Accuracy and precision are critical in pharmaceutical manufacturing to ensure consistent product quality and dosage accuracy. These palletizers offer high accuracy and precision in palletizing operations, allowing pharmaceutical manufacturers to maintain tight tolerances and ensure uniform pallet stacks, minimizing errors and product waste. Thus, the pharmaceutical segment would acquire nearly 13% of the total market share by 2031.

Automation, particularly robotic palletizing, streamlines the palletization process, enhancing efficiency and productivity. In addition, robots offer precise and consistent palletizing, reducing errors and ensuring uniformity in palletized loads. Therefore, the increased demand for automation is driving the market’s growth. Additionally, E-commerce has led to a surge in order volumes for retailers and fulfilment centers. As the number of orders grows, so does the need for efficient palletizing solutions to handle the increased throughput. Moreover, e-commerce companies optimize their fulfilment centers to minimize order processing times and shipping costs.

However, Robotic palletizing systems involve substantial upfront costs, including purchasing robotic equipment, peripheral machinery (such as conveyors and sensors), installation, and integration with existing production lines or warehouse systems. Also, some businesses may be risk-averse and reluctant to invest in new technologies, particularly if they perceive the associated risks, such as technology obsolescence or operational disruptions, to outweigh the potential benefits. In conclusion, the high initial investment costs impede the market’s growth.

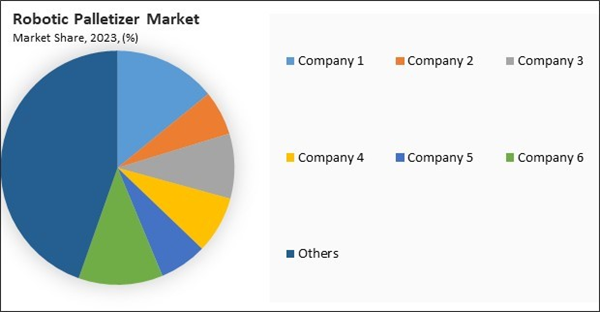

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Component Outlook

Based on component, the market is divided into robotic arm, end-of-arm tooling (EOAT), control system, and others. In 2023, the control system segment procured 25% revenue share in the market. Control systems in these palletizers are evolving to offer advanced functionality and features that enhance system performance, flexibility, and user experience. These include capabilities such as motion control, trajectory planning, collision avoidance, predictive maintenance, and remote monitoring.Application Outlook

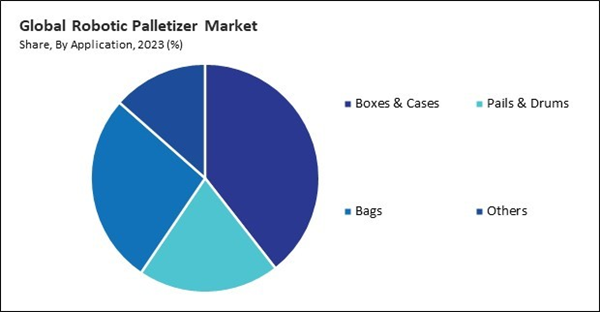

Based on application, the market is categorized into bags, boxes & cases, pails & drums, and others. The bags segment witnessed 27% revenue share in the market in 2023. There is a growing trend towards using bags as a packaging format in various industries, such as food and beverage, agriculture, chemicals, and pharmaceuticals. Bags offer portability, flexibility, and cost-effectiveness, making them popular for packaging a wide range of products, including grains, powders, chemicals, and pet food.Robot Type Outlook

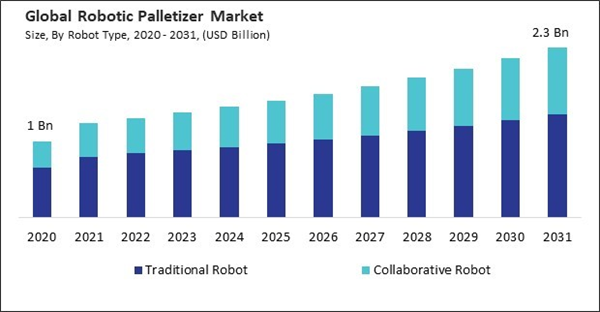

On the basis of robot type, the market is segmented into traditional robot and collaborative robot. The collaborative robot segment procured 36% revenue share in the market in 2023. Collaborative robots are specifically designed to work alongside human operators in a shared workspace without the need for physical safety barriers or guarding. Their built-in safety features, such as force and torque sensors, collision detection, and power-limiting capabilities, enable safe interaction between humans and robots, reducing the risk of workplace accidents and injuries.End Use Outlook

On the basis of end-use, the market is segmented into food & beverages, pharmaceutical, cosmetics & personal care, chemical, e-commerce & logistics, and others. The e-commerce & logistics segment held a 16.7% growth rate in the market in 2023. The e-commerce industry is experiencing rapid growth, driven by increasing consumer demand for online shopping and home delivery services. As e-commerce companies handle a growing volume of orders and shipments, there is a need for efficient and scalable solutions to streamline warehouse operations, including palletizing.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region witnessed 36.7% revenue share in the market in 2023. North America has been at the forefront of industrial automation adoption, with many manufacturing and logistics companies embracing automation technologies to improve efficiency, productivity, and competitiveness. These palletizers offer a scalable and cost-effective solution for automating palletizing operations in various industries, driving widespread adoption across the region.List of Key Companies Profiled

- FANUC Corporation

- Kuka AG (Midea Group Co., Ltd.)

- ABB Ltd.

- Krones AG

- Schneider Packaging Equipment Company, Inc. (Pacteon Group)

- Honeywell International Inc

- Kaufman Engineered Systems

- Concetti S.p.A.

- Brenton, LLC (Pro Mach, Inc.)

- Rothe Packtech Pvt. Ltd.

- KION GROUP AG

Market Report Segmentation

By Robot Type

- Traditional Robot

- Collaborative Robot

By Component

- Robotic Arm

- End-of-Arm Tooling (EOAT)

- Control System

- Others

By Application

- Boxes & Cases

- Pails & Drums

- Bags

- Others

By End Use

- Food & Beverages

- Chemical

- E-Commerce & Logistics

- Pharmaceutical

- Cosmetic & Personal Care

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- FANUC Corporation

- Kuka AG (Midea Group Co., Ltd.)

- ABB Ltd.

- Krones AG

- Schneider Packaging Equipment Company, Inc. (Pacteon Group)

- Honeywell International Inc

- Kaufman Engineered Systems

- Concetti S.p.A.

- Brenton, LLC (Pro Mach, Inc.)

- Rothe Packtech Pvt. Ltd.

- KION GROUP AG