This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

The industrial and institutional cleaning chemicals industry plays a crucial role in maintaining cleanliness and hygiene standards across various sectors, including manufacturing, healthcare, food service, and more. These specialized chemicals are designed to effectively remove tough stains, grime, oil, and contaminants from industrial equipment, machinery, floors, and surfaces. With increasing environmental concerns and a growing emphasis on sustainability, there's a rising demand for eco-friendly and biodegradable cleaning chemicals derived from natural sources.

Manufacturers are investing in research and development to create more effective and versatile cleaning formulations that offer superior performance while minimizing environmental impact. The integration of automation and Internet of Things (IoT) technologies is revolutionizing cleaning processes, enabling remote monitoring, predictive maintenance, and data-driven insights for more efficient and cost-effective operations. As end-user industries have unique cleaning requirements, there's a growing trend towards customized cleaning solutions tailored to specific surfaces.

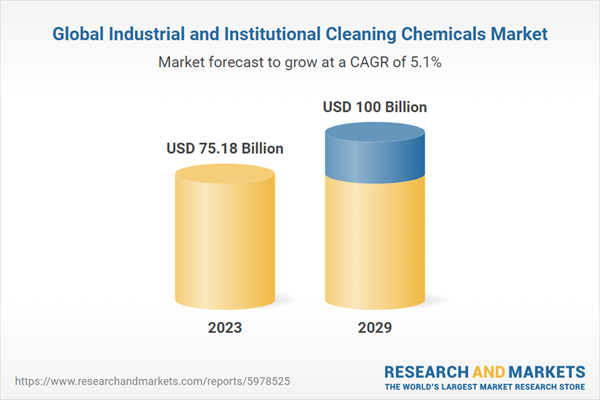

According to the research report, the market is anticipated to cross USD 100 Billion by 2029, increasing from USD 75.18 Billion in 2023. The market is expected to grow with 5.10% CAGR by 2024-29. The global industrial cleaning chemicals market is witnessing significant growth, with projections indicating substantial expansion in the coming years. Factors such as the increasing demand for cleaner and safer working environments, stringent regulations on workplace hygiene, and the rising awareness of the importance of cleanliness are driving the market forward. Moreover, the industry is experiencing a surge in demand for green and bio-based cleaning chemicals, reflecting a growing emphasis on environmentally friendly solutions.

Industrial cleaning chemicals play a vital role in protecting surfaces, removing contaminants, and ensuring the longevity of equipment and machinery. These chemicals are specially formulated to meet specific cleaning needs, such as degreasing, sanitization, and protection against corrosion. Professional industrial cleaners are trained to handle these chemicals safely and effectively, considering the diverse cleaning requirements of different industries, including pharmaceutical manufacturing, warehouses, chemical plants and food-handling facilities. The industrial cleaning chemicals industry faces challenges such as lengthy authorization processes for biocidal products and workforce shortages.

However, the market presents attractive opportunities for growth, driven by the increasing demand from end-use industries post-COVID-19 pandemic, workplace hygiene initiatives, and the adoption of advanced cleaning technologies. The market also benefits from the growing focus on maintaining a healthier environment and the development of innovative cleaning solutions.

Market Drivers

- Stringent Regulatory Standards: Regulatory mandates and standards imposed by governmental bodies and industry associations regarding cleanliness, hygiene, and safety are significant drivers for the industrial and institutional cleaning chemicals industry. These regulations compel businesses across various sectors, including healthcare, food processing, and hospitality, to maintain high standards of cleanliness and sanitation. Compliance with regulations often requires the use of specific cleaning chemicals and processes, driving demand within the industry.

- Increasing Awareness of Health and Hygiene: Heightened awareness of health and hygiene, particularly in the wake of global health crises such as the COVID-19 pandemic, is driving demand for industrial and institutional cleaning chemicals. Businesses and institutions are prioritizing cleanliness and sanitation to create safer environments for employees, customers, patients, and visitors. This increased focus on hygiene not only boosts demand for traditional cleaning chemicals but also drives innovation in the development of new, more effective cleaning formulations and technologies.

Market Challenges

- Environmental Concerns and Sustainability: One of the primary challenges facing the industrial and institutional cleaning chemicals industry is addressing environmental concerns and promoting sustainability. Traditional cleaning chemicals often contain ingredients that can be harmful to the environment and human health. Additionally, the disposal of cleaning chemicals and their packaging can contribute to pollution and waste. Manufacturers face pressure to develop eco-friendly, biodegradable formulations and adopt sustainable practices throughout the product lifecycle while maintaining performance and efficacy.

- Supply Chain Disruptions and Raw Material Prices: The industry is susceptible to supply chain disruptions and volatility in raw material prices, which can impact production, distribution, and pricing of cleaning chemicals. Global events such as natural disasters, geopolitical tensions, and pandemics can disrupt supply chains, leading to shortages or delays in the availability of raw materials. Fluctuations in raw material prices can also affect production costs and profit margins for manufacturers, necessitating effective supply chain management strategies to mitigate risks.

Market Trends

- Rise of Eco-Friendly and Green Cleaning Solutions: There is a growing trend towards eco-friendly and green cleaning solutions in response to increasing environmental awareness and regulatory pressure. Manufacturers are developing cleaning chemicals derived from renewable resources, with biodegradable formulations that minimize environmental impact. Green cleaning solutions appeal to environmentally conscious consumers and businesses seeking sustainable alternatives without compromising cleaning performance.

- Integration of Technology and Automation: Technology and automation are transforming the industrial and institutional cleaning chemicals industry, enhancing efficiency, productivity, and effectiveness. Advancements such as IoT-enabled cleaning equipment, automated dosing systems, and predictive maintenance solutions are revolutionizing cleaning processes. These technologies enable real-time monitoring, data-driven decision-making, and remote management of cleaning operations, resulting in cost savings, improved performance, and greater convenience for users.

The growth of general purpose cleaners in the industrial and institutional cleaning chemicals industry can be attributed to several interconnected factors, all converging to meet the evolving needs and demands of diverse end-users across various sectors. Versatility stands out as a paramount feature driving the increasing popularity of general purpose cleaners.

Unlike specialized cleaning products designed for specific surfaces or soil types, general purpose cleaners offer a comprehensive solution capable of addressing a wide range of cleaning challenges. Whether it's removing dirt, grease, oil, or other common soils, these cleaners are formulated to tackle multiple types of stains and contaminants effectively.

This versatility is particularly advantageous in industrial and institutional settings where different surfaces, from floors and walls to countertops and equipment, require regular cleaning and maintenance. By streamlining cleaning protocols and reducing the need for multiple products, general purpose cleaners simplify operations and enhance efficiency for facility managers and cleaning professionals. Moreover, the demand for general purpose cleaners is fueled by the need for convenience and cost-effectiveness. In today's fast-paced environments, where time and resources are often limited, the simplicity of using a single product for various cleaning tasks is highly appealing.

Facility managers and cleaning professionals seek solutions that can streamline their operations, minimize complexity, and optimize resource allocation. General purpose cleaners offer a convenient "one-size-fits-all" approach, eliminating the hassle of selecting and managing multiple cleaning products. Additionally, from a cost perspective, investing in a single versatile cleaner can be more economical than purchasing multiple specialized products, leading to potential cost savings for businesses and institutions. Furthermore, the growing emphasis on efficiency and sustainability in cleaning practices contributes to the popularity of general purpose cleaners.

As businesses and institutions strive to improve their environmental footprint and adopt more sustainable practices, the simplicity and effectiveness of general purpose cleaners align with these objectives. Manufacturers are responding to this trend by developing eco-friendly formulations that minimize environmental impact without compromising cleaning performance. Biodegradable ingredients, reduced packaging waste, and eco-friendly manufacturing processes are some of the features incorporated into modern general purpose cleaners, appealing to environmentally conscious consumers and businesses.

The growing demand for chlor-alkali products in the industrial and institutional cleaning chemicals industry is driven by their essential role as key ingredients in the manufacturing of various cleaning agents, disinfectants, and sanitizers.

The expansion of chlor-alkali products in the industrial and institutional cleaning chemicals industry is primarily propelled by their indispensable function as fundamental components in the production of a wide array of cleaning agents, disinfectants, and sanitizers. Chlor-alkali products, including chlorine, sodium hydroxide (caustic soda), and hydrogen, serve as critical raw materials in the formulation of numerous cleaning formulations utilized across various sectors.

Chlorine, for instance, is a versatile disinfectant renowned for its potent antimicrobial properties, making it a cornerstone ingredient in the development of disinfectants and sanitizers essential for maintaining hygiene standards in healthcare facilities, food processing plants, and public spaces. Sodium hydroxide, commonly known as caustic soda, is prized for its powerful cleaning and degreasing capabilities, rendering it indispensable in industrial cleaning applications, particularly in the removal of stubborn stains, grease, and residues from equipment and surfaces.

Additionally, hydrogen, a byproduct of chlor-alkali electrolysis, finds utility in diverse cleaning processes, from pH adjustment and water treatment to surface cleaning and rinsing. The versatility and efficacy of chlor-alkali products make them indispensable in the formulation of cleaning solutions tailored to meet the stringent cleanliness and sanitation requirements of industrial and institutional environments.

As the demand for high-performance cleaning chemicals continues to escalate, driven by regulatory compliance, hygiene standards, and public health concerns, the role of chlor-alkali products as essential building blocks in the manufacturing of cleaning agents is expected to witness sustained growth, further solidifying their position in the industrial and institutional cleaning chemicals industry.

The growth of commercial cleaning in the industrial and institutional cleaning chemicals industry is propelled by the increasing demand for professional cleaning services and products to maintain high standards of cleanliness and hygiene in commercial establishments.

The expansion of commercial cleaning in the industrial and institutional cleaning chemicals industry is fueled by the escalating demand for professional cleaning services and products aimed at upholding rigorous standards of cleanliness and hygiene in commercial establishments. With businesses, offices, retail stores, hospitality venues, and other commercial facilities placing greater emphasis on creating clean and sanitary environments, the need for effective cleaning solutions has never been more pronounced. Commercial cleaning companies play a pivotal role in meeting this demand by providing specialized cleaning services tailored to the unique requirements of various commercial sectors.

These services encompass a wide range of cleaning tasks, including routine maintenance, deep cleaning, disinfection, and sanitation, designed to ensure that commercial spaces remain safe, healthy, and welcoming for employees, customers, and visitors alike. To achieve optimal results, commercial cleaning companies rely on a diverse arsenal of industrial and institutional cleaning chemicals specifically formulated for commercial applications. These chemicals encompass a broad spectrum of products, including disinfectants, sanitizers, degreasers, floor cleaners, glass cleaners, and specialized cleaning agents, each tailored to address specific cleaning challenges encountered in commercial settings.

From combating germs and pathogens to removing stubborn stains and maintaining pristine surfaces, these cleaning chemicals are essential tools in the arsenal of commercial cleaning professionals. As businesses increasingly prioritize cleanliness, hygiene, and sanitation to enhance the overall customer experience, mitigate health risks, and comply with regulatory standards, the demand for commercial cleaning services and products is projected to continue its upward trajectory, driving further growth in the industrial and institutional cleaning chemicals industry.

The expansion of food services in the industrial and institutional cleaning chemicals industry is primarily propelled by the stringent cleanliness and sanitation regulations imposed by regulatory authorities to safeguard food safety and hygiene.

In the food services sector, which encompasses restaurants, cafeterias, catering facilities, food processing plants, and other food-related establishments, maintaining impeccable cleanliness is not just a matter of aesthetics but a critical requirement to prevent foodborne illnesses and ensure consumer safety. Regulatory agencies such as the Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) enforce strict standards and guidelines governing hygiene practices, sanitation procedures, and cleanliness protocols within food establishments.

To comply with these regulations and mitigate the risk of food contamination, food service operators rely heavily on industrial and institutional cleaning chemicals specifically formulated for food-related applications. These cleaning chemicals are designed to effectively remove food residues, grease, oil, and other contaminants from surfaces, equipment, utensils, and food preparation areas. Additionally, disinfectants and sanitizers play a crucial role in eliminating harmful pathogens and bacteria that may pose health risks to consumers if left unchecked.

In addition to that, in response to these stringent regulations and consumer expectations, food and beverage processing companies invest significantly in sanitation protocols and cleaning practices. Industrial and institutional cleaning chemicals play a pivotal role in these efforts, providing specialized formulations tailored to the unique challenges of food processing environments. These cleaning chemicals are specifically formulated to effectively remove food residues, grease, oils, and other contaminants from processing equipment, pipelines, tanks, and production surfaces. Moreover, disinfectants and sanitizers are indispensable in controlling microbial contamination and ensuring the microbiological safety of food products.

The main reason for the growth of the industrial and institutional cleaning chemicals industry in North America is the increasing demand for cleaning and sanitization products due to heightened awareness about health, hygiene, and infection control, coupled with stringent regulatory regulations and the presence of major market players.

North America, particularly the United States and Canada, have been witnessing a significant surge in the demand for industrial and institutional cleaning chemicals. This is primarily driven by the increasing awareness about the importance of maintaining clean and hygienic environments in the wake of public health crises, such as the COVID-19 pandemic. Hospitals, schools, food processing plants, and other commercial and institutional facilities are now more than ever focused on infection control and prevention, which is fueling the demand for disinfectants, sanitizers, and other cleaning products.

In addition to the heightened demand, the growth of the I&I cleaning chemicals industry in North America is also attributed to the stringent regulatory regulations in the region. The U.S. Environmental Protection Agency (EPA), the Food and Drug Administration (FDA), and Health Canada in Canada have set strict standards for cleaning and sanitization in various sectors. This not only ensures the safety and health of the public but also encourages the development and adoption of advanced and effective cleaning solutions.

Furthermore, North America is home to several major players in the global I&I cleaning chemicals market, such as Ecolab, 3M, and The Clorox Company. These companies have a strong presence in the region, with well-established distribution networks and a broad range of product offerings. They also invest heavily in research and development, which helps in the introduction of innovative and sustainable cleaning products, thereby contributing to the industry's growth.

- In 2022, BASF has partnered with Inditex to develop a groundbreaking detergent aimed at reducing microfiber release from textiles during washing. This collaborative effort represents a significant step in addressing environmental concerns related to microplastic pollution in water systems.

- In 2022, BASF introduced its new solutions, including Lavergy, Tinopal CBS X optical brightener, Sokalan SR 400 A, and more, at the SEPAWA event held in Berlin. These innovations showcase the company's commitment to advancing the chemical industry.

- In 2021, Diversey Holdings Ltd. revealed its acquisition agreement with Tasman Chemicals, further expanding its presence in the chemical industry. This strategic move underscores Diversey's commitment to growth and diversification in its market portfolio.

- In 2021, Azelis confirmed its agreement to acquire the distribution assets of Indian firms Spectrum Chemicals and Nortons Exim Private Limited. This strategic move enhances Azelis' presence in the Indian market and strengthens its distribution capabilities.

Years considered in this report:

- Historic year: 2018

- Base year: 2023

- Estimated year: 2024

- Forecast year: 2029

Aspects covered in the report:

- Industrial and institutional cleaning chemicals market Outlook with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Product:

- General Purpose Cleaners

- Disinfectants and Sanitizers

- Laundry Care Products

- Others(Vehicle Wash, Floor care, Dishwashing,Specail cleaning product)

By Raw Material:

- Chlor-Alkali

- Surfactant

- Phosphates

- Biocides

- Solvents

- Other

By End Use Verticals::

- Commercial

- Manufacturing

By Commercial:

- Food Services

- Retail

- Healthcare

- Laundry Care

- Institutional Buildings

- Others

By Manufacturing:

- Food & Beverage Processing

- Metal Manufacturing & Fabrication

- Electronic Components

- Others

The approach of the report:

This report consists of a combined approach of primary and secondary research. Initially, secondary research was used to get an understanding of the market and list the companies that are present in it. The secondary research consists of third-party sources such as press releases, annual reports of companies, and government-generated reports and databases.After gathering the data from secondary sources, primary research was conducted by conducting telephone interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. After this, the analysts made primary calls to consumers by equally segmenting them in regional aspects, tier aspects, age group, and gender. Once the analysts acquired primary data, they started verifying the details obtained from secondary sources.

Intended audience:

This report can be useful to industry consultants, manufacturers, suppliers, associations, and organizations related to the Industrial and institutional cleaning chemicals industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BASF SE

- Clariant AG

- Evonik Industries AG

- Solvay NV/SA

- Henkel AG & Co. KGaA

- The Procter & Gamble Company

- Reckitt Benckiser Group PLC

- Eastman Chemical Company

- Stepan Company

- 3M Company

- Albemarle Corporation

- Westlake Corporation

- Croda International plc

- Lanxess AG

- The Clorox Company

- The Dow Chemical Company

- Akzo Nobel N.V.

- Huntsman Corporation

- Sasol Limited

- Unilever PLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | May 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 75.18 Billion |

| Forecasted Market Value ( USD | $ 100 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |