Band Reject Filter is the fastest growing segment, Asia-Pacific is the largest regional market

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The rapid expansion of advanced communication technologies significantly drives the global electronic filters market. The proliferation of 5G networks, for instance, necessitates sophisticated filtering solutions to manage increased bandwidth and higher frequency spectrums, crucial for signal integrity across communication channels. Filters are critical for base stations, user equipment, and network infrastructure to prevent interference and maintain high data transfer rates.According to the Ericsson Mobility Report, June 2024, global 5G subscriptions surpassed 1.7 billion, demonstrating the vast scale of network deployment and sustained demand for advanced filtering components. Concurrently, growing demand from the automotive sector profoundly influences this market. Modern vehicles integrate an increasing array of electronic systems, including Advanced Driver-Assistance Systems and infotainment units, which rely on precise signal processing. Electric vehicles, in particular, require robust electromagnetic interference filtering for reliable operation of sensitive electronic control units.

Key Market Challenges

A significant challenge impeding the growth of the Global Electronic Filters Market is the substantial complexity and considerable cost associated with developing miniaturized filters capable of operating at higher frequencies. Achieving the stringent performance and material requirements for these advanced filters, essential for emerging technologies such as 5G communication and Advanced Driver-Assistance Systems, necessitates extensive research and development investment. The intricate design and specialized manufacturing processes contribute to protracted development cycles and elevated engineering expenses.Key Market Trends

A notable trend driving the Global Electronic Filters Market is the shift towards digital filter implementations, which offers enhanced flexibility and precision over traditional analog designs. Digital filters allow for reconfigurable and adaptable signal processing solutions, crucial for modern electronic systems that require dynamic frequency management and complex data manipulation. These advantages are particularly relevant with the pervasive adoption of smart devices across consumer and industrial sectors. According to the Consumer Technology Association (CTA), approximately 75% of households are projected to own at least one smart device by 2025, underscoring the widespread demand for robust digital signal processing.Key Market Players Profiled:

- 3M Company

- Dell Inc.

- KYOCERA AVX Components Corporation

- Qorvo, Inc.

- Akoustis Technologies Inc.

- Anatech Eletronics, Inc.

- Schneider Electric SE

- Fellowes Inc.

- Spectrum Control Microelectronics Limited

- CTS Corporation

Report Scope:

In this report, the Global Electronic Filters Market has been segmented into the following categories:By Type:

- Low Pass Filter

- High Pass Filter

- Bandpass Filter

- Band Reject Filter

- All-Pass Filter

By Application:

- Power Supplies

- Audio Electronics

- Radio Communications

- Analog to digital Communication

By Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Electronic Filters Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Electronic Filters market report include:- 3M Company

- Dell Inc.

- KYOCERA AVX Components Corporation

- Qorvo, Inc.

- Akoustis Technologies Inc.

- Anatech Eletronics, Inc.

- Schneider Electric SE

- Fellowes Inc.

- Spectrum Control Microelectronics Limited

- CTS Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | November 2025 |

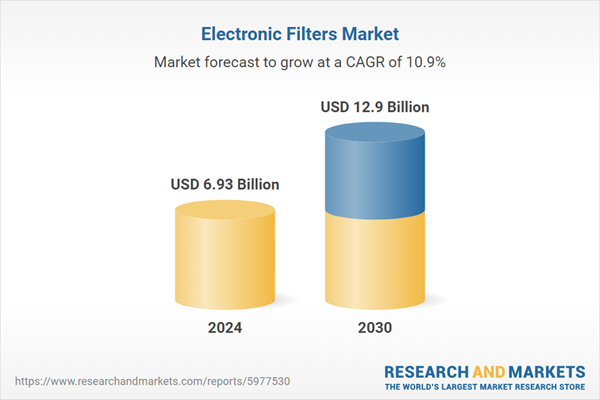

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6.93 Billion |

| Forecasted Market Value ( USD | $ 12.9 Billion |

| Compound Annual Growth Rate | 10.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |