Hyperphosphatemia Drugs Market Analysis

The hyperphosphatemia drugs market is a vital segment within the pharmaceutical industry, focusing on treatments for hyperphosphatemia, a condition characterized by elevated phosphate levels in the blood. This condition is most commonly associated with chronic kidney disease (CKD) and end-stage renal disease (ESRD), where the kidneys' ability to excrete phosphate is compromised. The analysis of the hyperphosphatemia drugs market reveals several key trends, drivers, and challenges that shape its landscape.Market Drivers

The primary driver of the hyperphosphatemia drugs market is the increasing prevalence of chronic kidney diseases globally, fueled by aging populations and rising rates of diabetes and hypertension. As CKD progresses to ESRD, the demand for effective hyperphosphatemia treatments escalates, given the critical need to manage phosphate levels and prevent associated health complications, such as cardiovascular diseases and bone disorders.Market Challenges

Despite the growing need for effective treatments, the hyperphosphatemia drugs market faces challenges, including the high cost of drug development and stringent regulatory hurdles. Additionally, the side effects associated with current phosphate binders and treatments can affect patient compliance, highlighting the need for drugs with improved safety profiles.Hyperphosphatemia Drugs Market Trends

The hyperphosphatemia drugs market is witnessing significant growth, driven by an increasing prevalence of chronic kidney disease (CKD) and the subsequent rise in hyperphosphatemia cases worldwide. Hyperphosphatemia, characterized by abnormally high levels of phosphate in the blood, is primarily associated with CKD and end-stage renal disease (ESRD) patients undergoing dialysis. This market analysis explores the current trends influencing the hyperphosphatemia drugs market and offers insights into future directions.- Technological Advancements in Drug Formulations

- Growing Incidence of Chronic Kidney Disease

- Shift Towards Non-Calcium-Based Phosphate Binders

- Increased Research and Development Efforts

- Regulatory Environment and Reimbursement Policies

The hyperphosphatemia drugs market is poised for continued growth, driven by the increasing prevalence of CKD, advancements in drug formulations, and a strategic shift towards non-calcium-based treatments. As the market evolves, stakeholders, including pharmaceutical companies, healthcare providers, and regulatory bodies, will need to navigate these trends to address the unmet needs of patients effectively. The focus on innovation, coupled with an understanding of the disease's pathophysiology, is expected to lead to the development of more effective and safer treatments for hyperphosphatemia in the near future.

Hyperphosphatemia Drugs Market Segmentation

Market Breakup by Type

- Acute Hyperphosphatemia

- Chronic Hyperphosphatemia

Market Breakup by Drugs Type

- Calcium based Phosphate Binders

- Aluminum based Phosphate Binders

- Magnesium based Phosphate Binders

- Iron based Phosphate Binders

- Others

Market Breakup by Dosage Form

- Tablets

- Capsules

- Solution/ Suspension

Market Breakup by Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

Market Breakup by Region

- United States

- EU-4 and the United Kingdom

- Germany

- France

- Italy

- Spain

- United Kingdom

- Japan

- India

Hyperphosphatemia Drugs Market Competitive Landscape

The competitive landscape of the hyperphosphatemia drugs market features a diverse array of key players, including multinational pharmaceutical giants and specialized biotech firms. DSM, Pfizer Inc., Amag Pharmaceuticals, Johnson and Johnson, Zeria Pharmaceutical, Sun Pharm Inc., Keryx Biopharmaceuticals, Roche Diagnostics Corporation, Fermenta Biotech Ltd, Bruno Pharmaceutical Spa, Astellas Pharma Inc., Japan Tobacco Inc., OPKO Health, Inc., and Lupin Limited are notable for their extensive portfolios and investment in research and development, driving innovations in treatment options. Together, these companies shape a competitive and dynamic market environment, propelled by continuous innovation and a deep understanding of patient needs in managing hyperphosphatemia.Key Questions Answered in This Report

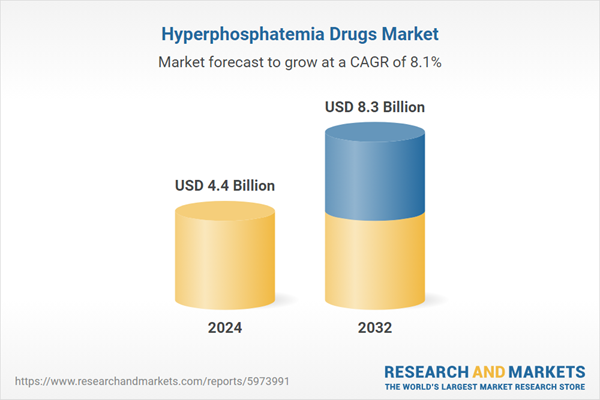

- What is the current and future performance of the hyperphosphatemia drugs market?

- What's driving the growth of the hyperphosphatemia drug market, and what challenges and innovations are shaping it, particularly for CKD patients?

- What's fueling the demand for hyperphosphatemia drugs in relation to the global increase in chronic kidney disease, diabetes, and hypertension?

- How do the distinct needs of acute and chronic hyperphosphatemia drive the demand and development of treatments within the hyperphosphatemia drugs market?

- How are hospital, retail, and online pharmacies each pivotal to the distribution of hyperphosphatemia drugs, and what trends are influencing their roles in the market?

- How do the diverse key players, from pharmaceutical giants to specialized biotech firms, shape the competitive landscape and drive innovation in the hyperphosphatemia drugs market?

- What are the main players/companies in the market?

Key Benefits for Stakeholders

- The industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the hyperphosphatemia drugs market from 2017-2032.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the hyperphosphatemia drugs market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the hyperphosphatemia drugs industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

This product will be delivered within 5-7 business days.

Table of Contents

Companies Mentioned

- DSM

- Pfizer Inc.

- Amag Pharmaceuticals

- Johnson and Johnson

- Zeria Pharmaceutical

- Sun Pharm Inc.

- Keryx Biopharmaceuticals

- Roche Diagnostics Corporation

- Fermenta Biotech Ltd

- Bruno Pharmaceutical Spa

- Astellas Pharma Inc.

- Japan Tobacco Inc.

- OPKO Health, Inc.

- Lupin Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | May 2024 |

| Forecast Period | 2024 - 2032 |

| Estimated Market Value ( USD | $ 4.4 Billion |

| Forecasted Market Value ( USD | $ 8.3 Billion |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |