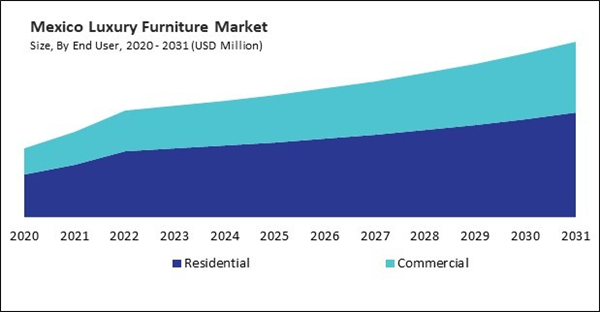

The US market dominated the North America Luxury Furniture Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of$8.75 billion by 2031. The Canada market is experiencing a CAGR of 6.8% during (2024 - 2031). Additionally, The Mexico market would exhibit a CAGR of 6.1% during (2024 - 2031).

Luxury furniture is most commonly used in residential settings where homeowners aim to create personalized living spaces. Luxury beds, dressers, wardrobes, and nightstands enhance the comfort and aesthetic of personal sanctuaries. High-end mattresses and bedding further augment the luxury experience, prioritizing rest. Also, dining tables, chairs, and buffets crafted from fine woods and metals, often with custom details, create a setting for intimate family dinners and lavish entertainment.

In addition, living rooms are often considered the centerpiece of a home. They are a prime location for this furniture. Sofas, armchairs, coffee tables, and entertainment units made from top-tier materials serve functional purposes and act as focal points of personal style and comfort. Furthermore, luxury outdoor furniture is designed to withstand the elements while maintaining style and comfort. This includes elegant lounge chairs, outdoor sofas, and dining sets that transform gardens and patios into sophisticated, relaxing areas.

E-commerce platforms are expanding the reach of the furniture brands across Mexico, particularly to regions where physical stores may be limited. According to the International Trade Administration (ITA), the domestic e-commerce industry was valued at USD 26.2 billion in 2022, representing a 23 percent increase over 2021. Mexico is positioned among the top five countries in the world in terms of e-commerce retail growth rate. Mexico’s e-commerce sector value will reach USD 70.4 billion by 2027. Furthermore, as construction activities in Canada, particularly in residential and commercial sectors, increase, there is a corresponding rise in demand for this furniture. As per the data from Statistics Canada, investment in building construction rose 1.7% to $19.8 billion in November 2023. The residential sector grew 2.2% to $13.7 billion, while non-residential sector investment increased 0.4% to $6.0 billion. Thus, rising e-commerce sector and construction sector investments in North America will increase the demand for this furniture in the region.

Based on Distribution Channel, the market is segmented into Offline, and Online. Based on Materials, the market is segmented into Wood, Metal, Leathers, Glass, Plastic, and Others. Based on End User, the market is segmented into Residential (Living & Bedroom, Kitchen, Outdoor, Lighting, and Bathroom), and Commercial (Hospitality, Office, and Others). Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- Ashley Furniture Industries, LLC

- Lee Industries, Inc. (American Leather Holdings LLC)

- Maiden Home, Inc.

- Williams-Sonoma, Inc.

- Kimball International, Inc.

- Century Furniture LLC (RHF Investments, Inc.)

- Duresta Upholstery Limited

- Giovanni Visentin S.r.l.

- Scavolini S.p.A.

- Muebles Pico S.A.

Market Report Segmentation

By Distribution Channel- Offline

- Online

- Wood

- Metal

- Leathers

- Glass

- Plastic

- Others

- Residential

- Living & Bedroom

- Kitchen

- Outdoor

- Lighting

- Bathroom

- Commercial

- Hospitality

- Office

- Others

- US

- Canada

- Mexico

- Rest of North America

Table of Contents

Companies Mentioned

- Ashley Furniture Industries, LLC

- Lee Industries, Inc. (American Leather Holdings LLC)

- Maiden Home, Inc.

- Williams-Sonoma, Inc.

- Kimball International, Inc.

- Century Furniture LLC (RHF Investments, Inc.)

- Duresta Upholstery Limited

- Giovanni Visentin S.r.l.

- Scavolini S.p.A.

- Muebles Pico S.A.