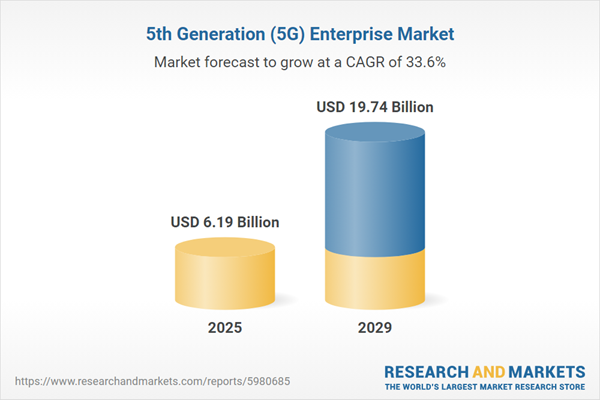

The 5th generation (5G) enterprise market size has grown exponentially in recent years. It will grow from $4.62 billion in 2024 to $6.19 billion in 2025 at a compound annual growth rate (CAGR) of 34%. The growth in the historic period can be attributed to the growing IoT adoption, demand for enhanced connectivity, industry-specific use cases, regulatory support and standards development, technological advancements.

The 5th generation (5G) enterprise market size is expected to see exponential growth in the next few years. It will grow to $19.74 billion in 2029 at a compound annual growth rate (CAGR) of 33.6%. The growth in the forecast period can be attributed to expansion of industry 4 initiatives, rise of edge computing, increased focus on cybersecurity, emergence of industry-specific solutions, economic recovery and digital transformation. Major trends in the forecast period include rapid adoption of private 5G networks, integration of AI and IoT with 5G, emergence of network slicing services, focus on green and sustainable 5G, expansion of cross-industry collaboration.

The increasing adoption of IoT devices is set to drive the growth of the 5G enterprise market in the foreseeable future. IoT devices, which are physical objects embedded with sensors, software, and connectivity capabilities, enable data collection, exchange, and automated actions without human intervention. The rise in demand for IoT devices is attributed to factors like automation, efficiency, improved connectivity, and consumer demand. 5G technology offers ultra-fast speeds and low latency, facilitating seamless connectivity for IoT devices and supporting real-time data transmission across diverse applications such as industrial automation and smart cities. For example, according to a report from Ericsson in September 2023, global IoT connections reached 15.7 billion connections in 2023 and are projected to increase by 16% to 38.9 billion connections by 2029. Hence, the growing adoption of IoT devices is a driving force behind the expansion of the 5G enterprise market.

Major players in the 5G enterprise market are focusing on deploying private networks, including 5G wireless networks, to meet specific communication needs. 5G wireless networks, the fifth generation of cellular network technology, offer significantly faster data speeds, lower latency, increased network capacity, and improved reliability compared to previous generations. For instance, in February 2024, Wipro Ltd. and Nokia Corporation launched a joint private 5G wireless solution for enterprises, aiming to accelerate digital transformation and innovation. This partnership empowers businesses with enhanced connectivity and AI-driven capabilities, enabling them to scale their digital initiatives, enhance security, and optimize operations efficiently.

In June 2023, Hewlett-Packard Enterprise (HPE) acquired Athonet to expand its portfolio of edge-to-cloud solutions, particularly in the realm of 5G technology. This strategic acquisition strengthens HPE's position as a leader in delivering next-generation infrastructure and services to enterprises leveraging edge computing and 5G technologies. Athonet, an Italy-based telecommunications company, specializes in providing private 5G technology for enterprises, further enhancing HPE's capabilities in offering transformative solutions to businesses.

Major companies operating in the 5th generation (5G) enterprise market report are Samsung Electronics Co. Ltd.; Microsoft Corporation; Verizon Communications Inc.; AT&T Inc.; Huawei Technologies Co. Ltd.; Intel Corporation; Vodafone Group Plc; Cisco Systems Inc.; Qualcomm Incorporated; Oracle Corporation; NTT Docomo Inc.; Hewlett Packard Enterprise Company; Telefonaktiebolaget LM Ericsson; Nokia Corporation; NEC Corporation; ZTE Corporation; Telstra Corporation Limited; SK Telecom Co. Ltd.; CommScope Holding Company Inc.; Juniper Networks Inc.; Ciena Corporation; Fujitsu Limited; Mavenir plc.

North America was the largest region in the 5th generation (5G) enterprise market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the 5th generation (5G) enterprise market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the 5th generation (5G) enterprise market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The 5th generation (5G) enterprise market consist of revenues earned by entities by providing services such as network infrastructure services and IoT connectivity services. The market value includes the value of related goods sold by the service provider or included within the service offering. The 5th generation (5G) enterprise market also includes sales of base stations, smartphones and tablets, antennas, and test and measurement equipment. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The concept of 5th generation (5G) enterprise entails leveraging 5G technology primarily for business and industrial purposes, aiming to enhance operational efficiency and unlock opportunities for new ventures across various industries. 5G networks offer notably faster data speeds and reduced latency compared to previous generations, facilitating swift and efficient data access and transfer for businesses.

Key network types within the realm of 5th generation (5G) enterprises include hybrid networks, private networks, enterprise networks, and communication service provider (CSP) networks. Hybrid networks involve the integration of different networking technologies, such as wired, wireless, and satellite, to create adaptable infrastructures tailored to diverse connectivity requirements. These networks incorporate frequency bands like Sub-6GHz and mmWave, encompassing various infrastructure components such as access equipment, small cells, E-RAN equipment (service node), core networks, software-defined networking (SDN), and network function virtualization (NFV). They cater to a spectrum of applications including mobile robots (AGV), video analytics, drones, augmented reality (AR), virtual reality (VR), and communication across verticals such as banking, financial services, and insurance (BFSI), manufacturing, energy and utilities, retail, healthcare, government and public safety, transportation and logistics, aerospace and defense, media and entertainment, and office buildings.

The 5th generation (5G) enterprise market research report is one of a series of new reports that provides 5th generation (5G) enterprise market statistics, including 5th generation (5G) enterprise industry global market size, regional shares, competitors with a 5th generation (5G) enterprise market share, detailed 5th generation (5G) enterprise market segments, market trends and opportunities, and any further data you may need to thrive in the 5th generation (5G) enterprise industry. This 5th generation (5G) enterprise market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

5th Generation (5G) Enterprise Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on 5th generation (5g) enterprise market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for 5th generation (5g) enterprise? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The 5th generation (5g) enterprise market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Network Type: Hybrid Networks; Private Networks; Enterprise Network; Communication Service Provider (CSP) Network2) By Frequency Band: Sub-6GHz; mmWave

3) By Infrastructure: Access Equipment; Small Cells; E-RAN Equipment (Service Node); Core Network; Software-Defined Networking (SDN); Network Function Virtualization (NFV)

4) By Application: Mobile Robots (AGV); Video Analytics; Drones; Augmented Reality (AR) Or Virtual Reality (VR); Communication; Other Applications

5) By Vertical: Banking, Financial Services, And Insurance (BFSI); Manufacturing; Energy And Utilities; Retail; Healthcare; Government And Public Safety; Transportation And Logistics; Aerospace And Defense; Media And Entertainment; Office Buildings

Subsegments:

1) By Hybrid Networks: Combination Of Private And Public Networks; Integration With Cloud Networks2) By Private Networks: On-premises Private 5G Networks; Remote or Distributed Private 5G Networks

3) By Enterprise Network: Large Enterprise Networks; Small And Medium Enterprise Networks

4) By Communication Service Provider (CSP) Network: CSP-owned 5G Networks; CSP-managed Private 5G Networks

Key Companies Mentioned: Samsung Electronics Co. Ltd.; Microsoft Corporation; Verizon Communications Inc.; AT&T Inc.; Huawei Technologies Co. Ltd.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this 5th Generation (5G) Enterprise market report include:- Samsung Electronics Co. Ltd.

- Microsoft Corporation

- Verizon Communications Inc.

- AT&T Inc.

- Huawei Technologies Co. Ltd.

- Intel Corporation

- Vodafone Group Plc

- Cisco Systems Inc.

- Qualcomm Incorporated

- Oracle Corporation

- NTT Docomo Inc.

- Hewlett Packard Enterprise Company

- Telefonaktiebolaget LM Ericsson

- Nokia Corporation

- NEC Corporation

- ZTE Corporation

- Telstra Corporation Limited

- SK Telecom Co. Ltd.

- CommScope Holding Company Inc.

- Juniper Networks Inc.

- Ciena Corporation

- Fujitsu Limited

- Mavenir plc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 6.19 Billion |

| Forecasted Market Value ( USD | $ 19.74 Billion |

| Compound Annual Growth Rate | 33.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |