Panel is the fastest growing segment, Asia-Pacific is the largest market globally

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Solid state relays are critical enablers for the ongoing expansion of industrial automation and Industry 4.0 adoption, providing the reliability and rapid switching capabilities essential for advanced manufacturing processes. The integration of robotics, automated machinery, and sophisticated control systems within smart factories necessitates robust components capable of enduring high operational cycles without mechanical wear. This demand is further amplified by the shift towards predictive maintenance and real-time process control, where SSRs offer superior longevity and diagnostic potential compared to traditional electromechanical relays.Key Market Challenges

The comparatively higher initial cost of Solid State Relays presents a notable impediment to their broader market penetration. This financial disparity positions traditional electromechanical relays as a more attractive option for budget-constrained projects and applications, particularly in industries where cost optimization is a paramount concern. Despite the acknowledged performance benefits of SSRs, such as enhanced reliability and faster switching speeds, the upfront investment often leads purchasers to favor less expensive alternatives. This directly restricts the growth trajectory of the global Solid State Relay market by limiting adoption in price-sensitive segments.Key Market Trends

The integration of Solid State Relays with IoT and Smart Systems signifies a key evolution, advancing beyond basic automation to interconnected, data-driven operational intelligence. This trend facilitates real-time monitoring, enhanced predictive maintenance, and remote control of industrial processes, thereby improving efficiency and reducing downtime. Manufacturers are increasingly deploying smart manufacturing technologies to manage risks and improve performance.Key Market Players Profiled:

- Omron Corporation

- Schneider Electric SE

- LittelFuse Inc.

- Carlo Gavazzi Holding AG

- Vishay Intertechnology, Inc.

- Panasonic Corporation

- TE Connectivity Ltd.

- Broadcom Inc.

Report Scope:

In this report, the Global Solid State Relay Market has been segmented into the following categories:Solid State Relay Market,,By Type:

- Panel

- PCB

By Output Voltage:

- AC

- DC

- AC/DC

By Current Rating:

- Low

- Medium

- High

By Application:

- Industrial Automation

- Automotive & Transportation

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Solid State Relay Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Omron Corporation

- Schneider Electric SE

- LittelFuse Inc.

- Carlo Gavazzi Holding AG

- Vishay Intertechnology, Inc.

- Panasonic Corporation

- TE Connectivity Ltd.

- Broadcom Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | November 2025 |

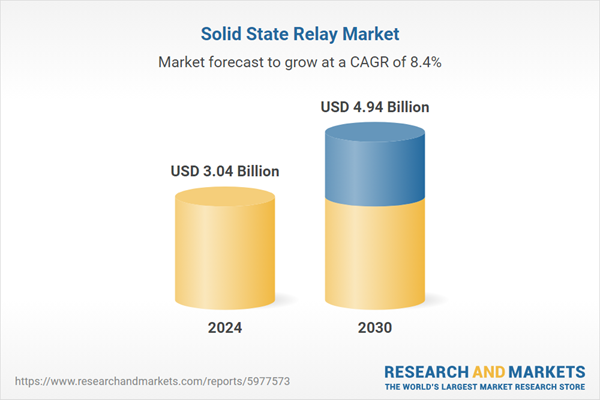

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.04 Billion |

| Forecasted Market Value ( USD | $ 4.94 Billion |

| Compound Annual Growth Rate | 8.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |