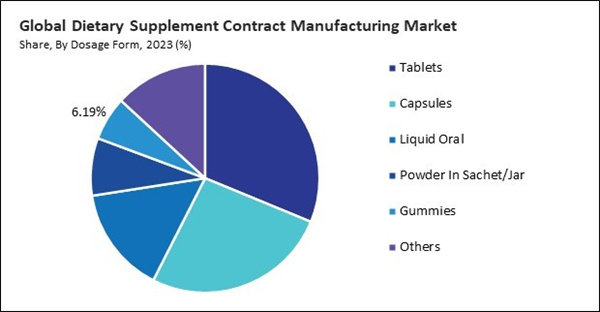

As an entertaining and practical substitute for conventional supplement forms like pills and capsules, gummies are a great option. Their chewable format eliminates the need for swallowing large pills, making them especially appealing to children, seniors, and individuals who have difficulty swallowing. Consequently, the gummies segment would acquire nearly 7% of the total market share by 2031. The pleasant taste and texture of gummies, often resembling candy, make them a preferred choice for consumers seeking a more enjoyable supplement experience. Therefore, owing to these factors, the segment will witness increased demand.

The consumer's surge in health and wellness consciousness is fueling a significant uptick in the market. In addition, with busy lifestyles and changing dietary habits, many individuals struggle to obtain adequate nutrition solely from their diet. As a result, nutritional deficiencies have become increasingly prevalent, driving the need for dietary supplements as a convenient and effective solution. Contract manufacturers play a pivotal role in addressing these deficiencies by producing various supplements containing essential vitamins, minerals, and other nutrients. Thus, these factors will lead to enhanced demand in the future. Additionally, Consumer preferences for dietary supplements vary widely based on age, gender, lifestyle, and health goals. Some individuals may seek supplements tailored for specific health concerns, such as joint support, immune health, or cognitive function, while others may prioritize natural, organic, or vegan formulations. Contract manufacturers work closely with brands to understand these preferences and develop customized solutions that meet consumer needs and expectations. Additionally, contract manufacturers collaborate with brands to develop bespoke formulations that address unique health concerns and optimize ingredient efficacy. Hence, these factors will pose lucrative growth prospects for the market.

However, the dietary supplement industry operates within a complex regulatory environment, presenting substantial challenges for contract manufacturers. Moreover, dietary supplement labeling requirements are governed by regulations that mandate accurate and truthful representation of product identity, ingredients, dosage, and health claims. Thus, these factors can hamper the growth of the market.

Driving and Restraining Factors

Drivers- Growing health and wellness awareness

- Customization and personalization trends

- Aging population and chronic disease prevention

- Regulatory compliance challenges linked with dietary supplements

- Quality control and assurance issues

- Rise of functional and nutraceutical ingredients

- Shift towards natural and organic products

- Product formulation and customization complexity

- Concerns about pricing pressure and margin erosion

Dosage Form Outlook

On the basis of dosage form, the market is divided into tablets, capsules, liquid oral, powder in sachet / jar, gummies, and others. The capsules segment procured a 26% revenue share in the market in 2023. Capsules offer convenience and ease of use, making them popular among consumers seeking dietary supplements. Unlike tablets or powders, capsules are easy to swallow and require minimal preparation, making them ideal for individuals with busy lifestyles. Thus, these aspects will pose lucrative growth prospects for the segment.Product Type Outlook

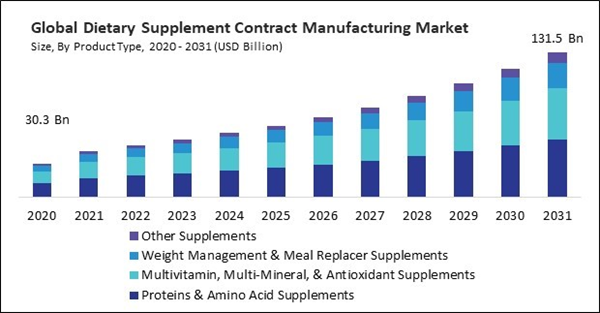

Based on product type, the market is segmented into proteins & amino acid supplements, multivitamin, multi-mineral, & antioxidant supplements, weight management & meal replacer supplements, and others. In 2023, the weight management and meal replacer supplements segment garnered 16% revenue share in the market. As individuals become more health-conscious and strive to maintain healthy lifestyles, a growing demand for weight management solutions supporting fitness goals and promoting overall well-being is growing. By creating cutting-edge formulas specifically suited to assist weight management, meal replacement shakes, protein powders, and nutritional supplements intended to boost metabolism and regulate appetite, contract manufacturers play a critical part in satisfying this need.Regional Outlook

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. The North America segment procured 34.9% revenue share in the market in 2023. North America has witnessed a surge in health and wellness awareness, with consumers seeking dietary supplements to support their overall well-being. Aging populations, escalating healthcare expenses, and a focus on preventative healthcare have all contributed to the region's increased need for dietary supplements. Hence, the segment will expand rapidly in the coming years.Recent Strategies Deployed in the Market

- Mar-2024: Lonza Group Ltd. has signed an agreement to acquire Genentech, Inc., large-scale biologics manufacturing site in Vacaville, California (US). The acquisition will significantly increase Lonza’s large-scale biologics manufacturing capacity to meet demand for commercial mammalian contract manufacturing from customers.

- Mar-2024: CAPTEK Softgel International Inc. has expanded its portfolio by officially beginning gummy supplement production in La Mirada, California. This new facility will increase the capacity and position the organization to manufacture a wider array of products to satisfy changing customer demand.

- Aug-2022: Catalent, Inc. acquired Metrics Contract Services (Metrics), a full-service specialty contract development and manufacturing organization (CDMO) with a facility in Greenville, North Carolina. This acquisition will further expand Catalent’s ability to meet its customers’ expectations in fast-growing areas of business and patient needs.

- May-2022: Glanbia Plc acquired Sterling Technology, a US-based leading manufacturer of dairy bioactive solutions. This acquisition will enhance the bioactive solutions portfolio of Glanbia Plc to support the customers’ needs and growth ambitions.

- May-2022: Glanbia Plc acquired PacMoore Processing Technologies, the company that specializes in extrusion, spray-drying, and blending. This acquisition will strengthen Glanbia Nutritionals’ ability to support its customers in the healthy snacking and related nutrition segments.

List of Key Companies Profiled

- Ashland Inc.

- Lonza Group Ltd.

- Captek Softgel International, Inc.

- DCC Plc

- Glanbia PLC

- Catalent, Inc.

- Biotrex Nutraceuticals

- Martinez Nieto, S.A.

- Menadiona SL

- Nutrivo LLC

Market Report Segmentation

By Product Type- Proteins & Amino Acid Supplements

- Multivitamin, Multi-Mineral, & Antioxidant Supplements

- Weight Management & Meal Replacer Supplements

- Other Supplements

- Tablets

- Capsules

- Liquid Oral

- Powder In Sachet/Jar

- Gummies

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Ashland Inc.

- Lonza Group Ltd.

- Captek Softgel International, Inc.

- DCC Plc

- Glanbia PLC

- Catalent, Inc.

- Biotrex Nutraceuticals

- Martinez Nieto, S.A.

- Menadiona SL

- Nutrivo LLC