Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

In the Mining Automation market, mining companies employ various automation systems and technologies, including autonomous vehicles, remote monitoring and control systems, sensor networks, artificial intelligence, and data analytics. These technologies are leveraged to optimize mineral extraction, reduce operational costs, and minimize risks to workers in often hazardous mining environments.

Key objectives of the Mining Automation market include improving productivity, ensuring compliance with safety and environmental regulations, and addressing labor shortages in the mining workforce through the reduction of human intervention in certain processes. The sector also focuses on data-driven decision-making and the development of innovative solutions for resource extraction, exploration, and sustainability.

The Mining Automation market plays a pivotal role in modernizing the mining industry and driving its transformation toward safer, more efficient, and environmentally responsible practices. It encompasses a wide range of technologies, services, and solutions designed to meet the evolving needs of the global mining sector.

Key Market Drivers

Safety and Workforce Health Concerns:

Safety and workforce health concerns have been at the forefront of the mining industry for decades. Mining operations often take place in challenging and hazardous environments, including underground mines and open-pit quarries. The well-being of workers is a top priority, and mining automation is a significant driver in addressing these concerns.Automation technologies, such as autonomous haulage trucks and remotely operated drilling equipment, reduce the need for on-site human workers in dangerous roles. This minimizes the risk of accidents, injuries, and exposure to harmful substances. With automation, miners can control and monitor equipment from a safe distance, which not only enhances safety but also provides peace of mind for both workers and management. This focus on workforce safety is a driving force behind the adoption of mining automation.

Efficiency and Productivity Gains:

Efficiency and productivity are crucial factors in the highly competitive mining industry. Automation offers substantial gains in this regard. Automated systems optimize mining operations by reducing downtime, streamlining processes, and maximizing resource utilization. Autonomous vehicles and equipment can work around the clock without the need for rest, breaks, or shift changes. This results in increased output, lower operational costs, and improved overall profitability.Automation enhances precision and consistency in tasks such as drilling, blasting, and materials handling. This consistency leads to higher-quality ore extraction and reduces waste, further contributing to efficiency and productivity. Mining companies worldwide are embracing automation to stay competitive in a global market where efficiency and productivity are key drivers.

Environmental Sustainability:

Increasing environmental concerns and stringent regulations have put pressure on the mining industry to adopt more sustainable practices. Automation plays a pivotal role in achieving this goal. Automated systems can be programmed to optimize resource usage, minimize waste, and reduce emissions. This not only ensures compliance with environmental regulations but also enhances a company's reputation and commitment to social responsibility.By reducing energy consumption and waste, mining automation helps mitigate the industry's impact on ecosystems, air quality, and water resources. As sustainability becomes a growing priority, mining automation is a critical driver in the effort to balance economic objectives with environmental responsibility.

Resource Scarcity and Deeper Mining:

As easily accessible and high-grade ore deposits become scarcer, mining companies are compelled to explore deeper and more challenging geological formations. Automation enables mining operations to access these resources efficiently. Remote-controlled and autonomous equipment can operate in environments where human access is difficult or impossible, making previously uneconomical deposits viable.In deep mining operations, where conditions are extreme and the risk to human workers is substantial, automation ensures consistent and reliable performance. These advancements in technology have opened up new possibilities for resource extraction, making automation an indispensable driver for addressing the challenge of resource scarcity.

Data-Driven Decision Making:

Mining automation generates an abundance of data, from sensor readings to equipment performance metrics. This data can be harnessed for predictive maintenance, process optimization, and better decision-making. Machine learning and artificial intelligence enable mining companies to gain valuable insights into their operations.By analyzing this data, companies can identify trends, anticipate maintenance needs, and optimize workflows. This leads to improved efficiency and cost reduction. The ability to make informed, data-driven decisions is a key driver of mining automation, as it empowers companies to continuously refine their operations for optimal performance.

Labor Shortages and Skills Gap:

The mining industry has been grappling with a shortage of skilled labor in recent years. Automation offers a solution to this problem by reducing the industry's reliance on specialized personnel for manual operation of heavy machinery. With automation, mining companies can cope with the skills gap while still maintaining efficient operations.Automated systems can be operated and monitored remotely, which allows for centralized control centers where a smaller number of highly skilled workers can manage multiple mining sites. This not only addresses the labor shortage issue but also ensures that the available skilled workers are utilized most effectively.

The global Mining Automation market is being driven by a combination of safety concerns, the need for increased efficiency and productivity, environmental sustainability, the necessity of accessing deeper resources, the opportunities presented by data-driven decision-making, and the need to address labor shortages. These drivers collectively contribute to the growth and evolution of the mining automation sector as it continues to gain traction worldwide.

Government Policies are Likely to Propel the Market

Regulatory Framework for Safety and Environmental Compliance:

Government policies play a crucial role in regulating safety and environmental practices within the global Mining Automation market. Mining operations, even when automated, carry inherent risks to both workers and the environment. Governments around the world have established comprehensive regulatory frameworks to ensure that mining companies adhere to strict safety standards and minimize their environmental footprint.These policies typically include guidelines for worker safety, such as training requirements and equipment safety standards. Additionally, environmental compliance regulations focus on limiting air and water pollution, mitigating habitat disruption, and minimizing the extraction of non-renewable resources.

For example, in the United States, the Mine Safety and Health Administration (MSHA) enforces safety regulations in mines, while the Environmental Protection Agency (EPA) oversees environmental compliance. Government policies in these areas drive the adoption of automation technologies that can help mining companies meet these stringent standards and reduce the associated risks.

Incentives for Technology Adoption and Innovation:

Governments worldwide recognize the economic benefits of technology adoption and innovation within the mining industry. To encourage mining companies to invest in automation and related technologies, policymakers often offer incentives and subsidies.These incentives can take the form of tax breaks, grants, or research and development funding. By providing financial support, governments aim to accelerate the adoption of automation, which can lead to increased efficiency, reduced operational costs, and improved competitiveness. An example of such a policy is the Australian Government's Exploration Development Incentive (EDI), which provides tax incentives to mining companies investing in exploration and innovation.

Workforce Training and Development Programs:

Mining automation brings about changes in the skill requirements for the mining workforce. To address potential labor displacement and skills gaps, governments may implement policies that support workforce training and development programs.These policies can include funding for vocational training, apprenticeships, and education in automation-related fields. By preparing the workforce for the increasing automation of mining operations, governments aim to ensure a smooth transition and reduce the negative impacts of job displacement.

For instance, the Canadian Government's Canada Job Grant program provides financial assistance to employers for employee training, including training related to automation in the mining sector.

Taxation and Royalty Structures:

Taxation and royalty policies significantly influence the economics of the mining industry. Governments often determine tax rates and royalty structures for mining companies based on the level of automation and the environmental impact of their operations.Higher levels of automation that lead to improved safety, environmental compliance, and resource optimization may be rewarded with reduced tax rates or royalties. Conversely, operations that do not meet specified automation and environmental standards may face higher taxation. For example, the Brazilian Government has implemented tax incentives for mining companies adopting advanced automation technologies.

Export and Trade Policies:

Government policies related to export and trade play a critical role in shaping the global mining automation market. These policies impact the export of minerals and resources extracted using automated technologies, affecting the competitiveness of mining companies.Government export policies can include export restrictions, tariffs, and trade agreements. These policies influence the global supply chain for minerals and may impact the strategic decisions of mining companies regarding their level of automation. For example, the export restrictions imposed by the Chinese government on certain minerals have led to increased efforts to automate mining processes to meet domestic demand while adhering to export quotas.

Research and Development Funding for Mining Technology:

Government support for research and development (R&D) in mining technology is a significant driver of innovation and automation within the industry. Governments often allocate funding to support R&D initiatives that aim to improve the efficiency and sustainability of mining operations.This funding may go toward the development of new automation technologies, exploration methods, and environmental monitoring systems. In the European Union, for instance, the Horizon 2020 program has provided substantial funding for R&D projects in the mining sector, encouraging the development and adoption of advanced automation solutions.

Government policies in the global Mining Automation market encompass a wide range of areas, from safety and environmental compliance to incentives for technology adoption, workforce development, taxation, trade, and research and development. These policies shape the regulatory and economic landscape for mining companies, influencing their decisions regarding the adoption of automation technologies and their approach to sustainable and responsible mining practices.

Key Market Trend

Growing Adoption of Autonomous Mining Equipment and Systems:

The increasing adoption of autonomous mining equipment and systems represents a major trend in the Mining Automation Market. These technologies offer significant benefits to mining operations by enhancing safety, efficiency, and productivity. With autonomous systems, tasks such as drilling, hauling, and transportation can be performed with minimal human intervention, reducing the risk of accidents and improving operational continuity. The advancements in artificial intelligence, machine learning, and sensor technologies are driving the development of sophisticated autonomous mining solutions, enabling companies to optimize their operations and stay competitive in the market. This trend reflects a shift towards greater automation and innovation within the mining industry, as companies seek to leverage technology to improve performance and sustainability.Key Market Challenges

Technological Hurdles and Integration Complexities:

One of the primary challenges in the global Mining Automation market is the complex and rapidly evolving nature of the technology itself. Mining automation relies on a wide array of cutting-edge technologies, including autonomous vehicles, sensor networks, data analytics, artificial intelligence, and remote monitoring systems. These technologies, while promising substantial benefits, present several formidable challenges.First and foremost, the mining industry operates in diverse and often harsh environments, such as underground mines, open-pit quarries, and remote locations. The adoption of automation in such settings necessitates robust and reliable technologies that can withstand extreme conditions, including temperature variations, high levels of dust, humidity, and corrosive substances. Developing and maintaining automation systems that can operate seamlessly in these environments is a technical challenge.

Integrating various automation components into an existing mining infrastructure can be complex. Retrofitting older mines with automation technology often requires significant modifications and investments. Ensuring compatibility between different automation systems and software platforms is critical to achieving seamless automation across the entire operation.

Data management and cybersecurity are additional technological challenges. Automation generates vast amounts of data, and mining companies must have the infrastructure and expertise to collect, process, and analyze this data effectively. Ensuring data security and protection against cyber threats is paramount, given the potential consequences of data breaches in mining operations.

Finally, there is a skills gap in the industry. While automation promises increased efficiency, it also requires a workforce with the technical skills to manage and maintain these complex systems. Addressing this skills gap by providing training and education presents yet another technological challenge.

Regulatory and Social Acceptance Issues:

A significant challenge for the global Mining Automation market lies in navigating the complex landscape of regulations and addressing societal concerns related to automation in mining.Regulatory challenges arise from the need to comply with safety, environmental, and labor laws. Governments impose strict regulations to ensure the safety of workers, protect the environment, and manage the social impact of mining operations. Mining automation systems must adhere to these regulations while also addressing concerns related to potential job displacement. Striking a balance between the advancement of automation and the preservation of jobs is a delicate challenge that mining companies must navigate.

Social acceptance is another critical issue. Automation in mining can be perceived as a threat to employment, leading to opposition from labor unions and local communities. Miners and their families may be concerned about job security, leading to resistance against automation initiatives. Overcoming these social challenges requires effective communication, engagement with local communities, and demonstrating the benefits of automation, such as improved safety and environmental stewardship.

Ethical concerns related to automation, such as the potential for surveillance and the impact on communities, need to be addressed. Ensuring that automation technologies are developed and implemented ethically is a growing concern and challenge in the mining industry.

The global nature of mining operations further complicates matters. Mining companies often operate in multiple countries, each with its own set of regulations and societal expectations. Navigating this complex web of regulations and community engagement requires careful planning, significant resources, and a commitment to corporate social responsibility.

The global Mining Automation market faces challenges related to the complex and evolving nature of automation technology, including technological hurdles, integration complexities, and data management. Additionally, the industry must navigate the regulatory landscape, address social concerns about job displacement, and ensure ethical and responsible automation practices. These challenges, while significant, present opportunities for innovative solutions and the continued growth of the Mining Automation sector.

Segmental Insights

Technique Insights

The Surface Mining Automation segment held the largest Market share in 2023. Surface mining automation is more prevalent in the extraction of minerals found in open-pit mines, where ore deposits are closer to the surface. Minerals like coal, iron ore, and copper are often associated with large, accessible surface deposits. This abundance of surface resources has historically favored the use of automation in surface mining. Surface mining often involves large-scale, bulk commodity production. Automation in surface mining allows for economies of scale, making it financially feasible to invest in advanced technology. Automated systems, such as autonomous haul trucks and shovels, can efficiently move vast quantities of materials, making it cost-effective for mining companies. Surface mining automation contributes to improved safety and reduced environmental impact. Automated equipment can operate in open, well-ventilated spaces, reducing the risks associated with confined underground environments. Moreover, automation can help in minimizing overburden removal, which can lead to reduced habitat disruption and a smaller environmental footprint. Automation enhances the efficiency and productivity of surface mining operations. Autonomous vehicles and equipment can work continuously, reducing downtime associated with shift changes and breaks. The precision and consistency of automation technology contribute to higher-quality ore extraction and reduced waste, further boosting productivity. Advances in technology have made surface mining automation more feasible and efficient. The development of robust autonomous vehicles, sophisticated monitoring and control systems, and improved sensor technology has driven the adoption of automation in surface mining. Consumer and industrial demand for minerals extracted through surface mining, such as coal for energy production and iron ore for steel manufacturing, remains high. This ongoing demand incentivizes mining companies to invest in automation to meet production targets efficiently. Regulatory requirements and environmental standards have driven the adoption of automation in surface mining. Automation can help mining companies adhere to regulations related to air quality, habitat protection, and safety in surface mining operations.Regional Insights

North America was the largest market for mining automation, in 2023. North America has emerged as the largest market for the Global Mining Automation market due to several key factors that have contributed to its dominance in this sector. These factors include technological advancements, regulatory frameworks, extensive mining operations, and a focus on operational efficiency and safety.North America has been at the forefront of technological innovation in the mining industry. The region boasts a robust ecosystem of technology companies, research institutions, and mining equipment manufacturers that continuously develop and deploy cutting-edge automation solutions tailored to the specific needs of the mining sector. These advancements include the integration of autonomous vehicles, drones, robotics, and real-time monitoring systems, enhancing productivity, and safety in mining operations.

Stringent regulatory frameworks in North America have played a significant role in driving the adoption of mining automation technologies. Government agencies such as the Mine Safety and Health Administration (MSHA) in the United States and regulatory bodies in Canada have implemented stringent safety standards and regulations to protect workers and the environment. As a result, mining companies in North America are compelled to invest in automation technologies to ensure compliance with these regulations while maximizing operational efficiency.

North America is home to vast mineral reserves and extensive mining operations across various commodities, including coal, metals, and minerals. The region's abundant natural resources have spurred significant investments in mining infrastructure and equipment, creating a fertile ground for the adoption of automation technologies. Mining companies in North America recognize the potential of automation to increase production rates, reduce operational costs, and mitigate risks associated with manual labor in hazardous environments.

Key Market Players

- Caterpillar Inc

- Hitachi Construction Machinery Co., Ltd.

- Komatsu Ltd.

- Liebherr-International AG

- Sandvik AB

- Volvo Group

- ABB Ltd.

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

Report Scope:

In this report, the Global Mining Automation Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Mining Automation Market, By Technique:

- Underground Mining Automation

- Surface Mining Automation

Mining Automation Market, By Type:

- Equipment

- Software

- Communication System

Mining Automation Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Mining Automation Market.Available Customizations:

Global Mining Automation Market report with the given Market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:Company Information

- Detailed analysis and profiling of additional Market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

1. Product Overview1.1. Market Definition

1.2. Scope of the Market

1.2.1. Markets Covered

1.2.2. Years Considered for Study

1.3. Key Market Segmentations

2. Research Methodology

2.1. Objective of the Study

2.2. Baseline Methodology

2.3. Formulation of the Scope

2.4. Assumptions and Limitations

2.5. Sources of Research

2.5.1. Secondary Research

2.5.2. Primary Research

2.6. Approach for the Market Study

2.6.1. The Bottom-Up Approach

2.6.2. The Top-Down Approach

2.7. Methodology Followed for Calculation of Market Size & Market Shares

2.8. Forecasting Methodology

2.8.1. Data Triangulation & Validation

3. Executive Summary

4. Voice of Customer

5. Global Mining Automation Market Outlook

5.1. Market Size & Forecast

5.1.1. By Value

5.2. Market Share & Forecast

5.2.1. By Technique (Underground Mining Automation, Surface Mining Automation)

5.2.2. By Type (Equipment, Software, Communication System)

5.2.3. By Region

5.2.4. By Company (2023)

5.3. Market Map

6. North America Mining Automation Market Outlook

6.1. Market Size & Forecast

6.1.1. By Value

6.2. Market Share & Forecast

6.2.1. By Technique

6.2.2. By Type

6.2.3. By Country

6.3. North America: Country Analysis

6.3.1. United States Mining Automation Market Outlook

6.3.1.1. Market Size & Forecast

6.3.1.1.1. By Value

6.3.1.2. Market Share & Forecast

6.3.1.2.1. By Technique

6.3.1.2.2. By Type

6.3.2. Canada Mining Automation Market Outlook

6.3.2.1. Market Size & Forecast

6.3.2.1.1. By Value

6.3.2.2. Market Share & Forecast

6.3.2.2.1. By Technique

6.3.2.2.2. By Type

6.3.3. Mexico Mining Automation Market Outlook

6.3.3.1. Market Size & Forecast

6.3.3.1.1. By Value

6.3.3.2. Market Share & Forecast

6.3.3.2.1. By Technique

6.3.3.2.2. By Type

7. Europe Mining Automation Market Outlook

7.1. Market Size & Forecast

7.1.1. By Value

7.2. Market Share & Forecast

7.2.1. By Technique

7.2.2. By Type

7.2.3. By Country

7.3. Europe: Country Analysis

7.3.1. Germany Mining Automation Market Outlook

7.3.1.1. Market Size & Forecast

7.3.1.1.1. By Value

7.3.1.2. Market Share & Forecast

7.3.1.2.1. By Technique

7.3.1.2.2. By Type

7.3.2. United Kingdom Mining Automation Market Outlook

7.3.2.1. Market Size & Forecast

7.3.2.1.1. By Value

7.3.2.2. Market Share & Forecast

7.3.2.2.1. By Technique

7.3.2.2.2. By Type

7.3.3. Italy Mining Automation Market Outlook

7.3.3.1. Market Size & Forecast

7.3.3.1.1. By Value

7.3.3.2. Market Share & Forecast

7.3.3.2.1. By Technique

7.3.3.2.2. By Type

7.3.4. France Mining Automation Market Outlook

7.3.4.1. Market Size & Forecast

7.3.4.1.1. By Value

7.3.4.2. Market Share & Forecast

7.3.4.2.1. By Technique

7.3.4.2.2. By Type

7.3.5. Spain Mining Automation Market Outlook

7.3.5.1. Market Size & Forecast

7.3.5.1.1. By Value

7.3.5.2. Market Share & Forecast

7.3.5.2.1. By Technique

7.3.5.2.2. By Type

8. Asia-Pacific Mining Automation Market Outlook

8.1. Market Size & Forecast

8.1.1. By Value

8.2. Market Share & Forecast

8.2.1. By Technique

8.2.2. By Type

8.2.3. By Country

8.3. Asia-Pacific: Country Analysis

8.3.1. China Mining Automation Market Outlook

8.3.1.1. Market Size & Forecast

8.3.1.1.1. By Value

8.3.1.2. Market Share & Forecast

8.3.1.2.1. By Technique

8.3.1.2.2. By Type

8.3.2. India Mining Automation Market Outlook

8.3.2.1. Market Size & Forecast

8.3.2.1.1. By Value

8.3.2.2. Market Share & Forecast

8.3.2.2.1. By Technique

8.3.2.2.2. By Type

8.3.3. Japan Mining Automation Market Outlook

8.3.3.1. Market Size & Forecast

8.3.3.1.1. By Value

8.3.3.2. Market Share & Forecast

8.3.3.2.1. By Technique

8.3.3.2.2. By Type

8.3.4. South Korea Mining Automation Market Outlook

8.3.4.1. Market Size & Forecast

8.3.4.1.1. By Value

8.3.4.2. Market Share & Forecast

8.3.4.2.1. By Technique

8.3.4.2.2. By Type

8.3.5. Australia Mining Automation Market Outlook

8.3.5.1. Market Size & Forecast

8.3.5.1.1. By Value

8.3.5.2. Market Share & Forecast

8.3.5.2.1. By Technique

8.3.5.2.2. By Type

9. South America Mining Automation Market Outlook

9.1. Market Size & Forecast

9.1.1. By Value

9.2. Market Share & Forecast

9.2.1. By Technique

9.2.2. By Type

9.2.3. By Country

9.3. South America: Country Analysis

9.3.1. Brazil Mining Automation Market Outlook

9.3.1.1. Market Size & Forecast

9.3.1.1.1. By Value

9.3.1.2. Market Share & Forecast

9.3.1.2.1. By Technique

9.3.1.2.2. By Type

9.3.2. Argentina Mining Automation Market Outlook

9.3.2.1. Market Size & Forecast

9.3.2.1.1. By Value

9.3.2.2. Market Share & Forecast

9.3.2.2.1. By Technique

9.3.2.2.2. By Type

9.3.3. Colombia Mining Automation Market Outlook

9.3.3.1. Market Size & Forecast

9.3.3.1.1. By Value

9.3.3.2. Market Share & Forecast

9.3.3.2.1. By Technique

9.3.3.2.2. By Type

10. Middle East and Africa Mining Automation Market Outlook

10.1. Market Size & Forecast

10.1.1. By Value

10.2. Market Share & Forecast

10.2.1. By Technique

10.2.2. By Type

10.2.3. By Country

10.3. Middle East and Africa: Country Analysis

10.3.1. South Africa Mining Automation Market Outlook

10.3.1.1. Market Size & Forecast

10.3.1.1.1. By Value

10.3.1.2. Market Share & Forecast

10.3.1.2.1. By Technique

10.3.1.2.2. By Type

10.3.2. Saudi Arabia Mining Automation Market Outlook

10.3.2.1. Market Size & Forecast

10.3.2.1.1. By Value

10.3.2.2. Market Share & Forecast

10.3.2.2.1. By Technique

10.3.2.2.2. By Type

10.3.3. UAE Mining Automation Market Outlook

10.3.3.1. Market Size & Forecast

10.3.3.1.1. By Value

10.3.3.2. Market Share & Forecast

10.3.3.2.1. By Technique

10.3.3.2.2. By Type

10.3.4. Kuwait Mining Automation Market Outlook

10.3.4.1. Market Size & Forecast

10.3.4.1.1. By Value

10.3.4.2. Market Share & Forecast

10.3.4.2.1. By Technique

10.3.4.2.2. By Type

10.3.5. Turkey Mining Automation Market Outlook

10.3.5.1. Market Size & Forecast

10.3.5.1.1. By Value

10.3.5.2. Market Share & Forecast

10.3.5.2.1. By Technique

10.3.5.2.2. By Type

11. Market Dynamics

11.1. Drivers

11.2. Challenges

12. Market Trends & Developments

13. Company Profiles

13.1. Caterpillar Inc

13.1.1. Business Overview

13.1.2. Key Revenue and Financials

13.1.3. Recent Developments

13.1.4. Key Personnel/Key Contact Person

13.1.5. Key Product/Services Offered

13.2. Hitachi Construction Machinery Co., Ltd.

13.2.1. Business Overview

13.2.2. Key Revenue and Financials

13.2.3. Recent Developments

13.2.4. Key Personnel/Key Contact Person

13.2.5. Key Product/Services Offered

13.3. Komatsu Ltd.

13.3.1. Business Overview

13.3.2. Key Revenue and Financials

13.3.3. Recent Developments

13.3.4. Key Personnel/Key Contact Person

13.3.5. Key Product/Services Offered

13.4. Liebherr-International AG

13.4.1. Business Overview

13.4.2. Key Revenue and Financials

13.4.3. Recent Developments

13.4.4. Key Personnel/Key Contact Person

13.4.5. Key Product/Services Offered

13.5. Sandvik AB

13.5.1. Business Overview

13.5.2. Key Revenue and Financials

13.5.3. Recent Developments

13.5.4. Key Personnel/Key Contact Person

13.5.5. Key Product/Services Offered

13.6. Volvo Group

13.6.1. Business Overview

13.6.2. Key Revenue and Financials

13.6.3. Recent Developments

13.6.4. Key Personnel/Key Contact Person

13.6.5. Key Product/Services Offered

13.7. ABB Ltd.

13.7.1. Business Overview

13.7.2. Key Revenue and Financials

13.7.3. Recent Developments

13.7.4. Key Personnel/Key Contact Person

13.7.5. Key Product/Services Offered

13.8. Rockwell Automation Inc.

13.8.1. Business Overview

13.8.2. Key Revenue and Financials

13.8.3. Recent Developments

13.8.4. Key Personnel/Key Contact Person

13.8.5. Key Product/Services Offered

13.9. Schneider Electric SE

13.9.1. Business Overview

13.9.2. Key Revenue and Financials

13.9.3. Recent Developments

13.9.4. Key Personnel/Key Contact Person

13.9.5. Key Product/Services Offered

13.10. Siemens AG

13.10.1. Business Overview

13.10.2. Key Revenue and Financials

13.10.3. Recent Developments

13.10.4. Key Personnel/Key Contact Person

13.10.5. Key Product/Services Offered

14. Strategic Recommendations

15. About the Publisher & Disclaimer

Companies Mentioned

- Caterpillar Inc

- Hitachi Construction Machinery Co., Ltd.

- Komatsu Ltd.

- Liebherr-International AG

- Sandvik AB

- Volvo Group

- ABB Ltd.

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | June 2024 |

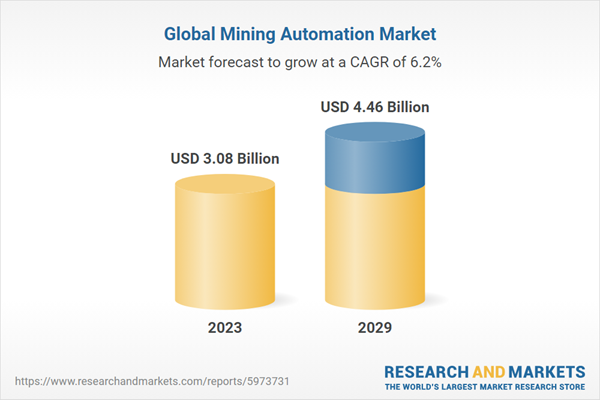

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 3.08 Billion |

| Forecasted Market Value ( USD | $ 4.46 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |