Speak directly to the analyst to clarify any post sales queries you may have.

A strategic orientation detailing why modern account reconciliation solutions are indispensable for financial integrity, compliance, and scalable operational efficiency

The introduction situates account reconciliation software within the broader landscape of financial operations, emphasizing its role in ensuring accuracy, compliance, and operational efficiency across diverse enterprise settings. Reconciliation workflows underpin trust in financial records by automating comparison, anomaly detection, and exception management across bank statements, sub-ledgers, and third-party feeds. As organizations balance regulatory expectations and internal demands for faster close cycles, reconciliation solutions have evolved from spreadsheet-driven workstreams to integrated platforms that synthesize transactional inputs and apply rule-based and machine learning techniques to reduce manual effort.This section highlights the contemporary drivers that make reconciliation technology a strategic priority. Chief financial officers and controllers increasingly prioritize solutions that deliver auditability, traceability, and seamless integration with ERP and treasury systems. Beyond routine ledger maintenance, advanced reconciliation platforms support business continuity by offering centralized controls, role-based access, and standardized audit trails that satisfy internal auditors and external regulators alike. The introduction also frames the reader’s expectations for the remainder of the report by outlining the key themes explored in subsequent sections: shifts in technology and governance, regulatory influences, segmentation nuances, regional dynamics, competitive positioning, and recommended actions for leaders seeking to modernize their reconciliation environments.

Finally, the introduction sets the tone for a pragmatic and actionable analysis by underscoring the intersection of technology, process redesign, and organizational change management. It explains that meaningful improvements rarely stem from point solutions alone; instead, sustainable gains require aligning solution capabilities with end-to-end processes, data governance practices, and clear executive sponsorship. With that orientation established, readers are prepared to navigate the deeper assessments and evidence-based recommendations that follow.

An exploration of converging technological, regulatory, and operational shifts that are redefining reconciliation processes and organizational priorities across finance functions

Transformations in the account reconciliation landscape are driven by several converging shifts in technology, regulation, and corporate expectations that collectively alter how organizations approach reconciliation risk and productivity. First, the maturation of cloud-native architectures and APIs has enabled real-time data flows between banking partners, payment processors, and enterprise resource planning platforms, reducing latency and improving the timeliness of exception detection. This technical evolution supports distributed teams and hybrid work models while lowering the barrier to adopting centralized reconciliation services that scale with transaction volumes.Parallel to technological advancement, the adoption of intelligent automation has redefined the boundary between manual intervention and algorithmic resolution. Machine learning and deterministic matching algorithms increasingly handle high-volume, repetitive reconciliations, enabling human specialists to focus on complex exceptions and root-cause analysis. As a result, reconciliation teams are being reconstituted with new skill mixes that emphasize oversight, data interpretation, and continuous model tuning rather than purely transactional processing.

Regulatory scrutiny and reporting obligations continue to nudge organizations toward greater transparency and audit readiness. In response, reconciliation solutions are being designed with immutable audit logs, user activity tracking, and configurable workflows that support regulatory inquiries and internal reviews. At the same time, the marketplace exhibits a steady shift toward outcome-based pricing, service-level guarantees, and cloud delivery models that emphasize security, encryption, and compliance certifications. Taken together, these shifts create both opportunity and complexity: institutions that adopt strategic, integrated reconciliation platforms can reduce close-cycle times and operational risk, while those that rely on fragmented tools may face persistent inefficiencies and elevated compliance burden.

A detailed assessment of how tariff policy changes in 2025 have altered transaction structures, exception volumes, and the reconciliation requirements of cross-border trade finance

The imposition of tariffs and trade policy adjustments within the United States in 2025 has had meaningful ripple effects across financial operations, supply chain finance, and reconciliation practices, prompting finance teams to revise controls and transaction mapping to accommodate altered cost structures and payment patterns. Tariff changes altered vendor invoicing, import duty calculations, and landed cost accounting, compelling reconciliation systems to ingest additional data fields and validation rules to verify pricing and tax components against updated contractual terms. In many cases, automated matching logic had to be extended to account for new tax and duty line items and to reconcile currency and duty timing differences that emerged as suppliers adjusted invoicing cadence.These policy shifts also influenced cash flow patterns and credit management, as certain suppliers sought extended payment terms or required amended letters of credit to accommodate increased duties. Finance teams experienced changes in payment sequencing and the timing of bank statement entries, generating a higher incidence of exceptions that reconciliation platforms needed to triage. Robust exception management capabilities and flexible rule engines proved essential for institutions aiming to preserve vendor relationships while maintaining accurate ledger positions. In parallel, treasury and accounts payable functions placed a renewed emphasis on scenario modeling to understand the financial statement implications of tariff-driven cost inflation and to adapt vendor onboarding and contract review processes accordingly.

Operationally, organizations that had previously centralized reconciliation across shared service centers encountered the need for closer coordination with procurement and trade compliance teams. This multidisciplinary alignment ensured that reconciliation outcomes reflected the true economic impact of tariff adjustments and supported executive decision-making around sourcing, pricing, and working capital. From an IT perspective, the policy environment underscored the importance of flexible data schemas and configurable reconciliation platforms that can be updated rapidly as accounting treatments and regulatory disclosures evolve.

A comprehensive dissection of component, deployment, organization size, industry vertical, and application segmentation that clarifies buyer needs and vendor positioning

A nuanced view of segmentation reveals where reconciliation solutions must concentrate functionality and support. Component-level differentiation separates software from services, and within services there is a clear bifurcation between managed services and professional services. The professional services domain further divides into consulting services that orient programs and governance frameworks, and implementation services that focus on technical deployment and systems integration. This layered structure implies that buyers often require an orchestration of advisory expertise and hands-on implementation capability to derive full value from reconciliation technology.Deployment mode segmentation highlights the trade-offs between cloud and on premises delivery. Cloud deployments encompass hybrid cloud, private cloud, and public cloud configurations, each offering different balances of control, scalability, and compliance posture. Hybrid models commonly appeal to organizations that require both the elasticity of public cloud environments and the data residency controls of private infrastructures, whereas strictly on premises deployments remain relevant for entities with stringent data sovereignty or legacy integration constraints.

Organization size differentiates the needs of large enterprises from those of small and medium enterprises. Large enterprises typically prioritize scalability, multi-entity consolidation, and advanced role-based controls, while small and medium enterprises often seek simplified configuration, lower total cost of ownership, and rapid time-to-value. End user industry segmentation matters because reconciliation requirements vary by vertical: banking, financial services, and insurance demand granular audit trails and complex cash management features; healthcare organizations require integration with billing and patient accounting systems; information technology and telecom companies manage high-volume transaction feeds and diverse revenue streams; manufacturing operations reconcile supply chain and inventory-related financial flows; retail and ecommerce prioritize point-of-sale and omni-channel settlements.

Finally, application-based segmentation contrasts integrated solutions with standalone offerings. Integrated solutions deliver reconciliation as a component of broader financial platforms, promoting cross-functional data consistency, whereas standalone products focus specifically on reconciliation workflows and may be favored where organizations require deep, specialized capability without replacing existing ERP investments. Together, these segmentation perspectives define buyer requirements, inform implementation strategies, and shape the competitive landscape for vendors and service providers.

An in-depth regional analysis explaining how Americas, Europe Middle East & Africa, and Asia-Pacific markets drive divergent reconciliation requirements and deployment strategies

Regional dynamics influence both solution adoption and deployment patterns, with distinct priorities emerging across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, organizations often prioritize speed of close, integration with expansive banking networks, and support for multi-currency reconciliation driven by cross-border commerce. The American market also shows strong interest in cloud-native solutions and outsourced managed services that relieve internal resource constraints, reflecting a propensity to adopt subscription-based commercial models and centralized control frameworks.In Europe, the Middle East & Africa, regulatory diversity and data sovereignty considerations shape deployment choices. Organizations in this broad region place elevated emphasis on auditability, local compliance, and role-based access controls, and tend to require flexible deployment architectures that accommodate national data protection laws. Vendors that offer localized support, language capabilities, and regional compliance expertise often find stronger engagement with enterprise and public-sector customers across these markets.

Asia-Pacific exhibits rapid adoption of digital payment rails and a dynamic fintech ecosystem, which drives demand for reconciliation platforms that can accommodate high transaction volumes, varied payment formats, and rapid integration with local clearing houses. Organizations in this region also demonstrate growing interest in hybrid cloud models that balance performance with regulatory responsiveness. Across all regions, successful reconciliation strategies hinge on aligning solution capabilities with regional banking practices, tax regimes, and supplier ecosystems to ensure precise ledger reconciliation and resilient operational continuity.

A strategic appraisal of the vendor landscape that highlights functional differentiation, partnership models, and service approaches that determine long term customer value

The competitive environment for reconciliation offerings is characterized by a blend of specialized vendors, large enterprise software providers, and professional services firms that together create an ecosystem of product and implementation options. Vendors differentiate through depth of matching algorithms, flexibility of rule engines, prebuilt integrations with common ERPs and banks, and the richness of exception management and audit capabilities. Meanwhile, professional services firms add value through process redesign, governance frameworks, and managed operations that accelerate adoption and improve outcomes.Strategically, buyers evaluate providers not only on functional breadth but also on their operational delivery models. Firms offering managed services and outcome-oriented engagements attract organizations seeking to reduce internal operational overhead while maintaining control over critical finance functions. Conversely, software vendors emphasizing extensible APIs and developer-friendly toolsets appeal to enterprises that prefer to embed reconciliation capabilities within broader financial stacks. Partnerships among technology providers, systems integrators, and regional service bureaus continue to shape go-to-market approaches, enabling tailored deployments across industries and jurisdictions.

For enterprise procurement teams, vendor selection is informed by proof points such as implementation case studies, security certifications, and the ability to support multi-entity, multi-currency environments. Equally important are roadmaps that demonstrate a commitment to automation, analytics, and interoperability. As the landscape matures, alignment between a vendor’s service model and the client’s internal operating model becomes a decisive factor in achieving sustained value from reconciliation investments.

Actionable strategic and operational guidance designed to align technology selection, process redesign, and capability building to realize measurable reconciliation performance gains

Leaders seeking to modernize reconciliation should pursue a coordinated strategy that integrates technology choices with process redesign and organizational capability building. Prioritize platforms that offer configurable rule engines and robust exception workflows so that automation can be safely extended across high-volume reconciliations while preserving human oversight for complex cases. Ensure that reconciliation initiatives are sponsored at a senior level and include representation from treasury, accounts payable, procurement, and IT to accelerate cross-functional alignment and remove implementation roadblocks.Invest in data governance and integration workstreams before large-scale automation so that upstream data quality issues do not undermine automated matching accuracy. Implement a phased rollout that begins with high-impact reconciliation types where rapid automation yields measurable reductions in cycle time and error rates, and then extend the approach to more complex or lower-volume reconciliations. Where organizational bandwidth is limited, consider managed services or co-sourced models that retain control over policy while offloading day-to-day processing.

Finally, equip reconciliation teams with new capabilities in exception analysis, control monitoring, and vendor relationship management. Re-skill staff to supervise automated processes, interpret analytics, and engage in continuous improvement. Track operational metrics that align to business outcomes rather than transactional throughput alone, and use those metrics to iterate on rules, machine learning models, and governance practices. This holistic approach ensures that investments in reconciliation technology translate into durable efficiency, stronger controls, and improved financial confidence.

A transparent and reproducible research approach melding primary interviews, feature analysis, and scenario modeling to validate capabilities and sector implications

The research methodology combines qualitative and quantitative techniques to develop a rigorous and reproducible analysis of account reconciliation solutions and practices. Primary research included structured interviews with finance leaders, treasury professionals, reconciliation operators, and solution providers to capture firsthand perspectives on pain points, functionality priorities, and implementation experiences. These conversations were supplemented by workshops with subject matter experts to validate emerging themes and assess the practical implications of technological and policy shifts.Secondary research encompassed a review of vendor documentation, product feature sets, regulatory guidance, and publicly available case studies to construct detailed profiles of solution capabilities and deployment patterns. Comparative feature analysis focused on matching engines, exception handling, audit logging, API connectivity, cloud architecture options, and managed service offerings. Care was taken to cross-verify vendor claims with customer testimonials and independent evidence where available to ensure balanced representation.

Analytical techniques included capability mapping, scenario analysis to explore the operational impacts of policy and tariff changes, and segmentation analysis to differentiate requirements by component, deployment, organization size, industry vertical, and application type. Throughout the methodology, emphasis was placed on transparency of approach and reproducibility of findings so that readers can understand the evidentiary basis for the conclusions and recommendations offered in the report.

A conclusive synthesis emphasizing governance, automation, and cross functional alignment as the essential pillars for sustainable reconciliation modernization

In conclusion, the trajectory of account reconciliation reflects a broader shift toward integrated, automated, and governance-driven financial operations. Organizations that embrace configurable reconciliation platforms, strengthen data governance, and realign talent toward oversight and analysis will be best positioned to reduce manual effort, improve audit readiness, and enhance cash and vendor management. The interaction between tariff-induced transaction complexity and evolving deployment architectures underscores the need for flexible systems that can adapt to new accounting treatments and cross-border payment patterns.Regional and segmentation nuances mean there is no singular approach for all organizations; instead, successful programs tailor solution scope and delivery model to industry demands, regulatory contexts, and organizational scale. Vendors that combine strong technical automation with process consulting and managed operations provide a compelling pathway for institutions looking to accelerate benefits while mitigating implementation risk. Ultimately, modernization is as much about governance and change management as it is about software capability, and outcomes improve when executive sponsorship, cross-functional collaboration, and disciplined rollout strategies are present.

This report’s insights are intended to help leaders prioritize actions that yield rapid operational improvements while establishing a foundation for ongoing innovation in reconciliation and related treasury functions. By aligning people, process, and technology, finance organizations can transform reconciliation from a recurring administrative burden into a source of trusted financial control and strategic insight.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Account Reconciliation Software Market

Companies Mentioned

The key companies profiled in this Account Reconciliation Software market report include:- API Software Limited

- BlackLine Systems, Inc.

- Broadridge Financial Solutions, Inc.

- Corcentric, LLC

- Cube Planning Inc.

- Duco Technology Limited

- FloQast, Inc.

- Gresham Technologies PLC

- OneStream Software LLC

- Oracle Corporation

- Quickbooks by Intuit Inc.

- ReconArt, Inc.

- Sage Software, Inc

- SAP SE

- SmartStream Technologies Ltd

- SolveXia Pty Ltd

- Statement Matching

- Tata Consultancy Services

- Trintech, Inc.

- Xero Limited

Table Information

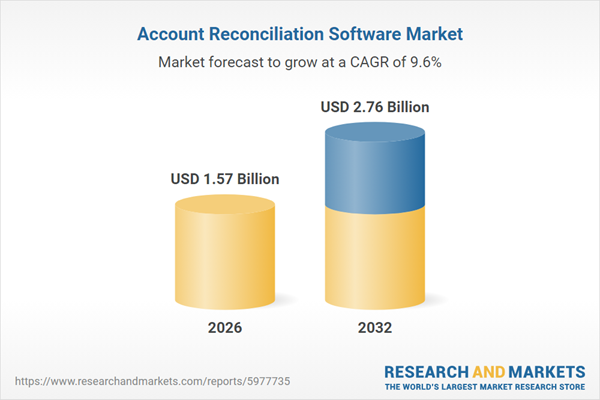

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 1.57 Billion |

| Forecasted Market Value ( USD | $ 2.76 Billion |

| Compound Annual Growth Rate | 9.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |