Healthcare is the fastest growing segment, North America is the largest market globally

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The pursuit of optimized operational efficiency and significant cost reduction remains a pivotal force propelling the Global Asset Management System Market. Businesses face continuous pressure to maximize asset utilization, minimize downtime, and reduce expenditures on maintenance and repairs. Modern asset management systems provide tools for predictive maintenance, lifecycle management, and performance monitoring, directly addressing these objectives. By leveraging granular data and advanced analytics, organizations transition from reactive to proactive maintenance, extending asset lifespan and enhancing productivity.Key Market Challenges

The complex integration of new asset management solutions with existing legacy infrastructure represents a significant impediment to the expansion of the Global Asset Management System Market. Organizations frequently contend with substantial investment requirements for data migration and ensuring system compatibility when attempting to modernize their asset management capabilities. This difficulty in harmonizing disparate systems leads to prolonged implementation cycles and increased project costs, thereby deterring potential adopters.Key Market Trends

The widespread adoption of cloud-based asset solutions is significantly influencing the Global Asset Management System Market by transforming how organizations deploy and manage their assets. This shift to cloud platforms offers unparalleled scalability, enabling businesses to expand their asset management capabilities without substantial upfront infrastructure investments.Cloud-native solutions also provide enhanced accessibility for remote monitoring and control, facilitating real-time data collection and analysis across geographically dispersed operations. According to Schneider Electric's Q2 2024 earnings call, revenues for their cloud offers, sold as a service, increased by 140% in the first half of the year, underscoring the strong market uptake and the proven value proposition of these flexible deployment models. This migration enables greater operational agility and fosters a more collaborative environment for asset lifecycle management.

Key Market Players Profiled:

- Zebra Technologies Corp.

- Stanley Black and Decker, Inc.

- Sato Holdings Corporation

- Impinj, Inc.

- Honeywell International Inc.

- Datalogic S.p.A

- Trimble Inc.

- TomTom International BV

- Topcon Corporation

- Cognex Corporation

Report Scope:

In this report, the Global Asset Management System Market has been segmented into the following categories:By Asset type:

- Electronic Assets

- Returnable Transport Assets

- In-Transit Equipment

- Manufacturing Assets

By Solutions:

- Radio Frequency Identification (RFID)

- Real-Time Location System (RTLS)

- Barcode

- Global Positioning System (GPS)

By Industry:

- Healthcare

- Retail

- Hospitality

- Transportation & Logistics

- Industrial Manufacturing

- Others

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Asset Management System Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Zebra Technologies Corp.

- Stanley Black and Decker, Inc.

- Sato Holdings Corporation

- Impinj, Inc.

- Honeywell International Inc.

- Datalogic S.p.A

- Trimble Inc.

- TomTom International BV

- Topcon Corporation

- Cognex Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | November 2025 |

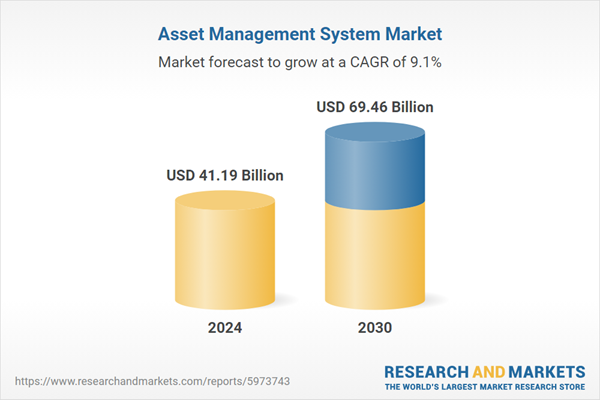

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 41.19 Billion |

| Forecasted Market Value ( USD | $ 69.46 Billion |

| Compound Annual Growth Rate | 9.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |