This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

With the rise of machinery and mass production, the demand for standardized and efficient fastening solutions grew exponentially. The 19th century witnessed pivotal advancements in fastener manufacturing techniques. The introduction of screw threads, standardized bolts, and nuts revolutionized industries, allowing for tighter and more secure connections.

With the emergence of steel as a dominant material, fasteners became stronger and more durable, paving the way for the construction of larger and more complex structures. Digitalization and the adoption of Industry 4.0 principles are transforming the fasteners industry, streamlining production processes, enhancing quality control, and enabling predictive maintenance.

Technologies such as Internet of Things (IoT) sensors, artificial intelligence (AI), and blockchain are being leveraged to optimize supply chain management and improve traceability and transparency throughout the value chain. With growing concerns about plastic pollution and environmental sustainability, there is a rising interest in biodegradable fasteners made from renewable materials such as PLA (polylactic acid) and PHA (polyhydroxyalkanoates). These eco-friendly alternatives offer comparable performance to traditional fasteners while minimizing environmental impact.

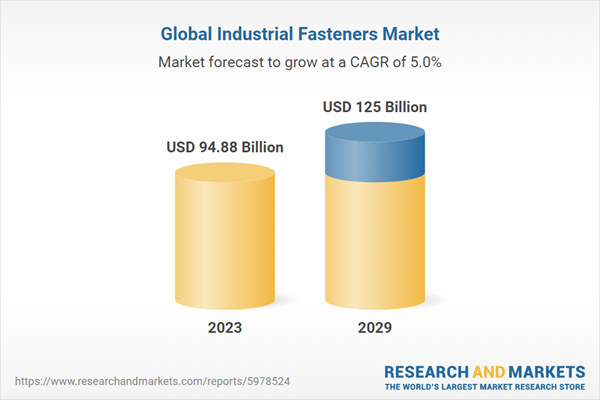

According to the research report, the market is anticipated to cross USD 125 Billion by 2029, increasing from USD 94.88 Billion in 2023. The market is expected to grow with 4.98% CAGR by 2024-29. The significance of industrial fasteners cannot be overstated as they serve as the backbone of manufacturing and construction, facilitating the assembly of everything from automobiles and airplanes to bridges and buildings. Without reliable fastening solutions, the structural integrity and safety of these structures would be compromised. Moreover, industrial fasteners contribute to efficiency and cost-effectiveness in production processes.

By enabling quick and easy assembly, they help reduce downtime and labor costs, ultimately improving productivity and profitability for businesses. The rapid pace of globalization and urbanization has spurred demand for infrastructure development, driving growth in the construction sector. Consequently, there is an increased need for reliable fastening solutions to support the construction of buildings, bridges, roads, and other critical infrastructure projects worldwide. Technological innovations have revolutionized the design, manufacturing, and application of industrial fasteners.

From advanced materials and coatings to precision machining techniques, technological advancements have enabled the production of fasteners that offer superior strength, durability, and performance. The automotive and aerospace industries are significant consumers of industrial fasteners, relying on them for the assembly of vehicles, aircraft, and spacecraft. With the automotive sector undergoing a shift towards electric and autonomous vehicles, and the aerospace industry exploring space exploration and sustainable aviation, there is a growing demand for lightweight and high-strength fastening solutions.

The energy sector, including oil and gas, renewable energy, and power generation, relies on industrial fasteners for the construction and maintenance of infrastructure such as pipelines, wind turbines, and power plants. As the world transitions towards cleaner and more sustainable energy sources, there is an increasing focus on fasteners that offer corrosion resistance and long-term reliability.

Market Drivers

- Technological Advancements: Innovations in materials science, manufacturing processes, and digitalization have revolutionized the design, production, and application of fasteners. Advanced materials such as high-strength alloys, titanium, and composites offer improved performance characteristics, including greater strength-to-weight ratios and corrosion resistance. Additionally, technologies like additive manufacturing (3D printing) enable the production of complex geometries and customized fasteners, opening new possibilities for design optimization and rapid prototyping.

- Global Infrastructure Development: The ongoing expansion of global infrastructure, driven by urbanization, population growth, and economic development, represents another significant driver for the industrial fasteners industry. Infrastructure projects ranging from transportation networks (roads, railways, airports) to energy facilities (power plants, wind farms) require vast quantities of fasteners for construction and maintenance. As countries invest in infrastructure to support their growing populations and economies, the demand for industrial fasteners continues to rise, presenting lucrative opportunities for manufacturers and suppliers.

Market Challenges

- Supply Chain Disruptions: The industrial fasteners sector faces challenges related to supply chain disruptions, exacerbated by factors such as geopolitical tensions, natural disasters, and pandemics. Global supply chains are interconnected, with many fastener manufacturers relying on raw materials and components sourced from various countries. Disruptions in the supply chain, whether due to trade tensions or unforeseen events like the COVID-19 pandemic, can lead to shortages, price volatility, and delays in production. Managing supply chain risks and building resilience through strategic sourcing and inventory management is crucial for mitigating these challenges.

- Environmental Sustainability: Environmental sustainability is an increasingly pressing challenge for the industrial fasteners industry. Traditional fastener manufacturing processes often involve energy-intensive production methods and the use of materials with significant environmental footprints, such as steel and aluminum. Moreover, the disposal of fasteners at the end of their lifecycle can contribute to waste and pollution. Addressing these environmental challenges requires the adoption of sustainable practices throughout the fastener lifecycle, including the use of recycled materials, energy-efficient manufacturing processes, and end-of-life recycling initiatives.

Market Trends

- Smart Fasteners: The emergence of smart fasteners equipped with sensors and embedded technology represents a growing trend in the industrial fasteners sector. Smart fasteners can monitor various parameters such as temperature, pressure, and torque in real-time, providing valuable data for condition monitoring, predictive maintenance, and quality control. These intelligent fasteners enable proactive maintenance strategies, reducing downtime and optimizing asset performance across industries such as aerospace, automotive, and manufacturing.

- Lightweight Materials and Design Optimization: With industries increasingly focused on lightweighting and fuel efficiency, there is a growing trend towards the use of lightweight materials and design optimization in fastener applications. Advanced materials such as carbon fiber composites and high-strength alloys offer comparable strength to traditional materials at reduced weight, making them ideal for applications where weight savings are critical, such as automotive and aerospace. Design optimization techniques, including topology optimization and finite element analysis, are used to optimize the shape and geometry of fasteners for maximum performance and efficiency.

Metal has long been the cornerstone of the industrial fasteners market, and its prominence continues to grow due to several key factors. Firstly, metal fasteners offer unparalleled strength and durability, making them well-suited for applications where reliability and performance are paramount. Whether it's securing heavy machinery in industrial settings or anchoring critical infrastructure in construction projects, metal fasteners provide the robustness needed to withstand high loads and harsh environmental conditions. Moreover, metal fasteners exhibit exceptional versatility, with a wide range of alloys and compositions available to suit different applications and environments.

From carbon steel and stainless steel to titanium and aluminum, each metal offers distinct properties such as corrosion resistance, temperature tolerance, and weight savings, allowing for tailored solutions to meet specific requirements. The inherent recyclability of metal makes it an attractive choice for industries increasingly focused on sustainability. Metal fasteners can be melted down and repurposed at the end of their lifecycle, reducing waste and minimizing environmental impact compared to non-metal alternatives.

Furthermore, advancements in metal manufacturing technologies, such as precision machining and surface treatments, have further enhanced the performance and functionality of metal fasteners. These innovations enable tighter tolerances, finer surface finishes, and improved resistance to wear and fatigue, extending the lifespan and reliability of metal fasteners in demanding applications.

Externally threaded fasteners are experiencing growth in the industrial market due to their ease of installation, versatility, and ability to provide strong and reliable connections in various applications.

Externally threaded fasteners, such as screws and bolts, are witnessing growth in the industrial fasteners market for several compelling reasons. Firstly, their design facilitates easy installation, making them highly preferred in industries where efficiency and productivity are paramount. Unlike internally threaded fasteners, which require tapping or pre-threading of the receiving component, externally threaded fasteners can be simply inserted into a pre-drilled hole and tightened using a wrench or power tool, streamlining the assembly process and reducing labor costs.

Furthermore, externally threaded fasteners offer versatility, as they can be used in a wide range of applications across industries, from automotive and aerospace to construction and electronics. Their ability to accommodate different materials, thicknesses, and joint configurations makes them indispensable for securing components in diverse environments and operating conditions. Externally threaded fasteners provide strong and reliable connections, essential for ensuring the structural integrity and safety of assembled structures and machinery. The threading design creates friction between the fastener and the mating component, preventing loosening due to vibrations or external forces.

Additionally, advancements in materials and coatings have further enhanced the performance of externally threaded fasteners, offering increased corrosion resistance, strength, and durability. Another contributing factor to the growth of externally threaded fasteners is the ongoing trend towards lightweighting in industries such as automotive and aerospace. Externally threaded fasteners can be manufactured using lightweight materials such as aluminum and titanium, allowing for significant weight savings without compromising on strength or performance.

The automotive sector is experiencing growth in the industrial fasteners market due to increasing vehicle production, technological advancements, and demand for lightweight and high-strength fastening solutions.

The automotive industry's expansion in the industrial fasteners market can be attributed to several interconnected factors driving demand for fastening solutions. Firstly, the automotive sector is witnessing a steady increase in vehicle production globally, fueled by rising consumer demand, economic growth in emerging markets, and technological innovations driving the development of electric and autonomous vehicles. With each vehicle comprising thousands of individual components, including a myriad of fasteners, the automotive industry represents a significant market for industrial fasteners.

Technological advancements in automotive design and manufacturing are driving the demand for specialized fastening solutions that can meet the stringent requirements of modern vehicles. As automakers strive to improve fuel efficiency, enhance safety, and reduce emissions, there is a growing need for lightweight materials and advanced joining techniques that can withstand the demands of high-performance applications. This has led to increased adoption of lightweight materials such as aluminum and composites, as well as innovative fastening methods such as adhesive bonding and friction stir welding, which require specialized fasteners to ensure optimal performance and reliability.

Moreover, the automotive industry's emphasis on sustainability and environmental stewardship is driving demand for eco-friendly fastening solutions that minimize waste and reduce the carbon footprint of vehicles. Manufacturers are increasingly exploring recyclable materials and energy-efficient production processes to align with regulatory requirements and consumer preferences for greener transportation options.

The automotive sector's push towards electrification and autonomous driving technologies presents new challenges and opportunities for fastener manufacturers. Electric vehicles require specialized fasteners capable of withstanding high voltages and temperatures, while autonomous vehicles necessitate robust fastening solutions to support the integration of sensors, cameras, and other advanced driver-assistance systems.

The Asia-Pacific region is experiencing growth in the industrial fasteners market primarily due to rapid industrialization, infrastructure development, and increasing manufacturing activities across diverse sectors.

The Asia-Pacific region's emergence as a key growth driver in the industrial fasteners market can be attributed to several interrelated factors fueling demand for fastening solutions. Firstly, the region is undergoing rapid industrialization, driven by economic growth, urbanization, and the expansion of manufacturing activities. Countries like China, India, and Southeast Asian nations have witnessed a surge in industrial output, leading to increased demand for industrial fasteners to support the assembly and construction of machinery, equipment, and infrastructure.

Infrastructure development initiatives in the Asia-Pacific region are driving significant demand for industrial fasteners across various sectors such as construction, transportation, and energy. Governments in countries like China, India, and Indonesia are investing heavily in building roads, bridges, airports, railways, and energy infrastructure to support growing populations and stimulate economic growth. These large-scale infrastructure projects require vast quantities of fasteners for structural assembly, anchoring, and fastening applications, contributing to the growth of the industrial fasteners market in the region.

Moreover, the Asia-Pacific region's position as a manufacturing hub for industries such as automotive, electronics, and aerospace further drives demand for industrial fasteners. With many multinational corporations establishing production facilities and supply chains in countries like China, Japan, South Korea, and Taiwan, there is a continuous need for high-quality fastening solutions to support manufacturing operations and ensure product quality and reliability.

Additionally, the Asia-Pacific region's diverse and dynamic industrial landscape presents opportunities for fastener manufacturers to cater to a wide range of applications and customer requirements. From heavy machinery and construction equipment to consumer electronics and automotive components, industrial fasteners find extensive usage across industries, creating a robust and diversified market for fastener suppliers in the region.

- In July 2023, Triangle Fastener Corporation (TFC) announced the acquisition of Connective Systems & Supply, Inc. (CSS). In particular, the company acquired the segment of CSS’s business primarily focused on fasteners for metal building, roofing, and mechanical contractors.

- In April 2022, LindFast Solutions Group (LSG), a major distributor of specialty fasteners in North America, announced the completion of its purchase of Toronto-based Fasteners and Fittings, Inc. (F&F), which has a leading position in imperial, metric, and stainless steel fasteners market.

- In February2022, Namakor Holdings acquired Duchesne Ltd. to accelerate the growth of Duchesne. Furthermore, Namakor Holdings will also provide financial and human resources to the company.

- In February2022, BECK Fastener Group launched its new product, LIGNOLOC wooden nail, after the success of collated wooden nails. LIGNOLOC wooden nails come with a head, specifically designed for façade application.

Years considered in this report:

- Historic year: 2018

- Base year: 2023

- Estimated year: 2024

- Forecast year: 2029

Aspects covered in the report:

- Industrial Fastener market Outlook with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By raw material:

- Metal

- plastic

By Product:

- Externally Threaded

- internally threaded

- Non Threaded

- aerospace Grade Fastener

By Application:

- Automotive

- Aerospace

- Building & Construction

- Industrial Machinery

- Home Appliances

- Plumbing products

- Others

The approach of the report:

This report consists of a combined approach of primary and secondary research. Initially, secondary research was used to get an understanding of the market and list the companies that are present in it. The secondary research consists of third-party sources such as press releases, annual reports of companies, and government-generated reports and databases.After gathering the data from secondary sources, primary research was conducted by conducting telephone interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. After this, the analysts made primary calls to consumers by equally segmenting them in regional aspects, tier aspects, age group, and gender. Once the analysts acquired primary data, they started verifying the details obtained from secondary sources.

Intended audience:

This report can be useful to industry consultants, manufacturers, suppliers, associations, and organizations related to the Industrial fastener industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- MISUMI Group Inc.

- Illinois Tool Works Inc.

- The SFS Group AG

- Stanley Black & Decker, Inc.

- Precision Castparts Corp.

- Arconic Corporation

- Hilti Corporation

- TriMas Corporation

- Bollhoff Group

- The Würth Group

- Penn Engineering & Manufacturing Corp.

- KAMAX Holding GmbH & Co. KG

- Bulten AB

- Howmet Aerospace Inc.

- EJOT ATF

- Sundram Fasteners Limited

- LISI Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 166 |

| Published | May 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 94.88 Billion |

| Forecasted Market Value ( USD | $ 125 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |