions, where cabin pressurization, thermal management, and oxygen systems play crucial roles in supporting the well-being of both crew and passengers. Advanced Air Management Systems are essential for ensuring the comfort and safety of individuals during prolonged missions or in harsh environmental conditions.

Many military helicopters, used for reconnaissance, transport, and attack missions, rely on sophisticated Air Management Systems to address the unique challenges of military operations. These systems contribute to the efficiency, survivability, and mission success of military rotary-wing platforms.

Advances in technology have led to the integration of more sophisticated and efficient Air Management Systems in rotary-wing aircraft. These systems are designed to enhance overall performance, reduce maintenance requirements, and improve the reliability of helicopters across various applications.

Regional Insights

North America

North America held the largest market share for Global Air Management System in 2023. North America commands the largest market share of the Global Air Management System market due to several key factors that contribute to its dominance in this industry. These factors encompass a combination of technological innovation, industrial infrastructure, regulatory environment, and market dynamics, all of which converge to create a favorable landscape for the adoption and growth of air management systems in the region.Technological innovation plays a pivotal role in driving the adoption of air management systems in North America. The region is home to numerous leading companies and research institutions at the forefront of developing cutting-edge air management technologies. These innovations encompass advancements in sensor technology, data analytics, and automation, enabling more precise monitoring and control of air flow in industrial processes. As North American industries strive for greater efficiency, productivity, and sustainability, they increasingly turn to these advanced air management solutions to optimize their operations.

North America benefits from a robust industrial infrastructure across various sectors such as manufacturing, automotive, aerospace, and healthcare, among others. These industries have a significant demand for air management systems to support their production processes, ensure product quality, and maintain regulatory compliance. The region's diverse industrial landscape creates a vast market opportunity for air management system providers to cater to a wide range of applications and requirements, further driving market growth and penetration.

The regulatory environment in North America incentivizes the adoption of air management systems to meet stringent environmental and occupational health standards. Regulatory bodies such as the Environmental Protection Agency (EPA) in the United States and Environment and Climate Change Canada (ECCC) impose regulations and emissions standards on industrial facilities to control air pollution and ensure workplace safety. Compliance with these regulations necessitates the implementation of effective air management solutions, spurring market demand in the region.

North America's strong focus on sustainability and corporate responsibility fuels the adoption of air management systems as part of broader environmental initiatives. Many companies in the region prioritize reducing their carbon footprint and minimizing environmental impact, driving investments in energy-efficient technologies, including air management systems. By optimizing air flow and reducing energy consumption, these systems contribute to greenhouse gas emission reductions and support organizations' sustainability goals, thereby driving their widespread adoption across North America.

Key Market Players

- Honeywell International Inc

- Meggitt Plc

- Eaton Corporation Plc

- Safran SA

- Thales Group

- Leonardo S.p.A.

- General Electric Company

- Emerson Electric Co.

- RTX Corporation

- Diehl Stiftung & Co. KG

Report Scope:

In this report, the Global Air Management System Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Air Management System Market, By System:

- Thermal Management

- Engine Bleed Air

- Oxygen System

- Fuel Tank Inserting

- Cabin Pressure Control

- ICE Protection

Air Management System Market, By Platform:

- Fixed Wing

- Rotary Wing

Air Management System Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Air Management System Market.Available Customizations:

Global Air Management System Market report with the given Market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:Company Information

- Detailed analysis and profiling of additional Market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

1. Product Overview

2. Research Methodology

5. Global Air Management System Market Outlook

6. North America Air Management System Market Outlook

7. Europe Air Management System Market Outlook

8. Asia-Pacific Air Management System Market Outlook

9. South America Air Management System Market Outlook

10. Middle East and Africa Air Management System Market Outlook

11. Market Dynamics

13. Company Profiles

Companies Mentioned

- Honeywell International Inc

- Meggitt Plc

- Eaton Corporation Plc

- Safran SA

- Thales Group

- Leonardo S.p.A.

- General Electric Company

- Emerson Electric Co.

- RTX Corporation

- Diehl Stiftung & Co. KG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | May 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 5.08 Billion |

| Forecasted Market Value ( USD | $ 7.35 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |