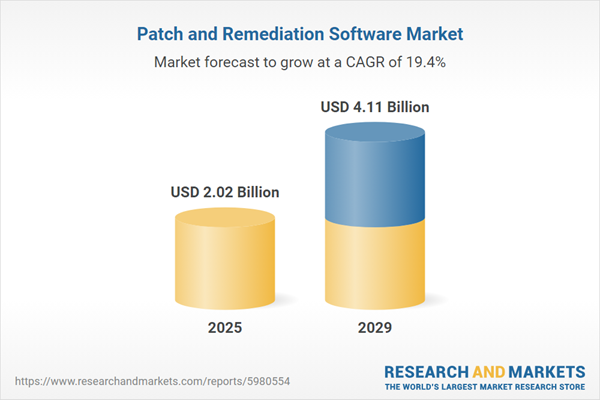

The patch and remediation software market size has grown rapidly in recent years. It will grow from $1.69 billion in 2024 to $2.02 billion in 2025 at a compound annual growth rate (CAGR) of 19.8%. The growth in the historic period can be attributed to the increased cyberattacks, increased vulnerability scanners, rise in security and data breaches, increased awareness and education, and the increased globalization of businesses.

The patch and remediation software market size is expected to see rapid growth in the next few years. It will grow to $4.11 billion in 2029 at a compound annual growth rate (CAGR) of 19.4%. The growth in the forecast period can be attributed to the rising remote workforces, growing IT infrastructures, the rising zero-day vulnerabilities, focus on operational efficiency, demand for integrated security solutions, and focus on user-centric patching. Major trends in the forecast period include threat intelligence platforms, cloud-native patch management solutions, enhanced visibility and reporting, adoption of AI-driven automation, AI-powered patch management solutions, and security orchestration, automation, and response (SOAR) platforms.

The surge in cyber threats is poised to drive the expansion of the patch and remediation software market in the foreseeable future. Cyber threats encompass malicious activities aimed at stealing or harming data, disrupting digital operations, or compromising information system security. These threats stem from various factors, including increased connectivity, a lack of cybersecurity awareness, the transition to remote work setups, and the use of sophisticated attack methods. Patch and remediation software plays a critical role in helping organizations stay vigilant against cyber threats by ensuring their systems are updated with the latest security patches and updates. This software aids in identifying, prioritizing, and implementing solutions to mitigate risks, thereby reducing the likelihood of successful cyberattacks. For instance, as per a report published by the Identity Theft Resource Center (ITRC) in January 2024, data compromises in 2023 surged to 3,205 cases, marking a 78% increase from 1,801 cases in 2022. Hence, the escalating cyber threats are fueling growth in the patch and remediation software market.

Leading companies in the patch and remediation software sector are concentrating on developing cutting-edge solutions utilizing innovative technologies, such as automated remediation of security vulnerabilities, to gain a competitive advantage in the market. Automated remediation of security vulnerabilities involves automatically identifying, prioritizing, and resolving security weaknesses or vulnerabilities present in computer systems. For instance, Action1 Corporation, a US-based provider of a risk-based patch management platform, introduced an enhanced version of its patch management platform in December 2022. This updated platform facilitates automated workflows to expedite the remediation process, offering seamless integration capabilities to link automated vulnerability repair operations with existing information technology infrastructures. It also expands its application repository for secure software deployment and updates. Through automated remediation of security vulnerabilities, organizations can proactively detect and address potential security risks, streamline remediation efforts, and enhance overall security posture.

In September 2024, Absolute Security, a US-based provider of enterprise cyber resilience solutions, acquired Syxsense Inc. for an undisclosed amount. The acquisition is intended to enhance Absolute Security's cyber resilience platform by adding automated vulnerability and patch management capabilities. This integration allows organizations to efficiently address vulnerabilities, ensuring that their operating systems, applications, and security controls are up to date and protected against potential threats. Syxsense Inc. is a US-based provider of patch management software.

Major companies operating in the patch and remediation software market report are Microsoft Corporation; Verizon Communications Inc.; International Business Machines Corporation; Broadcom Inc.; Red Hat Inc.; Micro Focus International plc; BMC Software Inc.; GoTo Group; Avast Software; Zoho Corporation Pvt. Ltd.; SolarWinds Worldwide LLC; Ivanti; Qualys Inc.; Flexera Software LLC; Kaseya Limited; Chef Software Inc.; Puppet; Comodo Group Inc.; SysAid Technologies; NetSPI LLC; Verve Industrial Protection; Patchworx; JetPatch; SmiKar Software; Lumension Security Inc.

North America was the largest region in the patch and remediation software market in 2024. The regions covered in the patch and remediation software market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the patch and remediation software market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The patch and remediation software market includes revenues earned by entities by providing services such as vulnerability scanning, software updates, compliance monitoring, risk assessment and prioritization, automation, reporting and analytics, and support and maintenance. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

Patch and remediation software refers to tools utilized in computer systems and networks to rectify risks, defects, or security issues in software applications, operating systems, or firmware. They aid organizations in proactively addressing potential threats and reducing the risk of security breaches and cyberattacks.

The primary types of patch and remediation software include security updates, Windows updates, and service packs. Security updates encompass patches, fixes, or enhancements developed to mitigate vulnerabilities or weaknesses in software, hardware, or systems, enabling organizations to fortify their defenses against security threats. These solutions encompass a range of components, including both software and services, deployable in on-premise and cloud environments. They cater to organizations of varying sizes across numerous industry verticals, such as banking, financial services, and insurance (BFSI), healthcare and life sciences, information technology (IT) and telecommunications (Telecom), energy and utilities, manufacturing, transportation, retail, and others.

The patch and remediation software market research report is one of a series of new reports that provides patch and remediation software market statistics, including the patch and remediation software industry global market size, regional shares, competitors with a patch and remediation software market share, detailed patch and remediation software market segments, market trends and opportunities, and any further data you may need to thrive in the patch and remediation software industry. This patch and remediation software market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Patch And Remediation Software Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on patch and remediation software market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for patch and remediation software? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The patch and remediation software market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Types: Security Updates; Windows Updates; Service Packs2) By Component: Solution; Services

3) By Deployment: On-Premise; Cloud-Based

4) By Organization Size: Small And Medium Enterprises (SMEs); Large Enterprises

5) By Industry Vertical: Banking Financial Services And Insurance (BFSI); Healthcare And Life Sciences; Information Technology (IT) And Telecommunications (Telecom); Energy And Utilities; Manufacturing; Transportation; Retail; Other Industry Verticals

Subsegments:

1) By Security Updates: Vulnerability Patches; Antivirus Or Anti-malware Updates; Firewall Patches2) By Windows Updates: Security Patches; Driver Updates; Service Packs

3) By Service Packs: Major Service Packs; Minor Service Packs

Key Companies Mentioned: Microsoft Corporation; Verizon Communications Inc.; International Business Machines Corporation; Broadcom Inc.; Red Hat Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Patch and Remediation Software market report include:- Microsoft Corporation

- Verizon Communications Inc.

- International Business Machines Corporation

- Broadcom Inc.

- Red Hat Inc.

- Micro Focus International plc

- BMC Software Inc.

- GoTo Group

- Avast Software

- Zoho Corporation Pvt. Ltd.

- SolarWinds Worldwide LLC

- Ivanti

- Qualys Inc.

- Flexera Software LLC

- Kaseya Limited

- Chef Software Inc.

- Puppet

- Comodo Group Inc.

- SysAid Technologies

- NetSPI LLC

- Verve Industrial Protection

- Patchworx

- JetPatch

- SmiKar Software

- Lumension Security Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.02 Billion |

| Forecasted Market Value ( USD | $ 4.11 Billion |

| Compound Annual Growth Rate | 19.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |