Banking is the fastest growing segment, Asia-Pacific is the largest regional market

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The Global Electronic Security Market's expansion is significantly propelled by the persistent rise in security threats and crime rates, necessitating robust protective measures across various sectors. Organizations and individuals alike are increasingly investing in electronic security solutions to mitigate risks from theft, vandalism, and other illicit activities. For instance, according to the National Retail Federation, December 2024, "The Impact of Retail Theft & Violence 2024," retailers experienced a 93% increase in the average number of shoplifting incidents per year in 2023 versus 2019, highlighting the escalating challenges faced by businesses.Key Market Challenges

The substantial initial investment and ongoing maintenance costs associated with complex electronic security systems present a considerable impediment to the growth of the Global Electronic Security Market. This financial barrier directly restricts widespread adoption, especially impacting smaller entities and organizations within cost-sensitive regions. These groups often contend with budget limitations that render comprehensive, integrated security system deployment financially unfeasible, thus preventing them from enhancing their protective infrastructure.This challenge also curtails market expansion by delaying system upgrades and limiting the implementation of advanced security functionalities. Organizations, even larger ones, often extend the lifecycle of existing equipment rather than investing in newer technologies due to the significant capital outlay required. For instance, according to ASIS International and the Security Industry Association (SIA), the global physical security equipment market is projected to be worth $60.1 billion in 2024. Despite this considerable market size, the high cost of acquiring and maintaining electronic security solutions continues to restrain quicker turnover and broader integration of innovative features, thereby hindering the market's full potential for growth and technological advancement.

Key Market Trends

Decentralized Edge AI Processing is fundamentally altering how security systems operate by shifting computational power and intelligence closer to the data source. This trend enables real-time analytics and rapid decision-making directly on devices like cameras and sensors, significantly reducing latency critical for immediate threat detection and response.This approach also enhances data privacy by minimizing the need to transmit sensitive information to centralized cloud servers. According to the PSA Certified 2024 report, produced in partnership with Arm, 50% of surveyed technology decision-makers highlighted improved security as a key benefit of edge AI. This localized processing capability makes security systems more resilient and efficient, particularly in environments with limited or intermittent connectivity. Axis Communications, in October 2025, unveiled new AI-powered bullet cameras and radars, incorporating advanced analytics and secure edge processing, supporting scalable deployments across integrated physical security, IT, and operational technology environments.

Key Market Players Profiled:

- Axis Communications AB

- Bosch Sicherheitssysteme GmbH

- Honeywell International Inc.

- Johnson Controls International plc

- Checkpoint Systems, Inc.

- Teledyne Technologies Incorporated

- ADT Inc.

- Siemens AG

- IBM Corporation

- Hangzhou Hikvision Digital Technology Co. Ltd.

Report Scope:

In this report, the Global Electronic Security Market has been segmented into the following categories:By Product Type:

- Surveillance Security System

- Alarming System

- Access and Control System

- Other

By End-user Vertical:

- Government

- Transportation

- Industrial

- Banking

- Hotels

- Retail stores

- Other

By Region:

- North America

- Europe

- South America

- Middle East & Africa

- Asia-Pacific

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Electronic Security Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Electronic Security market report include:- Axis Communications AB

- Bosch Sicherheitssysteme GmbH

- Honeywell International Inc.

- Johnson Controls International plc

- Checkpoint Systems, Inc.

- Teledyne Technologies Incorporated

- ADT Inc.

- Siemens AG

- IBM Corporation

- Hangzhou Hikvision Digital Technology Co. Ltd.

Table Information

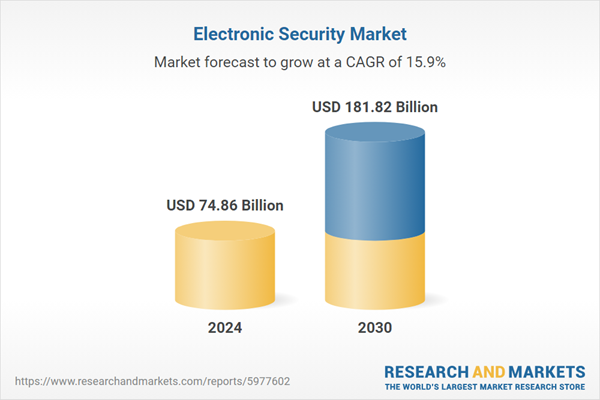

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | November 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 74.86 Billion |

| Forecasted Market Value ( USD | $ 181.82 Billion |

| Compound Annual Growth Rate | 15.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |