Medical is the fastest growing segment, North America is the largest market globally

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The Global System on Module (SoM) market is significantly driven by the expanding adoption of Internet of Things (IoT) and Industrial IoT (IIoT) solutions. These interconnected ecosystems necessitate compact, reliable, and power-efficient computing units capable of rapid deployment across diverse environments, from smart infrastructure to factory floors. SoMs address these needs by integrating essential functionalities onto a single production-ready board, thereby accelerating product development and reducing design complexities for IoT device manufacturers. The sheer scale of this transformation is evident as, according to GSMA, in February 2025, the number of IoT devices worldwide is projected to exceed 25 billion, underscoring the immense demand for pre-validated, embedded processing capabilities.Key Market Challenges

The persistent volatility and potential for disruption within the global supply chain for critical electronic components significantly hampers the growth of the Global System on Module (SoM) Market. Such disruptions lead directly to extended lead times and unpredictable availability of essential microprocessors, memory, and interface components necessary for SoM production. This instability creates considerable challenges for SoM manufacturers, causing delays in manufacturing schedules and hindering their ability to consistently meet customer demand.Key Market Trends

Enhanced 5G Communication Module Integration is a significant trend transforming the Global System on Module (SoM) Market by delivering capabilities essential for advanced connected applications. The integration of 5G modules into SoMs enables unprecedented data transfer speeds, reduced latency, and enhanced reliability, which are crucial for real-time processing and mission-critical systems in areas like industrial automation and autonomous vehicles. This technological advancement supports the proliferation of devices requiring high-bandwidth, consistent connectivity.Key Market Players Profiled:

- Advantech Co., Ltd.

- Connect Tech Inc.

- AAEON Technology Inc.

- Avnet, Inc.

- EMAC Inc.

- Avalue Technology Inc.

- Axiomtek Co., Ltd.

- Eurotech S.p.A.

- Emerson Electric Co.

- SECO S.p.A.

Report Scope:

In this report, the Global System on Module (SoM) Market has been segmented into the following categories:By Type:

- ARM Architecture

- X86 Architecture

- Power Architecture

By Standard:

- COM Express

- SMARC

- Qseven

- ETX/XTX

- COM-HPC

- Others

By Application:

- IndustrialAutomation

- Medical

- Entertainment

- Transportation

- Test & Measurement

- Others

By Region:

- North America

- Europe

- South America

- Middle East & Africa

- Asia Pacific

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global System on Module (SoM) Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Advantech Co., Ltd.

- Connect Tech Inc.

- AAEON Technology Inc.

- Avnet, Inc.

- EMAC Inc.

- Avalue Technology Inc.

- Axiomtek Co., Ltd.

- Eurotech S.p.A.

- Emerson Electric Co.

- SECO S.p.A.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | November 2025 |

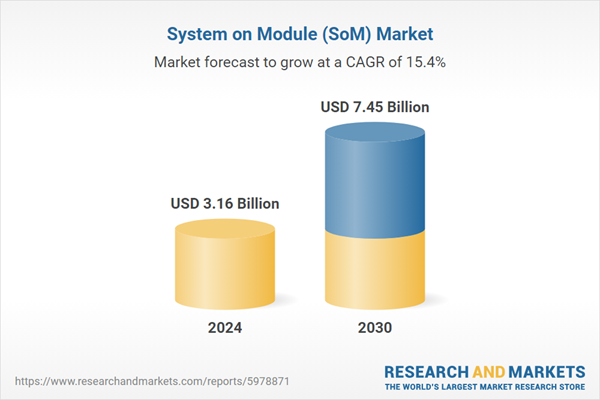

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.16 Billion |

| Forecasted Market Value ( USD | $ 7.45 Billion |

| Compound Annual Growth Rate | 15.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |