Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Advancements in Wound Care Technology

Technological advancements in wound care have significantly boosted the Global Hydrocolloid Dressing Market. Innovations in materials and design have enhanced the functionality and effectiveness of hydrocolloid dressings, making them a preferred choice for managing various types of wounds. These dressings are now engineered with improved adhesive properties that ensure they stay securely in place, even in challenging conditions, which helps maintain an optimal healing environment.One of the key advancements is the incorporation of antimicrobial agents into hydrocolloid dressings. These agents help reduce the risk of infection, a critical factor in wound management, especially for chronic wounds that are prone to bacterial contamination. The ability of these dressings to deliver antimicrobial protection while maintaining moisture balance accelerates the healing process and improves patient outcomes. Another significant innovation is the development of dressings with enhanced moisture-retentive capabilities. These advanced hydrocolloid dressings can maintain the necessary moist environment for longer periods, promoting faster and more efficient wound healing. This is particularly beneficial for patients with chronic or severe wounds, as it reduces the frequency of dressing changes and minimizes disruption to the healing tissue.

Moreover, advancements in the manufacturing process have led to the creation of hydrocolloid dressings that are thinner, more flexible, and more comfortable for patients to wear. These improvements enhance patient compliance and comfort, which are crucial for effective wound care. Enhanced wearability and ease of use have made hydrocolloid dressings more accessible and user-friendly, encouraging their adoption in both clinical and home care settings.

Increasing Prevalence of Chronic Wounds

The increasing prevalence of chronic wounds is a significant driver of the Global Hydrocolloid Dressing Market. Chronic wounds, such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers, are becoming more common due to rising rates of diabetes, obesity, and an aging population. These conditions often lead to wounds that do not heal properly or quickly, requiring advanced wound care solutions to manage effectively. For instance, As per the data published by the Institute for Health Metrics and Evaluation, over 500 million individuals globally are currently living with diabetes, impacting individuals of all ages and genders across every nation. This figure is forecasted to surpass 1.3 billion within the next three decades, with every country experiencing a surge in diabetic cases as highlighted in the Lancet’s study named- a systematic analysis for the Global Burden of Disease Study 2021.Hydrocolloid dressings are particularly well-suited for treating chronic wounds due to their ability to maintain a moist wound environment, which is essential for promoting faster and more efficient healing. Unlike traditional dressings, hydrocolloid dressings can stay in place for several days, reducing the need for frequent changes and minimizing disturbance to the wound site. This is especially beneficial for patients with chronic wounds, who need consistent and reliable care to avoid complications like infections and prolonged healing times.

As the incidence of chronic wounds increases, healthcare providers are increasingly turning to hydrocolloid dressings to improve patient outcomes. These dressings not only enhance the healing process but also provide a protective barrier against external contaminants, reducing the risk of infection. Their use in treating chronic wounds is supported by numerous clinical studies demonstrating their efficacy and benefits over traditional wound care methods. The growing awareness of the importance of advanced wound care among healthcare professionals and patients is driving demand for hydrocolloid dressings. Educational initiatives and professional training programs are helping to spread knowledge about the advantages of these dressings, leading to wider adoption in both hospital settings and home care.

Key Market Challenges

High Costs of Advanced Wound Care Products

One of the primary challenges hindering the Global Hydrocolloid Dressing Market is the high cost associated with advanced wound care products. Hydrocolloid dressings, while effective, are more expensive compared to traditional wound care products like gauze and bandages. This cost disparity can be a significant barrier, particularly in low- and middle-income countries where healthcare budgets are limited and patients often bear out-of-pocket expenses. The high price point of hydrocolloid dressings can deter their adoption among healthcare providers who may opt for more affordable alternatives despite the superior efficacy of hydrocolloid options.The high costs are attributed to the advanced materials and manufacturing processes involved in producing hydrocolloid dressings. Additionally, the incorporation of antimicrobial agents and other enhancements further increases production expenses. While these features contribute to better patient outcomes, the financial burden can be prohibitive for many healthcare systems. Insurance coverage and reimbursement policies also play a crucial role; in regions where such policies do not adequately cover advanced wound care products, patients and healthcare providers may be less likely to use hydrocolloid dressings. Consequently, addressing the cost issue through more efficient production methods, government subsidies, or improved insurance coverage is essential for broader market penetration.

Limited Availability in Developing Regions

Limited availability in developing regions poses a significant challenge to the Global Hydrocolloid Dressing Market. In many low- and middle-income countries, access to advanced wound care products, including hydrocolloid dressings, is restricted due to inadequate distribution networks, logistical challenges, and limited healthcare infrastructure. This lack of availability means that patients in these regions often have to rely on traditional wound care methods, which are less effective and can lead to prolonged healing times and higher rates of complications.Moreover, the healthcare systems in these regions may not have the resources or capabilities to procure and distribute hydrocolloid dressings widely. This is compounded by economic constraints that prioritize basic healthcare needs over advanced wound care solutions. As a result, the penetration of hydrocolloid dressings remains low, limiting market growth potential in these areas. To address this challenge, manufacturers need to develop more effective distribution strategies that can overcome logistical barriers and ensure that hydrocolloid dressings are readily available in developing regions. Partnerships with local healthcare providers, governments, and non-governmental organizations (NGOs) can also play a pivotal role in improving access. Additionally, investing in local production facilities could help reduce costs and improve the supply chain, making hydrocolloid dressings more accessible to a broader population.

Key Market Trends

Expansion of Healthcare Infrastructure

The expansion of healthcare infrastructure is a significant driver of the Global Hydrocolloid Dressing Market. As developing countries invest in enhancing their healthcare systems, access to advanced medical products, including hydrocolloid dressings, is increasing. This infrastructural growth is crucial for managing the rising burden of chronic diseases and improving overall healthcare delivery. In regions such as Asia-Pacific, Latin America, and Africa, substantial investments are being made to build new hospitals, clinics, and long-term care facilities. These investments are not only expanding the physical healthcare infrastructure but also integrating advanced medical technologies and training healthcare professionals in their use. With better-equipped facilities, the adoption of modern wound care products like hydrocolloid dressings is on the rise. These dressings, known for their ability to maintain a moist wound environment conducive to healing, are becoming more widely available and used in clinical practice.Moreover, improved healthcare infrastructure enhances the supply chain and distribution networks for medical products. This means that hydrocolloid dressings can reach more patients, including those in previously underserved rural and remote areas. As a result, there is a broader and more equitable access to effective wound care solutions, which is vital for treating chronic wounds and preventing complications.

Governments and private sectors in developing regions are also recognizing the economic benefits of investing in healthcare infrastructure. Effective wound care reduces the overall cost burden by minimizing hospital stays, lowering the risk of infections, and promoting faster healing. Thus, the expansion of healthcare facilities directly correlates with an increased demand for advanced wound care products, including hydrocolloid dressings.

Strategic Collaborations and Product Launches

Strategic collaborations and product launches are pivotal in driving the growth of the Global Hydrocolloid Dressing Market. Key players in the medical device industry are increasingly engaging in partnerships, mergers, and acquisitions to enhance their product offerings and expand their market presence. These strategic moves are vital for fostering innovation, improving product quality, and meeting the evolving needs of healthcare providers and patients. Collaborations between medical device manufacturers and research institutions are particularly impactful. These partnerships facilitate the development of advanced hydrocolloid dressings with enhanced features such as improved adhesion, antimicrobial properties, and greater moisture-retentive capabilities. By combining expertise and resources, these collaborations accelerate the innovation cycle, bringing cutting-edge wound care solutions to market more quickly.Product launches are another critical driver of market growth. Leading companies regularly introduce new and improved hydrocolloid dressings, incorporating the latest technological advancements. These products often feature novel materials and design improvements that enhance their efficacy and patient comfort. For instance, hydrocolloid dressings with integrated antimicrobial agents help reduce the risk of infection, while thinner and more flexible designs improve wearability and compliance.

The introduction of these advanced products not only meets the rising demand for effective wound care solutions but also sets new standards for the industry. Innovative hydrocolloid dressings are gaining traction in both acute and chronic wound care settings, from hospitals to home care environments. Moreover, these product launches are often accompanied by educational initiatives and marketing campaigns that raise awareness among healthcare professionals and patients about the benefits of advanced wound care.

Segmental Insights

Application Insights

Based on the Application, In 2023, the Chronic Wounds segment emerged as the dominant segment in the Global Hydrocolloid Dressing Market. This dominance can be attributed to several factors that underscore the importance of hydrocolloid dressings in managing chronic wounds effectively. Chronic wounds, such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers, pose significant challenges in healthcare due to their prolonged healing time and propensity for complications. Hydrocolloid dressings are particularly well-suited for managing these types of wounds because of their ability to maintain a moist wound environment, which is essential for optimal healing. The dressings create a barrier that protects the wound from external contaminants while absorbing excess exudate, promoting granulation tissue formation, and facilitating autolytic debridement.Hydrocolloid dressings provide a cushioning effect that helps alleviate pressure on the wound site, making them especially beneficial for patients with pressure ulcers or diabetic foot ulcers. The dressings are also highly conformable and can be molded to fit irregular wound shapes, ensuring optimal contact with the wound bed and minimizing the risk of leakage or maceration of surrounding skin.

Regional Insights

In 2023, North America solidified its position as the dominant region in the Global Hydrocolloid Dressing Market, capturing the largest market share. Several factors contributed to North America's prominent role in driving market growth and innovation in hydrocolloid dressings. North America boasts advanced healthcare infrastructure and robust regulatory frameworks that foster innovation and facilitate the rapid adoption of new medical technologies. The region is home to leading medical device manufacturers, research institutions, and healthcare providers who collaborate to develop and commercialize cutting-edge wound care products, including hydrocolloid dressings. This environment of innovation and collaboration enables North America to stay at the forefront of advancements in wound care technology.The high prevalence of chronic diseases and lifestyle-related conditions in North America drives the demand for effective wound care solutions. Conditions such as diabetes, obesity, and vascular diseases contribute to the increasing incidence of chronic wounds, necessitating advanced wound management strategies. Hydrocolloid dressings, with their ability to promote moist wound healing and prevent infections, are widely adopted in clinical practice across the region, further solidifying North America's dominance in the market.

Key Market Players

- Smith & Nephew Plc

- 3M company

- Coloplast Corp

- Paul Hartmann AG

- Convatec Group plc

- B. Braun SE

- Cardinal Health, Inc

- Covalon Technologies Ltd.

- Dermarite Industries, LLC.

- Medline Industries, Inc.

Report Scope:

In this report, the Global Hydrocolloid Dressing Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Hydrocolloid Dressing Market, By Application:

- Chronic Wounds

- Acute Wounds

Hydrocolloid Dressing Market, By End-Use:

- Hospitals

- Specialty Clinics

- Home Healthcare

- Others

Hydrocolloid Dressing Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Hydrocolloid Dressing Market.Available Customizations:

Global Hydrocolloid Dressing market report with the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Smith & Nephew Plc

- 3M company

- Coloplast Corp

- Paul Hartmann AG

- Convatec Group plc

- B. Braun SE

- Cardinal Health, Inc

- Covalon Technologies Ltd.

- Dermarite Industries, LLC.

- Medline Industries, Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | June 2024 |

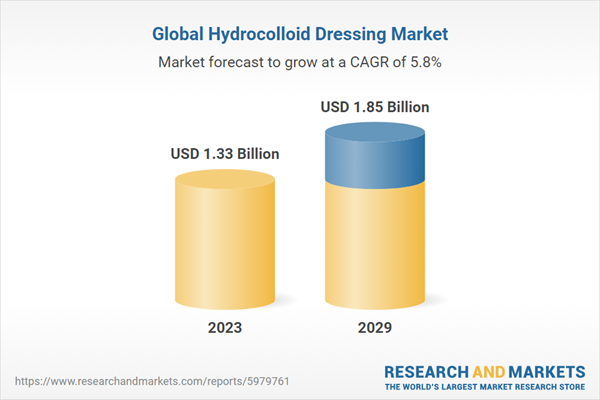

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 1.33 Billion |

| Forecasted Market Value ( USD | $ 1.85 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |