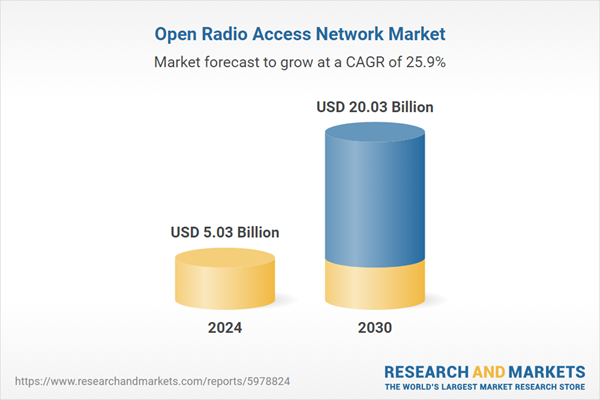

5G is the fastest growing segment, North America is the largest market globally

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The rapid acceleration of 5G network deployments is a primary catalyst for the Global Open Radio Access Network Market. Mobile network operators are actively seeking more flexible, scalable, and cost-efficient solutions to meet the growing demands of 5G, particularly as networks expand globally. Open RAN architecture, with its disaggregated hardware and software components, offers the agility required for widespread 5G rollout across diverse geographical and operational contexts. This architectural shift enables faster innovation cycles and more dynamic network management essential for next-generation services.Key Market Challenges

The inherent complexity of integrating disparate vendor components and ensuring robust, seamless interoperability and consistent performance across a disaggregated network architecture represents a significant impediment to the growth of the Global Open Radio Access Network Market. This challenge extends beyond mere technical alignment, necessitating extensive validation and testing to guarantee that diverse hardware and software elements function cohesively in live network environments. Such intricate integration processes can substantially prolong deployment timelines and increase the operational overhead for mobile network operators. It demands specialized engineering expertise to manage multi-vendor ecosystems, further contributing to higher operational expenditures.Key Market Trends

Increased Industry Collaboration and Standardization Efforts actively addresses interoperability challenges within the Open Radio Access Network market by fostering a unified development environment. Collaborative initiatives through organizations like the O-RAN Alliance establish open interfaces and specifications, crucial for enabling true multi-vendor deployments and reducing integration complexities. According to the O-RAN Alliance, since March 2025, it had published 134 technical specification titles in their current version, demonstrating substantial progress.Key Market Players Profiled:

- Huawei Technologies Co., Ltd.

- Telefonaktiebolaget LM Ericsson

- Nokia Corporation

- ZTE Corporation

- Samsung Electronics Co., Ltd.

- NEC Corporation

- Cisco Systems, Inc.

- Qualcomm Technologies, Inc.

- Intel Corporation

- Fujitsu Limited

Report Scope:

In this report, the Global Open Radio Access Network Market has been segmented into the following categories:By Deployment:

- Private

- Public

By Network:

- 2G

- 3G

- 4G

- 5G

By Component:

- Hardware

- Software

- Services

By Frequency:

- Sub-6 GHz

- mmWave

By End Use:

- Residential

- Commercial

- Industrial

By Region:

- North America

- Europe

- South America

- Middle East & Africa

- Asia Pacific

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Open Radio Access Network Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Huawei Technologies Co., Ltd.

- Telefonaktiebolaget LM Ericsson

- Nokia Corporation

- ZTE Corporation

- Samsung Electronics Co., Ltd.

- NEC Corporation

- Cisco Systems, Inc.

- Qualcomm Technologies, Inc.

- Intel Corporation

- Fujitsu Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | November 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.03 Billion |

| Forecasted Market Value ( USD | $ 20.03 Billion |

| Compound Annual Growth Rate | 25.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |