This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

These materials are extracted from natural sediments such as granite, limestone, and falling rocks by finely drilling and blasting them. These aggregates are used as foundation materials under airport runaways, highways, railroads, and parking lots. Aggregates are also used for water filtration, purification, and control of soil erosion. As the supply-demand gap for natural sand remains unfilled, construction aggregates have emerged as a viable solution to solve infrastructure problems. Moreover, owing to serious concerns about depletion of natural resources, construction aggregate remains a component of infrastructure, commercial, industrial, and housing development projects.

Additionally, the construction of residential and commercial buildings such as shopping malls, hospitals, schools, and others are also rising all across the world. For instance, as of January 2023, a well-known building developer ‘Triple Five Group’ has planned to construct American Dream Mall near Everglades National Park in Florida. Furthermore, innovation in the construction sector, and rise in tourism activities, and rapid infrastructural development are some other factors expected to support the growth of the construction aggregates market to a significant extent.

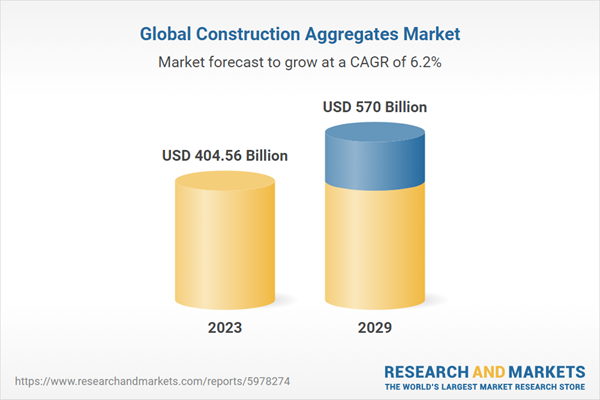

According to the research report, the market is anticipated to cross USD 570 Billion by 2029, increasing from USD 404.56 Billion in 2023. The market is expected to grow with 6.21% CAGR by 2024-29. The global demand for aggregates is largely driven by infrastructure development. Emerging economies, such as India and China, are witnessing significant growth in infrastructure projects, thereby boosting the aggregates market. With growing environmental concerns, there is an increasing emphasis on sustainable and eco-friendly construction practices. This trend is encouraging the use of recycled aggregates, derived from demolished concrete and asphalt structures.

The aggregates industry is benefiting from various technological innovations, such as drones for site surveying, automated crushing and screening equipment, and real-time data analytics for optimizing operations. The concrete aggregates market provides strength to structures and helps in reducing cracks. Growth in the tourism industry has been informed by the rise in investments in the development of competitive projects are anticipated to drive market growth.

Innovations in technologies are done so that aggregate production can substitute the efficiency of the manufacturing process and productivity with high-quality products which might thus; push the global construction aggregates market growth during the forecast period. The inception of Building Information Modelling (BIM) is said to accompany digital transformation in the construction sector where the BIM supports, in terms of time management, cost planning, waste reduction, and overall project performance improvement, henceforth, driving market growth.

Market Drivers

- Infrastructure Development: As populations grow and urbanization accelerates, there's a continuous need for infrastructure development such as roads, bridges, airports, and buildings. These projects require significant quantities of construction aggregates, thus driving demand in the industry.

- Population Growth and Urbanization: The global population continues to increase, particularly in urban areas. This trend creates demand for housing, commercial spaces, and other infrastructure, all of which rely heavily on construction aggregates for their construction and maintenance.

Market Challenges

- Environmental Concerns: Extraction of aggregates can have significant environmental impacts, including habitat destruction, water pollution, and air pollution. Balancing the need for aggregates with environmental sustainability presents a major challenge for the industry, particularly in regions with stringent regulations.

- Transportation Costs and Logistics: Aggregates are heavy and bulky materials, which can make transportation costs a significant portion of the overall production expenses. Accessibility to construction sites and efficient logistics management pose challenges for companies in the industry, especially in remote or geographically challenging areas.

Market Trends

- Recycling and Reuse: There's a growing emphasis on sustainability and circular economy principles in the construction industry. As a result, there's increasing interest in recycling and reusing construction aggregates from demolition waste, concrete, and asphalt. This trend not only reduces the environmental impact but also offers cost savings and resource efficiency.

- Technological Advancements: Technology is playing an increasingly important role in the aggregates industry. Advancements in materials science, automation, and data analytics are improving the efficiency of extraction, processing, and transportation processes. Technologies like drones, 3D printing, and advanced sensors are also being utilized for surveying, monitoring, and quality control purposes.

Crushed stones hold a dominant position in the construction aggregate market primarily because they offer a trifecta of qualities essential for modern construction projects. Firstly, their durability stands as a testament to their reliability in enduring various environmental and structural stresses over time. Whether it's the weight of heavy machinery or the wear and tear caused by natural elements, crushed stones maintain their integrity, ensuring the longevity of structures. Secondly, their versatility makes them indispensable across a spectrum of applications.

From forming the base of roads and railways to providing stability in concrete mixes, crushed stones adapt effortlessly to diverse construction needs, contributing to their widespread adoption. Lastly, their cost-effectiveness positions them as the preferred choice for builders and contractors alike. Compared to alternatives, crushed stones offer a compelling balance between performance and price, making them an economical option without compromising on quality. This combination of durability, versatility, and cost-effectiveness cements crushed stones' status as the frontrunner in the construction aggregate market, driving their continued dominance in the industry.

Concrete is leading in the construction aggregate market due to its versatility, durability, and widespread applicability in various construction projects.

Concrete's prominence in the construction aggregate market stems from its unparalleled versatility and adaptability to a multitude of construction applications. As a composite material composed of aggregates such as crushed stone, sand, and gravel bound together by cement, concrete possesses inherent qualities that make it indispensable in modern construction.

Its versatility allows it to be molded into virtually any shape or form, making it suitable for a diverse range of structures, from buildings and bridges to roads and dams. Furthermore, concrete's durability ensures the long-term stability and resilience of these structures, as it can withstand environmental factors such as weathering, erosion, and seismic activity.

Its ability to endure heavy loads and resist deterioration over time enhances the longevity of infrastructure projects, reducing the need for frequent repairs or replacements. Additionally, concrete's widespread availability and relatively low cost compared to alternative building materials contribute to its dominance in the construction aggregate market. These factors combined make concrete the preferred choice for builders and contractors worldwide, driving its continued leadership in the industry.

Infrastructure is leading in the construction aggregate market due to the continuous demand for development and maintenance of roads, bridges, airports, railways, and other essential public works projects.

The dominance of infrastructure in the construction aggregate market is primarily driven by the ongoing need for the construction, expansion, and upkeep of vital public works systems. Infrastructure serves as the backbone of modern society, facilitating economic growth, connectivity, and mobility. Roads, bridges, airports, railways, and other infrastructure projects require significant quantities of construction aggregates, including crushed stones, sand, gravel, and concrete, to be completed. These materials are essential for creating strong foundations, durable surfaces, and reliable transportation networks that can withstand heavy traffic and environmental stressors.

Moreover, the growing population, urbanization, and industrialization further fuel the demand for infrastructure development, leading to a continuous flow of construction projects that rely heavily on aggregates. Whether it's repairing aging infrastructure, expanding transportation networks, or constructing new facilities to accommodate population growth, the demand for construction aggregates in infrastructure projects remains robust and enduring.

The Asia-Pacific region is leading in the construction aggregate market due to rapid urbanization, extensive infrastructure development, and booming construction activities across diverse sectors.

The Asia-Pacific region's dominance in the construction aggregate market is underpinned by several interconnected factors that collectively drive robust demand for construction materials. Foremost among these is the region's unprecedented pace of urbanization, as millions of people migrates from rural areas to cities in search of better opportunities and improved living standards. This mass urban migration necessitates the construction of residential buildings, commercial complexes, and supporting infrastructure, all of which require substantial quantities of aggregates such as crushed stone, sand, and gravel.

Moreover, governments across the Asia-Pacific are heavily investing in infrastructure development to accommodate population growth, stimulate economic growth, and enhance connectivity within and between urban centers. Mega-projects including highways, railways, airports, ports, and smart cities are proliferating throughout the region, further driving demand for construction aggregates.

Additionally, the flourishing construction sector in sectors such as manufacturing, healthcare, hospitality, and education contributes to the sustained demand for aggregates. With the construction industry playing a pivotal role in the region's economic growth and development, the Asia-Pacific remains at the forefront of the construction aggregate market, continuously driving innovation, investment, and expansion in the industry.

- In June 2023, Vulcan Materials Company was named as one of the top 200 Best Companies to Work For by United States News and World Report. The company was also included in the 2023 Fortune 500 list of U.S. companies. Factors considered as part of the U.S. News review include quality of pay and benefits; work/life balance and flexibility; job and company stability; physical and psychological comfort; belongingness and esteem, and career opportunities and professional development.

- In July 2021, LafargeHolcim announced a cooperative agreement research project with its subsidiary company Geocycle aimed at mineral recycling. The research project might be conducted in collaboration with the US Army Corps of Engineers Research and Development Center (ERDC) to study how construction demolition material can be used for energy recovery and production of construction Aggregates.

- In June 2021, HeidelbergCement AG announced its plans to build a carbon-neutral plant in Sweden. The new plant is expected to be the world's first carbon-neutral cement plant, allowing the company to reduce carbon emissions by 1.8 million metric tons of carbon dioxide per year.

Years considered in this report:

- Historic year: 2018

- Base year: 2023

- Estimated year: 2024

- Forecast year: 2029

Aspects covered in the report:

- Construction Aggregates market Outlook with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Materials Type:

- Sand & Gravel

- Recycled Aggregates

- Crushed Stones

- Others

By Application Type:

- Concrete

- Road Base & Coverings

- Others

By End-Use:

- Residential Construction

- Commercial Construction

- Industrial Construction

- Infrastructure

- Others

The approach of the report:

This report consists of a combined approach of primary and secondary research. Initially, secondary research was used to get an understanding of the market and list the companies that are present in it. The secondary research consists of third-party sources such as press releases, annual reports of companies, and government-generated reports and databases.After gathering the data from secondary sources, primary research was conducted by conducting telephone interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. After this, the analysts made primary calls to consumers by equally segmenting them in regional aspects, tier aspects, age group, and gender. Once the analysts acquired primary data, they started verifying the details obtained from secondary sources.

Intended audience:

This report can be useful to industry consultants, manufacturers, suppliers, associations, and organizations related to the Construction Aggregates industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Holcim Limited

- Vulcan Materials Company

- CEMEX S.A.B. de C.V.

- Heidelberg Materials

- China Resources Cement Holdings Limited

- Martin Marietta Materials, Inc.

- Buzzi Unicem S.p.A.

- Sika AG

- Summit Materials Inc

- Boral Limited

- CRH plc

- Adbri

- Eagle Materials Inc

- LSR Group

- CRH plc

- Vicat SA

- Eiffage S.A.

- UltraTech Cement

- Saudi Readymix Concrete Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 173 |

| Published | May 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 404.56 Billion |

| Forecasted Market Value ( USD | $ 570 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |