This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

Early practitioners honed their skills through trial and error, discovering the transformative power of heating metals until they reached a molten state, ready to take on new forms. One of the earliest known casting methods, the lost-wax technique, epitomizes the ingenuity of ancient artisans. This method involved creating a wax model of the desired object, encasing it in clay, and then heating the mold to allow the wax to melt away, leaving a cavity to be filled with molten metal. As humanity progressed, so too did the techniques of metal casting. The Industrial Revolution marked a pivotal moment, as innovations in metallurgy and engineering propelled casting into the modern era.

Crucible casting, sand casting, and die casting emerged as prominent methods, each offering distinct advantages in terms of complexity, cost-effectiveness, and scalability. In July 2023, The American Foundry Society (AFS) has initiated a new program, AM for Metal Casting, to promote the adoption of additive manufacturing in metal casting. This endeavor seeks to assist metalcasters in integrating additive manufacturing technologies, fostering advancements in their products and processes for the benefit of the industry.

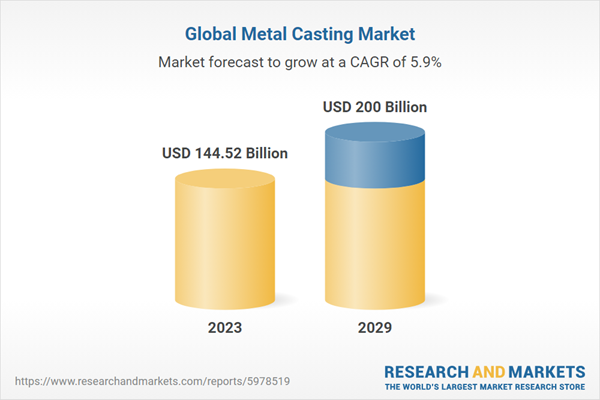

According to the research report, the market is anticipated to cross USD 200 Billion by 2029, increasing from USD 144.52 Billion in 2023. The market is expected to grow with 5.91% CAGR by 2024-29. The market is experiencing robust growth driven by the increasing demand from the automotive and aerospace industries, rapid technological advancements, sudden shift towards using recycled metals, expanding construction and infrastructure projects, and the rising investments in the defense and military sector. Beyond its industrial applications, metal casting embodies a rich tradition of craftsmanship and artistry.

Foundries around the world serve as incubators of creativity, where skilled artisans breathe life into molten metal, transforming it into works of enduring beauty. Artistic casting transcends mere functionality, giving rise to sculptures, monuments, and architectural embellishments that evoke awe and inspiration. From the iconic Statue of Liberty to contemporary installations pushing the boundaries of form and texture, artists continue to explore the expressive potential of metal casting, forging connections between the past and the present. As humanity stand on the cusp of a new era, metal casting stands poised for further evolution.

Advanced technologies such as 3D printing and computer simulation offer unprecedented opportunities to push the boundaries of design and performance. Additive manufacturing techniques promise to revolutionize casting by enabling the production of intricate geometries with minimal material waste. Moreover, sustainability concerns are driving the adoption of eco-friendly practices within the casting industry. Recycling scrap metal, optimizing energy consumption, and minimizing emissions are becoming imperatives for companies seeking to align with environmental stewardship principles.

Market Drivers

- Sustainable Practices and Circular Economy Initiatives: Increasing awareness of environmental issues and resource scarcity is driving the adoption of sustainable practices within the metal casting industry. Companies are embracing the principles of the circular economy, seeking to minimize waste, optimize resource utilization, and promote recycling and reuse of materials. Initiatives such as closed-loop systems for metal recovery, green sand recycling, and waste heat utilization contribute to reducing the environmental footprint of metal casting operations while enhancing resource efficiency and cost-effectiveness.

- Technological Convergence and Interdisciplinary Collaboration: Technological convergence, fueled by advancements in materials science, digitalization, and interdisciplinary collaboration, is reshaping the landscape of metal casting. Cross-disciplinary collaboration between materials scientists, engineers, and software developers is driving innovation in alloy design, process optimization, and predictive modeling. Integration of emerging technologies such as artificial intelligence, machine learning, and augmented reality enhances decision-making, improves process control, and accelerates product development cycles, fostering a culture of continuous innovation and improvement within the industry.

Market Challenges

- Environmental and Regulatory Pressures: The metal casting industry faces increasing scrutiny and regulation regarding its environmental impact. Foundries are under pressure to reduce emissions, minimize waste, and adopt sustainable practices throughout the production process. Compliance with stringent environmental regulations not only poses logistical and financial challenges but also requires significant investments in technology, training, and infrastructure upgrades.

- Skills Gap and Workforce Development: As experienced workers retire and technological advancements reshape industry practices, the metal casting sector grapples with a widening skills gap and the need for workforce development. Recruiting and retaining skilled labor, particularly in specialized areas such as metallurgy and process engineering, poses a significant challenge. Moreover, the industry must invest in training programs and apprenticeships to cultivate the next generation of casting professionals and ensure a sustainable talent pipeline.

Market Trends

- Industry 4.0 Integration: The metal casting industry is embracing the principles of Industry 4.0, incorporating automation, data analytics, and interconnected systems to optimize production processes and enhance operational efficiency. Smart foundries equipped with sensors, robotics, and real-time monitoring systems enable predictive maintenance, quality control, and resource optimization, driving cost savings and productivity gains.

- Focus on Material Innovation: With increasing demands for lightweighting, durability, and sustainability, there is a growing emphasis on material innovation within the metal casting industry. Advanced alloys, composite materials, and metal matrix composites are being developed to meet the evolving needs of modern applications. Additionally, research into alternative casting materials, such as bio-based resins and recycled metals, is gaining traction as companies seek to reduce their environmental footprint and enhance product performance.

The automotive sector holds a prominent position in the metal casting market primarily because of its insatiable demand for a diverse range of components crucial for vehicle manufacturing. Metal casting processes offer the versatility and scalability required to produce intricate and robust parts integral to automotive systems, including engines, transmissions, chassis, and drivetrain components. From engine blocks to suspension components, metal castings play a pivotal role in enhancing vehicle performance, reliability, and safety. Moreover, the automotive industry's emphasis on lightweighting to improve fuel efficiency and reduce emissions further drives the demand for advanced casting materials and processes.

Metal castings enable the production of lightweight yet durable components, such as aluminum engine blocks and magnesium transmission cases, that contribute to overall vehicle weight reduction without compromising strength or structural integrity. Metal casting technologies continue to evolve to meet the evolving needs of the automotive sector. Advanced casting techniques, such as high-pressure die casting and squeeze casting, enable the production of complex geometries with tight tolerances, meeting the stringent requirements of modern vehicle designs. Furthermore, ongoing research and development efforts focus on enhancing casting materials, optimizing process efficiency, and integrating digital technologies to drive innovation and competitiveness in the automotive casting market.

Sand casting leads in the metal casting market due to its versatility, cost-effectiveness, and ability to produce large and complex components across a wide range of industries.

Sand casting stands as a cornerstone of the metal casting market, holding a leading position driven by its unparalleled versatility and cost-effectiveness. This traditional casting method utilizes molds made from compacted sand, offering a flexible and adaptable approach to producing a vast array of metal components. One of the key advantages of sand casting lies in its ability to accommodate large and complex geometries, making it suitable for a diverse range of industries, including automotive, aerospace, construction, and industrial machinery. In the automotive sector, sand casting plays a vital role in producing engine blocks, cylinder heads, transmission cases, and other critical components that demand robustness and precision.

Its ability to handle various alloys, including aluminum, iron, and steel, makes it indispensable for automotive manufacturers seeking lightweighting solutions without compromising structural integrity. Beyond automotive, sand casting finds widespread application in aerospace for fabricating turbine blades, aerospace components, and structural parts that require stringent quality standards and high-performance materials.

Similarly, in the construction industry, sand casting is utilized for manufacturing architectural elements, decorative fixtures, and structural components needed for building infrastructure and urban development projects. Furthermore, sand casting's cost-effectiveness makes it an attractive choice for both small-scale and mass production applications. The relatively low tooling costs, minimal setup requirements, and efficient material utilization contribute to its economic viability, particularly for producing medium to large-sized parts in bulk quantities.

Cast iron leads in the metal casting market due to its exceptional strength, versatility, and cost-effectiveness, making it the material of choice for a wide range of applications across various industries.

Cast iron's prominence in the metal casting market is rooted in its unique combination of properties that make it a preferred material for a diverse array of applications. Renowned for its exceptional strength, durability, and thermal conductivity, cast iron offers unmatched versatility and performance across industries ranging from automotive and construction to machinery and infrastructure. In the automotive sector, cast iron finds extensive use in the production of engine blocks, cylinder heads, brake components, and suspension parts due to its high strength-to-weight ratio and excellent wear resistance.

Its ability to withstand high temperatures and mechanical stresses makes it indispensable for applications demanding reliability and longevity, such as heavy-duty trucks and industrial vehicles. Moreover, cast iron's thermal properties make it an ideal choice for applications requiring heat dissipation and thermal stability, such as engine components and industrial machinery.

Its relatively low cost compared to alternative materials further enhances its appeal, particularly for mass-produced components where cost-effectiveness is paramount. In the construction industry, cast iron is widely utilized for manufacturing pipes, fittings, valves, and architectural elements due to its corrosion resistance, fire resistance, and structural integrity.

Cast iron pipes have long been favored for conveying water, sewage, and other fluids in municipal infrastructure projects due to their longevity and reliability. Additionally, cast iron's machinability and damping capacity make it suitable for a range of machining operations and applications where vibration damping and noise reduction are critical, such as machine tool bases, engine blocks, and gear housings.

Despite the emergence of advanced materials and casting techniques, cast iron maintains its leading position in the metal casting market due to its proven track record, cost-effectiveness, and suitability for a wide range of industrial applications. As industries continue to evolve and innovate, cast iron's versatility and performance will ensure its enduring relevance in the ever-changing landscape of metal casting.

Asia-Pacific leads in the metal casting market due to its robust industrial growth, burgeoning manufacturing sector, and strategic investments in infrastructure development, driving significant demand for metal castings across diverse industries.

The Asia-Pacific region has emerged as a powerhouse in the metal casting market, propelled by dynamic economic growth, rapid industrialization, and a burgeoning manufacturing landscape. With countries like China, India, Japan, and South Korea at the forefront, the region boasts a formidable manufacturing sector encompassing automotive, aerospace, construction, machinery, and consumer goods industries. One of the primary drivers of Asia-Pacific's dominance in the metal casting market is its robust industrial growth, fueled by rising urbanization, expanding middle-class populations, and increasing disposable incomes.

As countries undergo rapid industrialization and urban development, there is a corresponding surge in demand for infrastructure, transportation, and consumer goods, driving the need for a wide range of metal components produced through casting processes. Moreover, Asia-Pacific's strategic investments in infrastructure development further catalyze demand for metal castings across various sectors. Large-scale infrastructure projects, including transportation networks, energy facilities, and urban development initiatives, require a vast array of metal components for construction, machinery, and equipment, driving sustained growth in the metal casting market.

Additionally, the region's competitive advantages in terms of labor availability, manufacturing expertise, and cost efficiencies contribute to its leadership in the metal casting industry. Countries like China and India have established themselves as manufacturing hubs, attracting investment from multinational corporations seeking to leverage the region's skilled workforce, extensive supply chains, and favorable business environments.

Asia-Pacific's strategic focus on technological innovation and adoption fosters continuous advancements in metal casting processes, materials, and technologies. From high-pressure die casting to investment casting and additive manufacturing, the region embraces cutting-edge techniques to enhance product quality, efficiency, and competitiveness in the global market.

- In May 2022, GF Casting Solutions, a division of GF, Schaffhausen (Switzerland), signed an agreement with Bocar Group, Mexico City (Mexico) to develop and invest in new technologies and services to support customers in North America, Europe and Asia on their way to sustainable mobility.

- In November 2022, POSCO declared that its steel plants in Pohang and Gwangyang received certification for their outstanding contributions to advancing sustainability in the steel industry. This significant achievement highlights the plants' unwavering dedication and effective management in promoting Environmental, Social, and Corporate Governance (ESG) objectives for a more sustainable future.

- In June 2020, Endurance Technologies Limited successfully concluded the acquisition of Grimeca Srl, an Italian automotive parts manufacturer. Endurance reported securing complete ownership, acquiring a 100% stake in Grimeca for 2.25 million Euros, approximately USD 2.45 million, as disclosed in a stock exchange filing.

- In December 2020, Ryobi Aluminum Casting (UK) Ltd secured a significant new multi-million pound contract with an emerging transmission supplier specializing in electrified drivetrains to produce 150,000 clutch and transmission cases per year for new hybrid vehicles commencing 2023.

- In April 2019, Aisin Seiki Co., Ltd. established Aisin (Anqing) Auto Parts Co., Ltd. jointly with Anhui Ring New Group Co., Ltd. for the purpose of manufacturing aluminum die-cast parts, such as transmission cases for automatic transmissions.

Years considered in this report:

- Historic year: 2018

- Base year: 2023

- Estimated year: 2024

- Forecast year: 2029

Aspects covered in the report:

- Metal Casting market Outlook with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Application:

- Automotive

- Industrial Machinery

- Infrastructure & Construction

- Aerospace

- Electronics

- Energy

- Others (Medical devices, consumer goods)

By Process:

- Sand Casting

- Die Casting

- Investment Casting

- Permanent Mold Casting

- Others(centrifugal casting, continuous casting, etc.)

By Material:

- Cast Iron

- Aluminum

- Steel

- Zinc

- Others (copper, magnesium, and other metal alloys)

The approach of the report:

This report consists of a combined approach of primary and secondary research. Initially, secondary research was used to get an understanding of the market and list the companies that are present in it. The secondary research consists of third-party sources such as press releases, annual reports of companies, and government-generated reports and databases.After gathering the data from secondary sources, primary research was conducted by conducting telephone interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. After this, the analysts made primary calls to consumers by equally segmenting them in regional aspects, tier aspects, age group, and gender. Once the analysts acquired primary data, they started verifying the details obtained from secondary sources.

Intended audience:

This report can be useful to industry consultants, manufacturers, suppliers, associations, and organizations related to the Metal casting industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Nemak, S.A.B. de C.V

- Ryobi Limited

- Ahresty Corporation

- Aisin Corporation

- ThyssenKrupp AG

- Rheinmetall AG

- Endurance Technologies Ltd.

- Kobe Steel, Ltd.

- Alcoa Corporation

- Form Technologies, Inc.

- Linamar Corporation

- Buhler AG

- ArcelorMittal S.A.

- Georg Fischer AG

- Hitachi, Ltd.

- Rio Tinto Group

- Gulf Metal Foundry

- Impro Precision Industries Ltd

- Precision Castparts Corp

- RLM Industries, Inc

- Company Snapshot

- Company Overview

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 174 |

| Published | May 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 144.52 Billion |

| Forecasted Market Value ( USD | $ 200 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |