Europe's strong focus on sustainability initiatives and the circular economy has driven the adoption of advanced waste management technologies. Consequently, the Europe region would acquire nearly 33% of the total market share by 2031. Integrating IoT sensors, automated sorting machines, and data analytics platforms has enhanced operational efficiency and environmental impact.

As more people migrate to urban areas, the volume of waste generated increases exponentially. The United Nations predicts that by 2050, 68% of the global population will reside in urban areas, a significant increase from the 55% who did so in 2018. Moreover, the economic implications of urban waste management are profound. The World Bank reports that the cost of managing solid waste is projected to rise from $205 billion per year in 2010 to about $375 billion by 2025, with the most significant cost increases occurring in low- and middle-income countries. Hence, these factors will aid in the expansion of the market.

Additionally, it is becoming increasingly common for governments all over the world to establish rigorous rules in order to mitigate the negative impact that pollution has on both human health and the environment. Moreover, policies like the Extended Producer Responsibility (EPR) are gaining traction globally. EPR policies hold manufacturers accountable for the end-of-life management of their products, incentivizing them to design more sustainable products and invest in recycling infrastructure. Thus, implementing stricter environmental regulations and policies is critical for adopting these waste management technologies.

However, Adopting waste management systems requires significant capital investment in sophisticated equipment and infrastructure. Furthermore, the costs of integrating new systems with existing infrastructure can be prohibitive, limiting the adoption of waste management solutions. Hence, this financial barrier slows the overall market growth.

Driving and Restraining Factors

Drivers- Rapid urbanization and increasing population densities

- Stricter environmental regulations and policies

- Offerings of substantial cost-saving opportunities

- High initial costs of smart waste management

- Substantial data privacy and security concerns

- Increasing number of government initiatives and funding

- Innovations in IoT, AI, and data analytics

- Infrastructure limitations particularly in developing regions

- Resistance to change among end users

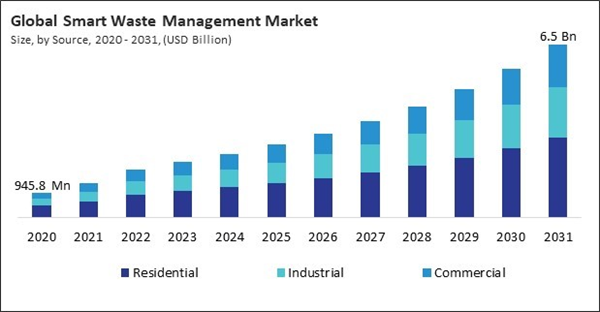

Source Outlook

By source, the market is divided into residential, commercial, and industrial. The industrial segment garnered 28.1% revenue share in the market in 2023. Adopting advanced waste processing technologies, such as automated sorting systems and waste-to-energy solutions, has enhanced the efficiency and effectiveness of industrial waste management.Method Outlook

On the basis of the method, the market is classified into smart collection, smart processing, and smart disposal. The smart disposal segment recorded 19.4% revenue share in the market in 2023. IoT sensors and data analytics have enabled real-time monitoring of landfill conditions, ensuring compliance with environmental regulations and minimizing environmental impact.Waste Type Outlook

Based on waste type, the market is characterized into solid waste, special waste, and e-waste. The e-waste segment procured a 30.4% revenue share in the market in 2023. E-waste generation has experienced a substantial increase as a result of the continued consumption of electronic devices and the rapid tempo of technological advancement. High-quality plastics, rare earth elements, and precious metals are among the valuable materials found in e-waste.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment procured 36% revenue share in the market in 2023. This growth is driven by the region's technological advancements, with widespread adoption of IoT, AI, and data analytics to optimize waste collection, processing, and disposal.List of Key Companies Profiled

- Sensoneo j.s.a.

- Reworld Waste, LLC

- Redwave (BT-Wolfgang Binder GmbH)

- Suez S.A.

- Ecube Labs

- Big Belly Solar, Inc.

- Waste Management, Inc.

- Republic Services, Inc. (Cascade Investment Group, Inc.)

- Veolia Environnement S.A.

Market Report Segmentation

By Source- Residential

- Industrial

- Commercial

- Smart Collection

- Smart Processing

- Smart Disposal

- Solid Waste

- E-Waste

- Special Waste

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Sensoneo j.s.a.

- Reworld Waste, LLC

- Redwave (BT-Wolfgang Binder GmbH)

- Suez S.A.

- Ecube Labs

- Big Belly Solar, Inc.

- Waste Management, Inc.

- Republic Services, Inc. (Cascade Investment Group, Inc.)

- Veolia Environnement S.A.