Automotive Aluminum Wheels are also widely utilized in Light Commercial Vehicles (LCVs), offering a combination of strength, durability, and functionality tailored to the demands of commercial use. Crafted from high-strength Aluminum alloys, these wheels are designed to withstand the rigors of daily driving, heavy loads, and varying road conditions typical in commercial operations. Thus, the Brazil market would utilize1.12 million units of Aluminum Wheels in Light Commercial Vehicles by 2031.

The Brazil market dominated the LAMEA Automotive Aluminum Wheels Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $623.8 million by 2031. The Argentina market is showcasing a CAGR of 11.2% during (2024 - 2031). Additionally, The UAE market would register a CAGR of 9.7% during (2024 - 2031).

Another area of innovation is the integration of smart technologies and connectivity features into Aluminum wheels. Manufacturers are exploring incorporating sensors, embedded electronics, and wireless communication systems to enable real-time monitoring of tire pressure, temperature, and wheel status. Smart Aluminum wheels offer improved safety, enhanced vehicle performance, and predictive maintenance capabilities, contributing to a more connected and intelligent automotive ecosystem.

Furthermore, integrating smart technologies into Aluminum wheels represents a cutting-edge advancement in the automotive industry. This involves embedding sensors and electronic components within the wheel structure, which can monitor various parameters and communicate data to the vehicle’s central control system or directly to the driver through a smartphone app or onboard display. Sensors can include tire pressure monitoring sensors (TPMS), temperature sensors, strain gauges, and accelerometers. These sensors continuously collect data on wheel and tire conditions. Microcontrollers and processors within the wheel can process sensor data and communicate with the vehicle’s onboard systems or external devices.

According to the International Trade Administration (ITA), the gross domestic product (GDP) of South Africa's automotive industry as a whole was 4.3% in 2021 (2.4% manufacturing and 1.9% retail). As the largest manufacturing sector in the economy, the production of vehicles and automotive components contributed a significant 18.7% of value-added to the domestic manufacturing output, maintaining the industry's position as a major player in South Africa's industrialization process. Therefore, the growing automotive sector in LAMEA will help in the growth of the regional automotive aluminum wheels market.

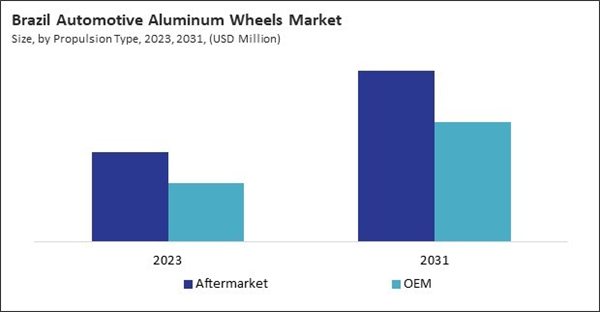

Based on Propulsion Type, the market is segmented into ICE and Electric. Based on Wheel Size, the market is segmented into Less Than 15, 16 to 20 and More than 21. Based on Vehicle Type, the market is segmented into Passenger Car, Light Commercial Vehicle Bus and Trucks. Based on Distribution Channel, the market is segmented into Aftermarket and OEM. Based on countries, the market is segmented into Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria, and Rest of LAMEA.

List of Key Companies Profiled

- Wheel Pros, LLC

- Howmet Aerospace Inc.

- OTTO FUCHS KG (Otto Fuchs Beteiligungen KG)

- BBS Japan Co., Ltd. (MAEDAKOSEN CO., LTD.)

- Iochpe-Maxion S.A.

- RONAL AG

- Accuride Corporation (Crestview Advisors, L.L.C.)

- CITIC Limited

Market Report Segmentation

By Propulsion Type (Volume, Thousand Units, USD Billion, 2020-2031)

- ICE

- Electric

By Wheel Size (Volume, Thousand Units, USD Billion, 2020-2031)

- Less Than 15

- 16 to 20

- More than 21

By Vehicle Type (Volume, Thousand Units, USD Billion, 2020-2031)

- Passenger Car

- Light Commercial Vehicle

- Bus

- Trucks

By Distribution Channel (Volume, Thousand Units, USD Billion, 2020-2031)

- Aftermarket

- OEM

By Country (Volume, Thousand Units, USD Billion, 2020-2031)

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Wheel Pros, LLC

- Howmet Aerospace Inc.

- OTTO FUCHS KG (Otto Fuchs Beteiligungen KG)

- BBS Japan Co., Ltd. (MAEDAKOSEN CO., LTD.)

- Iochpe-Maxion S.A.

- RONAL AG

- Accuride Corporation (Crestview Advisors, L.L.C.)

- CITIC Limited