Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite these favorable growth drivers, the market encounters a major obstacle in the form of high initial capital investments necessary for installing and calibrating complex monitoring equipment. This financial hurdle is particularly severe for extensive infrastructure networks, where the cost of instrumentation often competes directly with limited budgets allocated for actual structural repairs. Consequently, these substantial upfront expenses, coupled with the technical intricacies of processing massive amounts of sensor data, can retard widespread implementation across cost-sensitive industrial sectors.

Market Drivers

The growth of renewable energy infrastructure acts as a primary catalyst for the adoption of structural health monitoring technologies. As nations shift towards sustainable power, the deployment of wind energy assets, particularly in offshore environments, requires rigorous continuous surveillance to identify material fatigue and structural irregularities caused by harsh operating conditions. This operational necessity drives the integration of sensors to minimize downtime and optimize energy production. According to the Global Wind Energy Council's 'Global Wind Report 2024' published in April 2024, the wind industry installed a record 117 gigawatts of new capacity globally in 2023, creating a parallel demand for monitoring systems capable of ensuring the long-term reliability of turbine foundations and blades.Additionally, government funding allocations and public-private partnership infrastructure investments are accelerating market penetration by overcoming financial barriers. Significant capital injections into transportation networks allow operators to procure advanced diagnostic tools that ensure public safety and regulatory compliance. For example, the U.S. Department of Transportation announced in a July 2024 press release that the Biden-Harris Administration awarded over $5 billion to fund large bridge reconstruction and rehabilitation projects, directly supporting the deployment of monitoring solutions in critical transit corridors. Furthermore, Union Pacific planned a capital investment of $3.4 billion in 2024 to upgrade and maintain its network infrastructure, highlighting the extensive financial commitment directed toward asset integrity management.

Market Challenges

The high initial capital investment required for installing and calibrating monitoring equipment constitutes a substantial barrier to the expansion of the Global Structural Health Monitoring Market. Asset owners frequently operate under restricted financial conditions where the immediate costs of hardware, cabling, and data acquisition systems create significant budgetary pressure. When faced with finite resources, infrastructure managers must often prioritize urgent physical repairs over the procurement of diagnostic technologies. This financial strain is particularly severe when the expense of instrumentation represents a large percentage of the total project value, making it difficult to justify the return on investment for non-critical structures.This economic constraint is clearly visible in the widening disparity between infrastructure needs and available capital. According to the American Society of Civil Engineers, in 2025, the United States faces a cumulative infrastructure investment gap of $3.7 trillion that will persist through 2033. This profound funding deficit forces agencies to divert capital almost exclusively toward deferred maintenance and rehabilitation, leaving minimal room for the adoption of predictive monitoring systems. Consequently, the deployment of structural health monitoring solutions remains limited in cost-sensitive sectors as operators struggle to allocate funds beyond essential corrective measures.

Market Trends

The deployment of robotic and drone-assisted inspection systems is revolutionizing data acquisition by enabling frequent, non-contact assessments of critical infrastructure. These autonomous platforms mitigate human risk in hazardous environments while drastically reducing the time required for structural evaluations. Utilities and asset owners are increasingly operationalizing this technology at scale to maintain vast networks of distribution and transmission assets, shifting away from manual, labor-intensive methods. According to PG&E Corporation's April 2025 press release regarding their aerial system drone fleet, the company conducted over 250,000 drone inspections of distribution structures and 42,000 missions on transmission equipment in 2024, highlighting the sector's pivot toward automated surveillance to ensure grid reliability and asset integrity.Simultaneously, the implementation of digital twin technology for lifecycle management is transforming how operators analyze and utilize structural data. By creating dynamic virtual replicas of physical assets, engineers can simulate performance scenarios and predict failures before they occur, moving beyond simple condition monitoring to comprehensive asset stewardship. This shift is supported by the growing consumption of software platforms that integrate sensor data for real-time visualization and decision support. According to Bentley Systems' February 2025 report on their full-year 2024 results, the company saw subscription revenues rise 13.2% in 2024, a growth trajectory driven by the increasing adoption of its iTwin Platform for infrastructure digital twins, underscoring the market’s transition toward software-defined asset management solutions.

Key Players Profiled in the Structural Health Monitoring Market

- Campbell Scientific, Inc.

- COWI A/S

- SGS S.A.

- Acellent Technologies, Inc.

- Kinemetrics Inc.

- Digitexx Data Systems, Inc.

- RST Instruments Ltd.

- James Fisher and Sons PLC

Report Scope

In this report, the Global Structural Health Monitoring Market has been segmented into the following categories:Structural Health Monitoring Market, by Offering:

- Hardware

- Software & Services

Structural Health Monitoring Market, by Technology:

- Wired

- Wireless

Structural Health Monitoring Market, by End Use:

- Civil Infrastructure

- Aerospace & Defense

- Energy

- Mining

Structural Health Monitoring Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Structural Health Monitoring Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Structural Health Monitoring market report include:- Campbell Scientific, Inc.

- COWI A/S

- SGS S.A.

- Acellent Technologies, Inc.

- Kinemetrics Inc.

- Digitexx Data Systems, Inc.

- RST Instruments Ltd.

- James Fisher and Sons PLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | January 2026 |

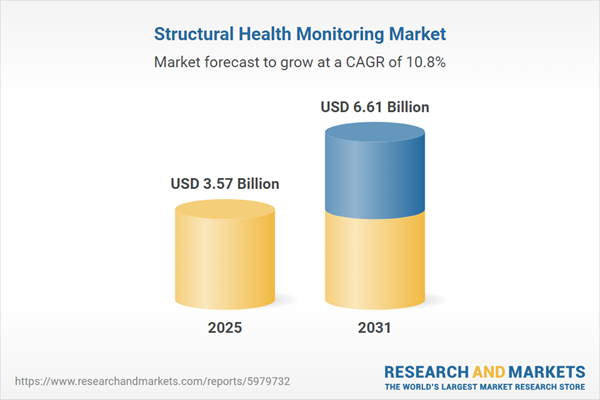

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 3.57 Billion |

| Forecasted Market Value ( USD | $ 6.61 Billion |

| Compound Annual Growth Rate | 10.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |