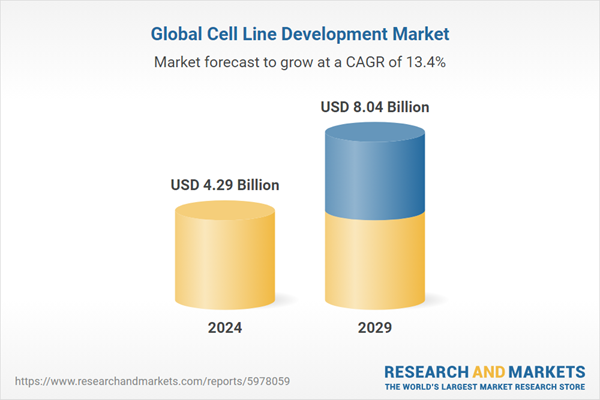

The global cell line development market is projected to grow at a CAGR of 13.37% over the forecast period, from US$4.297 billion in 2024 to reach US$8.047 billion by 2029.

The cell line is defined as the population of cells that can be maintained in culture for a longer period. Cell line development is the technique through which the cellular machinery manufactures therapeutic proteins. This enables biomedical researchers to optimize and produce drugs at a cost-efficient scale.One of the major drivers for the global cell line development market growth can be the expanding pharmaceutical and medicine market. Global pharmaceutical and medicine product growth will enable manufacturers to develop more cost-effective drugs to advance in the commercial market. The Eurostat stated that the region's medicine and pharmaceutical products imports increased from about US$120 billion (Euro 112 billion) in 2022 to about US$128.7 billion (Euro 119 billion) in 2023. In this import, Belgium became the biggest importer of medicinal and pharmaceutical products in the region, importing about US$28.1 billion (Euro 26 billion), followed by Germany and the Netherlands at US$21.6 billion (Euro 20 billion) and US$17.3 billion (Euro 16 billion) respectively, in 2023.

Additionally, the global cell line development market is expected to expand rapidly, fueled by rising research programs for cell-based vaccine development worldwide. This is expected to have a favorable market influence during the projected period. Further, the increase in advancement related to antibodies is expected to further elevate the necessity for cell line development services worldwide.

GLOBAL CELL LINE DEVELOPMENT MARKET DRIVERS:

An increase in the demand for monoclonal antibodies and vaccines is expected to boost the global cell line development market.

Monoclonal antibodies are the variants of antibodies developed in research laboratories to work as substitute antibodies, which can also mimic the immune system’s attack on cells. The cell line development process provides effective engineering and production of diverse biological products, such as monoclonal antibodies and vaccines. The increase in the worldwide cases of deadly diseases, such as cancer, COVID-19, Ebola, and others, is predicted to bolster the growth of monoclonal antibodies, growing the global market size of cell line development.With the increase in disease cases globally, the worldwide requirement for vaccines has grown substantially. The World Integrated Trade Solution stated that in 2023, Belgium's total import of vaccines for human medicine accounted for US$12.433 billion, followed by the US at about US$9.274 billion and the EU at US$7.376 billion. The imports of China and Germany in 2023 accounted for about US$6.225 billion and US$4.665 billion, respectively.

GLOBAL CELL LINE DEVELOPMENT MARKET RESTRAINTS:

High investment costs could hinder the global cell line development market’s growth.

The worldwide cell line development market faces challenges due to high investment costs in infrastructure. Moreover, setting up a cell culture research facility requires significant investments in equipment, cleanroom facilities, quality control equipment, a talented workforce, persistent training programs, and thorough testing and documentation. Hiring and retaining profoundly qualified researchers, engineers, and professionals is costly, and meeting regulatory prerequisites moreover requires noteworthy time and monetary resources. Overall, these costs substantially challenge the global cell line development market’s growth.Global Cell Line Development Market Geographical Outlook

The United States region is anticipated to have a significant market share.

Developed economies such as the United States are anticipated to account for significant growth during the projected cell line development market period. This is owing to the rising research and development initiatives coupled with increased investment in advanced processes in the country.Additionally, the increasing investment in research regarding biosimilars by companies in the United States will drive demand for cell line large-scale production in the coming years. For instance, in 2024, the US Food and Drug Administration (USFDA) approved Bkemv (eculizumab-aeeb) as the first interchangeable biosimilar for the treatment of two rare diseases. Similarly, the administration authorizes various proteins annually, including recombinant and therapeutic proteins. This shows the increasing requirement for vaccines, biosimilars, pharmaceuticals, and therapeutic proteins that will boost the expansion of cell line development in the region.

Moreover, the major developments in the market by industry players are expected to contribute to its long-term development. For instance, in 2023, Berkeley Lights, Inc., one of the leading companies in the United States, announced the launch of Beacon Select, the new optofluidic system for cell line development (CLD). The product is a two-chip beacon system that enables scientists to culture, clone, and select the top clone in a single run using a single platform. This is ideally most suitable for small to mid-sized biopharma set-ups and other CROs/CDMOs as well.

Moreover, CIRM (California Institute of Regenerative Medicine) announced an investment of around US$89 million in various clinical programs in its 2024 April meeting. Such interventions are expected to provide impetus for the cell line development market and thereby also provide favorable ground for advancement in cell-based vaccines in the forecast period.

Global Cell Line Development Key Market Players:

- Lonza- Lonza is among the global leaders providing cell line development services. The company has over 35 years of experience, with over 800 cell lines taken from GMP manufacturing. It delivers a complete suite of cell line development (CLD) services for any molecular format. The company strives to provide services for the development of mammalian cell culture processes. It also covers the optimization and validation services to fulfill the needs of all biopharma drug developers, small to large laboratories, among others

- Biofactura- Biofactura offers its biomanufacturing Platform, which helps rapidly generate stable NS0 cell lines for biopharmaceutical manufacturing. The company strongly focuses on biosimilars and biodefense, providing innovative technology such as StableFast™ platform for faster biomanufacturing. The company's experienced group, with a robust track record in the industry, guarantees effective and viable production.

- KBI Biopharma - KBI Biopharma is regarded as one of the leading players in premium advanced mammalian cell line development worldwide. The company operates numerous facilities in Europe and the US, focusing on progressed innovations for effective production.

Market Segmentation:

Global Cell Line Development Market is segmented and analyzed as below:By Type

- Recombinant Cell Lines

- Hybridomas

- Continuous Cell Lines

- Primary Cell Lines

By Source

- Mammalian Cell Line Development

- Non-Mammalian Cell Line Development

By Application

- Drug discovery

- Research

- Others

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Others

Table of Contents

Companies Mentioned

- Lonza

- Biofactura

- WuXi AppTec

- KBI Biopharma

- ATUM

- Fusion Antibodies plc

- Selexis

- In Vivo

- Celonic AG

- Merck KGaA

- Imgenex India

- Bhat Biotech

- Premas Biotech

- Aragen Life Science

- Chitose Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | August 2024 |

| Forecast Period | 2024 - 2029 |

| Estimated Market Value ( USD | $ 4.29 Billion |

| Forecasted Market Value ( USD | $ 8.04 Billion |

| Compound Annual Growth Rate | 13.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |