Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, a major obstacle hindering rapid market growth is the significant capital expenditure needed to deploy these advanced measurement systems. Small and medium-sized enterprises frequently delay adopting comprehensive scanning technologies due to high upfront costs and economic volatility, which restrict their investment capabilities. Data from VDMA Machine Vision in 2024 indicated that the European sector anticipated a ten percent nominal sales decline compared to the previous year, attributed to reduced demand in manufacturing industries. This financial sensitivity limits widespread adoption in price-sensitive regions and confines the customer base mainly to larger industrial organizations.

Market Drivers

The fusion of Industry 4.0 and smart factory automation is transforming the 3D metrology landscape by necessitating interconnected quality control systems. As manufacturers shift toward digitized workflows, there is a critical need for metrology solutions that offer real-time data exchange and closed-loop feedback for predictive maintenance. This transition allows for the automated adjustment of production parameters, reducing waste and boosting process efficiency. The magnitude of this industrial shift is reflected in the financial results of technology providers; for instance, Hexagon AB reported in their 'Interim Report 1 January - 30 September 2025', released in October 2025, that net sales reached 1.30 billion EUR, highlighting continued investment in digital manufacturing solutions.Additionally, the expansion of electric and autonomous vehicle manufacturing requires rigorous dimensional verification for essential powertrain components. The transition from internal combustion engines to electric platforms brings tighter tolerance requirements and faster production cycles that traditional measurement methods cannot support, compelling automotive OEMs to adopt non-contact 3D scanning technologies. This volume-driven demand is supported by global adoption trends; the International Energy Agency's 'Global EV Outlook 2025', published in May 2025, noted that global electric car sales exceeded 17 million units in 2024, driving the need for automated inspection throughput. To meet such industrial demands, specialized metrology firms are maintaining operational scales, as evidenced by Renishaw achieving record revenue of 713.0 million GBP in their 'Annual Report 2025' from September 2025.

Market Challenges

The primary barrier obstructing the growth of the Global 3D Metrology Market is the significant capital outlay required to deploy advanced measurement systems. High-precision optical scanners and coordinate measuring machines demand substantial upfront financial resources, creating an entry barrier for small and medium-sized enterprises. These organizations often operate with limited budgets and cannot easily absorb the costs associated with expensive hardware and necessary software integration. Consequently, economic instability causes these price-sensitive companies to postpone investments in quality assurance technologies to preserve liquidity.This hesitation to invest in capital equipment is evident in recent industrial performance metrics, which underscore the broader impact of financial constraints. According to the Association for Manufacturing Technology, orders for manufacturing technology in the United States declined by 11.5 percent in 2024 compared to the same period in the previous year. Such a contraction in broader manufacturing technology spending directly correlates with reduced procurement of auxiliary systems like 3D metrology units. When manufacturers reduce their capital outlay for production machinery, the demand for associated inspection and digitization tools inevitably contracts, limiting market growth to financially robust industrial conglomerates.

Market Trends

The integration of Artificial Intelligence for Automated Defect Recognition is fundamentally changing the ability of measurement systems to identify anomalies that traditional rule-based algorithms often miss. Instead of relying solely on pre-defined geometric tolerances, manufacturers are deploying machine learning models that analyze vast datasets of surface scans to predict potential failures and classify complex defects in real-time. This shift moves quality assurance from a reactive pass/fail gate to a proactive diagnostic tool, significantly enhancing the accuracy of component verification in variable production environments. The industrial commitment to this technological evolution is substantial; according to the American Supply Association, August 2024, in the article 'AI Revolutionizes Manufacturing', 93 percent of manufacturers have started new AI projects over the past year to capture strategic gains in productivity and quality control.Simultaneously, the Convergence of 3D Metrology with Digital Twin Technology is elevating scanning data from simple inspection reports to dynamic inputs for virtual system optimization. Metrology devices are now essential for capturing the "as-built" physical state of machinery and components, which is then fed back into a digital model to simulate performance and predict lifecycle outcomes under various stress conditions. This synchronization allows engineers to bridge the gap between design intent and operational reality, facilitating improvements in sustainability and efficiency. The value of this digital-physical alignment is increasingly recognized by industry leaders; according to Hexagon AB, November 2024, in the report 'Digital Twin Adoption and ROI', nearly 40 percent of respondents indicated they see a significant reduction in carbon emissions through the implementation of digital twin strategies.

Key Players Profiled in the 3D Metrology Market

- Hexagon AB

- Renishaw PLC

- FARO Technologies, Inc.

- Nikon Corporation

- Carl Zeiss AG

- KLA Corporation

- Keyence Corporation

- Perceptron, Inc.

- Applied Materials, Inc.

- Carl Zeiss GOM Metrology GmbH

Report Scope

In this report, the Global 3D Metrology Market has been segmented into the following categories:3D Metrology Market, by Product Type:

- Coordinate Measuring Machine

- Optical Digitizer & Scanner

- Automated Optical Inspection

- Video Measuring Machine

3D Metrology Market, by Application:

- Quality Control & Inspection

- Reverse Engineering

- Virtual Simulation

3D Metrology Market, by End User:

- Electronics

- Architecture & Construction

- Aerospace & Defense

- Manufacturing

- Automotive

- Others

3D Metrology Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global 3D Metrology Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this 3D Metrology market report include:- Hexagon AB

- Renishaw PLC

- FARO Technologies, Inc.

- Nikon Corporation

- Carl Zeiss AG

- KLA Corporation

- Keyence Corporation

- Perceptron, Inc.

- Applied Materials, Inc.

- Carl Zeiss GOM Metrology GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | January 2026 |

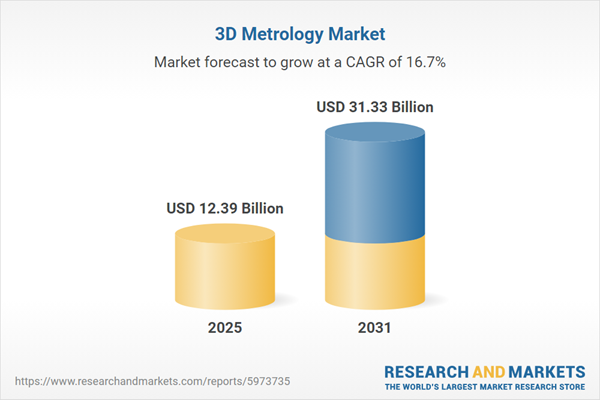

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 12.39 Billion |

| Forecasted Market Value ( USD | $ 31.33 Billion |

| Compound Annual Growth Rate | 16.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |