Service is the fastest growing segment, North America is the largest market globally

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The accelerated adoption of cloud computing and hybrid cloud models stands as a primary catalyst for the hyperscale data center market. Enterprises are increasingly migrating critical applications and workloads to cloud platforms, seeking enhanced scalability, operational flexibility, and optimized resource utilization. This directly drives substantial demand for underlying hyperscale infrastructure. Hybrid cloud strategies, integrating on-premises systems with public cloud services, further necessitate robust, interconnected hyperscale facilities to manage complex, distributed IT environments. These large-scale facilities provide the essential compute and storage capacity, alongside high availability and performance, for diverse cloud service offerings.Key Market Challenges

A significant challenge impeding the expansion of the Global Hyperscale Data Center Market is the substantial initial capital expenditure required. Developing these massive facilities demands considerable financial investment for land acquisition, advanced infrastructure development, and specialized cooling systems. This high financial barrier restricts market entry for new participants and smaller entities, consequently limiting overall market growth and fostering consolidation among established providers with deep financial resources. The intense competition for suitable land further amplifies this cost. According to Infrastructure Masons, in 2024, primary data center markets in North America experienced vacancy rates falling to a record low of 1.9%, concurrently pushing rent rates for 250 to 500 kilowatt requirements up by 12.6% to $184.06 per kilowatt per month. These rising real estate and construction costs directly translate into extended project timelines and elevated investment risk, thereby decelerating the deployment of crucial new hyperscale capacity needed to address increasing global digital service demand.Key Market Trends

Hyperscale data center development increasingly emphasizes sustainable and energy-efficient designs, propelled by environmental concerns, escalating energy costs, and stringent regulatory mandates. Operators adopt advanced cooling, optimize power distribution, and integrate renewable energy into infrastructure. According to the European Data Centre Association, new data centers in the European Union must achieve a Power Usage Effectiveness (PUE) below 1.4 by January 2025. This commitment is further demonstrated by Amazon, which announced in July 2024 it met its goal of matching 100% of its global operations' electricity consumption with renewable energy sources.Key Market Players Profiled:

- Hewlett-Packard Enterprise Development LP

- Marvell Technology, Inc.

- Nvidia Corporation

- Cisco Systems, Inc.

- IBM Corporation

- Western Digital Corporation

- Intel Corporation

- Quanta Computer Inc.

- Microsoft Corporation

- Alibaba Group

Report Scope:

In this report, the Global Hyperscale Data Center Market has been segmented into the following categories:By Component:

- Solution

- Service

By User Type:

- Cloud Providers

- Colocation Providers

By End-User:

- BFSI

- IT & Telecom

- Government

- Energy & Utilities

- Others

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Hyperscale Data Center Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Hewlett-Packard Enterprise Development LP

- Marvell Technology, Inc.

- Nvidia Corporation

- Cisco Systems, Inc.

- IBM Corporation

- Western Digital Corporation

- Intel Corporation

- Quanta Computer Inc.

- Microsoft Corporation

- Alibaba Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | November 2025 |

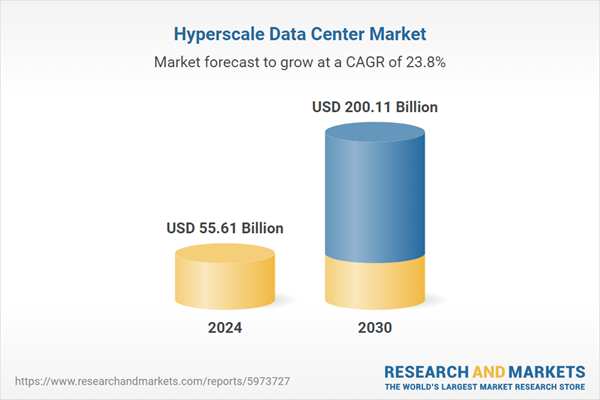

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 55.61 Billion |

| Forecasted Market Value ( USD | $ 200.11 Billion |

| Compound Annual Growth Rate | 23.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |