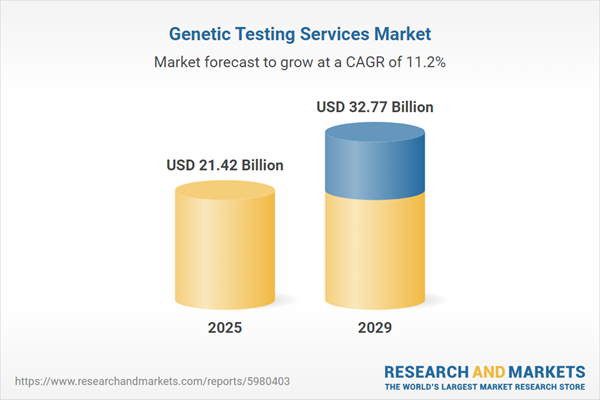

The genetic testing services market size has grown rapidly in recent years. It will grow from $19.19 billion in 2024 to $21.42 billion in 2025 at a compound annual growth rate (CAGR) of 11.6%. The growth in the historic period can be attributed to increasing demand for personalized and precision medicine, growing prevalence of genetic disorders, high demand for prenatal testing during pregnancy, increasing population, and increased awareness and education.

The genetic testing services market size is expected to see rapid growth in the next few years. It will grow to $32.77 billion in 2029 at a compound annual growth rate (CAGR) of 11.2%. The growth in the forecast period can be attributed to the growing demand for non-invasive prenatal testing (NIPT), the rise of pharmacogenomics, the growing focus on preventive healthcare, increasing direct-to-consumer (DTC) testing, and the focus on rare diseases and personalized therapies. Major trends in the forecast period include artificial intelligence (AI) and machine learning, advancements in user-friendly testing kits and online platforms, next-generation sequencing, microarray analysis, polymerase chain reaction (PCR), and advanced healthcare infrastructure.

The rising prevalence of genetic disorders is anticipated to drive the growth of the genetic testing services market in the future. Genetic disorders, stemming from abnormalities in an individual's DNA, result in various physical or developmental abnormalities. Factors contributing to the increased prevalence of genetic disorders include heightened awareness, improved diagnostic methods, expanded genetic screening initiatives, and a growing incidence of consanguineous marriages in certain populations. Genetic testing services play a pivotal role in diagnosing, prognosing, and determining treatment strategies for individuals with genetic disorders, facilitating personalized medical care and family planning decisions based on genetic information. For example, as reported by the World Health Organization (WHO) in February 2023, congenital diseases are responsible for approximately 240,000 infant deaths globally within the first 28 days of birth each year. Additionally, according to the Centers for Disease Control and Prevention (CDC), approximately 6,000 babies are born with Down syndrome in the United States annually, translating to about 1 in every 700 births. Hence, the escalating prevalence of genetic disorders is a driving force behind the growth of the genetic testing services market.

Key players in the genetic testing services market are concentrating on advancing technological solutions, such as cancer screening tests, to enhance precision, broaden testing capabilities, and improve patient outcomes overall. Cancer screening tests are routine examinations conducted on asymptomatic individuals to detect early signs of cancer. These tests aim to identify cancer or precancerous conditions before symptoms manifest, enabling more effective treatment interventions. For instance, in June 2022, Prenetics Group Limited introduced ColoClear, a non-invasive stool DNA test in Hong Kong, leveraging highly sensitive screening methods to detect early indications of colorectal cancer. Combining advanced stool DNA technology with fecal immunochemical testing (FIT), ColoClear offers a convenient and efficient alternative to colonoscopy. Clinical studies have demonstrated ColoClear's sensitivity of 96% in colorectal cancer detection and 64% in advanced adenoma detection.

In November 2022, Myriad Genetics Inc. bolstered its presence in women's health and oncology testing by acquiring Gateway Genomics for $67.5 million. This strategic move expands Myriad's portfolio of comprehensive and personalized genetic testing solutions for patients. Gateway Genomics LLC, a US-based genetics company specializing in genetic testing services, complements Myriad's capabilities in the field.

Major companies operating in the genetic testing services market are F. Hoffmann-La Roche Ltd, Thermo Fisher Scientific Inc., Abbott Laboratories, Danaher Corporation, Laboratory Corporation of America Holdings (LabCorp), Quest Diagnostics Incorporated, Eurofins Scientific SE, SGS SA, Agilent Technologies, Hologic Inc., Illumina Inc., PerkinElmer Inc., bioMérieux SA, Bio-Rad Laboratories Inc., QIAGEN N.V., Natera Inc., Myriad Genetics Inc., BGI Genomics Co. Ltd., Invitae Corporation, NeoGenomics Laboratories Inc, 23andMe Holding Co, Berry Genomics Co. Ltd, Pacific Biosciences of California Inc, Ambry Genetics Corporation, Biocartis SA, CENTOGENE N.V., Blueprint Genetics Oy, Igenomix, Veritas Genetics.

North America was the largest region in the genetic testing services market in 2024. The regions covered in the genetic testing services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the genetic testing services market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Genetic testing services involve the analysis of an individual's DNA to detect variations or mutations that may indicate disease susceptibility, ancestry information, or other genetic characteristics. These services typically provide insights into potential health risks, ancestral origins, and personalized recommendations based on genetic predispositions, aiding in informed medical decisions and lifestyle choices.

The primary categories of genetic testing services include predictive testing, carrier testing, prenatal testing, newborn screening, and other specialized tests. Predictive testing assesses an individual's risk of developing specific conditions such as cancer, metabolic disorders, cardiovascular diseases, and others. These services are utilized by a variety of stakeholders including diagnostic laboratories, hospitals and clinics, academic institutions, research centers, and others.

The genetic testing services market research report is one of a series of new reports that provides genetic testing services market statistics, including genetic testing services industry global market size, regional shares, competitors with a genetic testing services market share, detailed genetic testing services market segments, market trends and opportunities, and any further data you may need to thrive in the genetic testing services industry. This genetic testing services market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The genetic testing services market consists of revenues earned by entities by providing services such as newborn screening, diagnostic testing, carrier testing, prenatal testing, preimplantation testing, predictive and presymptomatic testing, ancestry testing, nutrigenomics testing, and forensic testing. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Genetic Testing Services Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on genetic testing services market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for genetic testing services ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The genetic testing services market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Predictive Testing; Carrier Testing; Prenatal Testing; Newborn Screening; Other Types2) By Disease: Cancer Disease; Metabolic Disease; Cardiovascular Disease; Other Diseases

3) By End User: Diagnostic Laboratories; Hospitals and Clinics; Academic Institutes and Research Centers; Other End Users

Subsegments:

1) By Predictive Testing: Cancer Predisposition Testing; Heart Disease Risk Testing; Neurological Disorder Risk Testing; Other Predictive Tests2) By Carrier Testing: Carrier Screening for Single-Gene Disorders; Carrier Screening for Multifactorial Conditions; Carrier Screening for Inherited Genetic Conditions; Other Carrier Tests

3) By Prenatal Testing: Non-Invasive Prenatal Testing (NIPT); Amniocentesis; Chorionic Villus Sampling (CVS); Ultrasound-Combined Genetic Testing; Other Prenatal Tests

4) By Newborn Screening: Metabolic Disorder Screening; Genetic Disorder Screening; Hearing Loss Screening; Endocrine Disorder Screening; Other Newborn Screening Tests

5) By Other Types: Pharmacogenetic Testing; Forensic Genetic Testing; Ancestry and Genetic Genealogy Testing; Paternity Testing; Other Specialized Genetic Tests

Key Companies Mentioned: F. Hoffmann-La Roche Ltd; Thermo Fisher Scientific Inc.; Abbott Laboratories; Danaher Corporation; Laboratory Corporation of America Holdings (LabCorp)

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Genetic Testing Services market report include:- F. Hoffmann-La Roche Ltd

- Thermo Fisher Scientific Inc.

- Abbott Laboratories

- Danaher Corporation

- Laboratory Corporation of America Holdings (LabCorp)

- Quest Diagnostics Incorporated

- Eurofins Scientific SE

- SGS SA

- Agilent Technologies

- Hologic Inc.

- Illumina Inc.

- PerkinElmer Inc.

- bioMérieux SA

- Bio-Rad Laboratories Inc.

- QIAGEN N.V.

- Natera Inc.

- Myriad Genetics Inc.

- BGI Genomics Co. Ltd.

- Invitae Corporation

- NeoGenomics Laboratories Inc

- 23andMe Holding Co

- Berry Genomics Co. Ltd

- Pacific Biosciences of California Inc

- Ambry Genetics Corporation

- Biocartis SA

- CENTOGENE N.V.

- Blueprint Genetics Oy

- Igenomix

- Veritas Genetics

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 21.42 Billion |

| Forecasted Market Value ( USD | $ 32.77 Billion |

| Compound Annual Growth Rate | 11.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |