The Brazil market dominated the LAMEA Automotive Dealer Management System Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $196.4 million by 2031. The Argentina market is showcasing a CAGR of 13.2% during (2024 - 2031). Additionally, The UAE market would register a CAGR of 11.9% during (2024 - 2031).

The automotive dealer management system market continuously evolves, driven by technological advancements, changing consumer behaviors, and industry trends. For example, there is a growing preference for cloud based automotive DMS solutions due to their scalability, accessibility, and cost-effectiveness. Cloud-based platforms offer greater flexibility, enabling dealerships to access real-time data from anywhere, streamline collaboration, and reduce infrastructure costs. Moreover, cloud based DMS solutions facilitate seamless integration with third-party applications and enable rapid deployment of updates and enhancements.

In addition, ADMS vendors emphasize providing seamless, omnichannel experiences that enable customers to interact with dealerships across multiple touchpoints. Mobile applications and responsive web interfaces allow customers to browse inventory, schedule service appointments, and complete transactions from their smartphones or tablets. Dealerships leverage mobile technology to enhance convenience, improve engagement, and build stronger customer relationships.

As vehicle sales surge in Saudi Arabia, automotive dealerships will need more robust DMS solutions to manage the increased sales volume, customer interactions, and inventory. The higher demand for efficient and scalable DMS systems will drive growth in the market as dealerships seek to optimize their operations to handle the larger volume of transactions. As per the International Trade Administration (ITA), in 2020, Saudi Arabia constituted 35% of the vehicles sold in the MENA region and nearly 52% of the vehicles sold in the Gulf Cooperation Council (GCC). In 2019, 5,56,000 vehicles were sold in Saudi Arabia. The projected sales figure by 2025 is 543,000 units. Likewise, as EV demand grows, dealerships will need DMS solutions capable of managing specialized EV inventories, including different models, battery types, and associated charging equipment. As per the ITA, The EV industry in the UAE is growing rapidly. The UAE government has shown a strong commitment to promoting the use of electric vehicles as part of its efforts to reach zero carbon emissions by 2050. In the UAE, demand for electric vehicles has been steadily increasing over the past several years, and between 2022 and 2028, growth of 30% is expected. Therefore, increasing demand for EVs and rising vehicle sales propel the market’s growth.

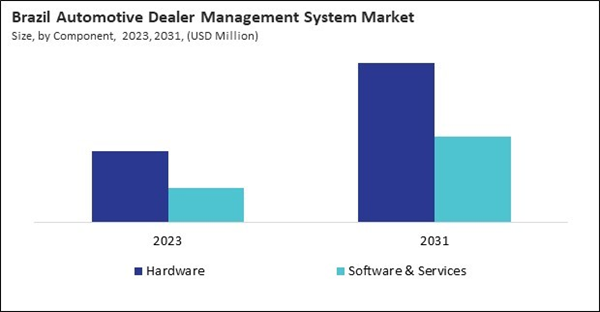

Based on Component, the market is segmented into Hardware, and Software & Services. Based on Application, the market is segmented into Customer Relationship Management, Inventory Management, Dealer Tracking, Finance & Sales, and Others. Based on Deployment, the market is segmented into On-Premise, and On-Cloud. Based on countries, the market is segmented into Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria, and Rest of LAMEA.

List of Key Companies Profiled

- Wipro Limited

- Irium Software (ISAGRI)

- The Reynolds and Reynolds Company

- Quorum Information Technologies Inc.

- Autosoft, Inc. (Tsi Auto Solutions Inc.)

- Oracle

- CDK Global, Inc. (Brookfield Business Partners L.P.)

- Dealertrack Inc. (Cox Automotive, Inc.)

- GaragePlug Inc.

- PBS Financial Systems Inc.

Market Report Segmentation

By Component

- Hardware

- Software & Services

By Application

- Customer Relationship Management

- Inventory Management

- Dealer Tracking

- Finance & Sales

- Others

By Deployment

- On-Premise

- On-Cloud

By Country

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Wipro Limited

- Irium Software (ISAGRI)

- The Reynolds and Reynolds Company

- Quorum Information Technologies Inc.

- Autosoft, Inc. (Tsi Auto Solutions Inc.)

- Oracle

- CDK Global, Inc. (Brookfield Business Partners L.P.)

- Dealertrack Inc. (Cox Automotive, Inc.)

- GaragePlug Inc.

- PBS Financial Systems Inc.