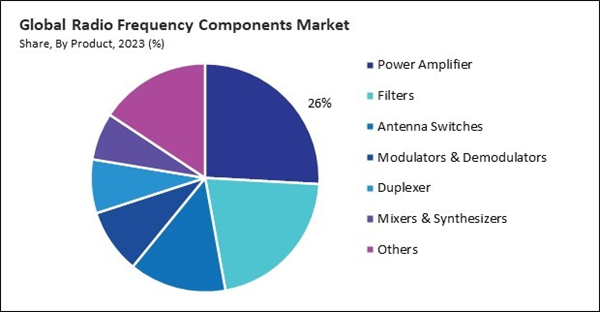

Ongoing advancements in semiconductor technology are leading to developing more sophisticated and power-efficient antenna switch solutions. Thus, the antenna switches segment acquired 13.8% revenue share in the market 2023. Manufacturers are innovating to offer switches with lower insertion loss, higher isolation, and better linearity, meeting the requirements of next-generation wireless systems. Thus, the segment will expand rapidly in the coming years.

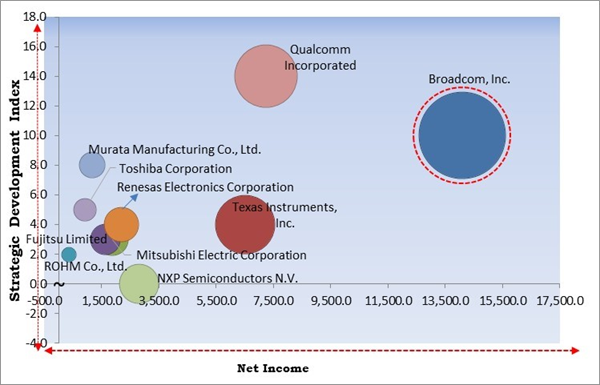

The major strategies followed by the market participants are partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In 2023, December, ROHM Co., Ltd. joined hands with Toshiba Electronic Devices & Storage Corporation, supplies a broad range of market-leading product lines, manufacture and increased volume production of power devices, a partnership recognized and supported by the Ministry of Economy, Trade and Industry as a measure supporting the Japanese Government’s target of secure and stable semiconductor supply. The collaboration is aimed to enhance both companies’ international competitiveness. Additionally, the companies will seek to contribute to strengthening the resilience of semiconductor supply chains in Japan. Additionally, In May, 2023, Broadcom, Inc. teamed up with Apple, an American multinational corporation and technology company. With this collaboration, the company aimed to develop 5G radio frequency components - including FBAR filters - and cutting-edge wireless connectivity components. The FBAR filters will be designed and built in several key American manufacturing and technology hubs, including Fort Collins, Colorado, where Broadcom has a major facility.

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal Matrix; Broadcom, Inc. is the forerunner in the Radio Frequency Components Market. Companies such as Qualcomm Incorporated, Texas Instruments, Inc., Renesas Electronics Corporation are some of the key innovators in Radio Frequency Components Market. In October, 2023, Texas Instruments, Inc. came into partnership with Picocom, the 5G Open RAN baseband semiconductor and software specialist. on a complete 5G Open RAN small cell radio unit reference design to help accelerate customers’ time-to-market. The 5G small cell radio unit will meet the O-RAN Alliance specification for a 5W 4T4R 200MHz 5G outdoor radio unit (O-RU). It will feature TI’s AFE7769D quad-channel RF transceiver integrating DPD/CFR with Picocom’s PC802 5GNR/LTE PHY System-on-Chip (SoC). The reference design hardware will also be LTE compatible.Market Growth Factors

The deployment of 5G networks is one of the most prominent drivers of RF component demand. 5G technology operates on higher frequencies and requires advanced RF components such as antennas, amplifiers, filters, and transceivers to support faster data rates, lower latency, and increased network capacity.Additionally, RF components are essential for communication systems used in defense and aerospace platforms, including military aircraft, ships, ground vehicles, and satellites. RF transceivers, antennas, amplifiers, and filters enable secure and reliable wireless communication between military units, command centers, and deployed forces in various operational environments. Therefore, these aspects will assist in the expansion of the market.

Market Restraining Factors

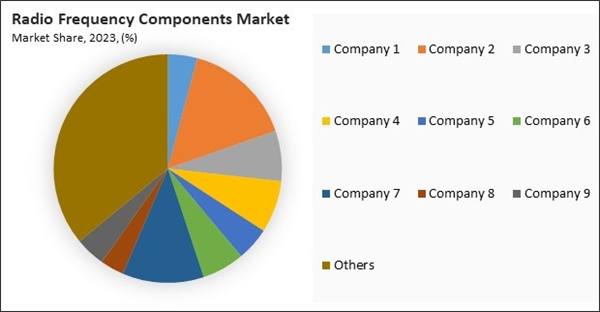

Meeting regulatory standards often requires significant research, development, and testing investment to ensure that RF components adhere to prescribed parameters. This can substantially increase the cost of bringing products to market, particularly for smaller manufacturers or startups with limited resources. Therefore, these factors can lead to reduced demand for radio frequency components.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships, Collaborations and Agreements.

Driving and Restraining Factors

Drivers- Expanding wireless communication networks

- Advancements in automotive electronics

- Growing demand in defense and aerospace

- Regulatory constraints and standards compliance

- Spectrum scarcity and allocation

- Integration of RF in consumer electronics

- Rapid development of IoT

- Interference and signal degradation

- Cost and complexity of integration

Product Outlook

Based on product, the market is segmented into power amplifier, filters, antenna switches, modulators & demodulators, duplexer, mixers & synthesizers, and others. The power amplifier segment held 25.8% revenue share in the market in 2023. Advances in semiconductor materials, device architectures, and manufacturing processes have developed more efficient and high-performance power amplifiers.Application Outlook

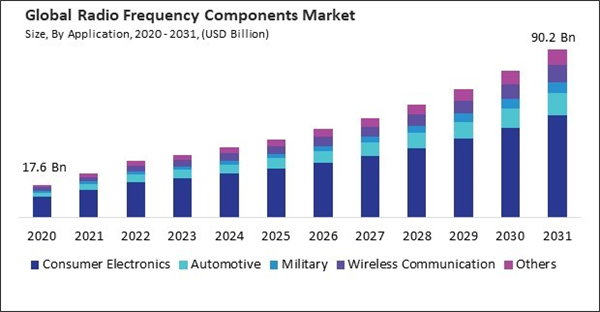

On the basis of application, the market is divided into consumer electronics, automotive, military, wireless communication, and others. In 2023, the automotive segment witnessed 13.3% revenue share in the market. The increasing demand for connected cars and in-vehicle connectivity features has driven the adoption of RF components such as RF amplifiers, filters, and antennas.By Regional Analysis

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. In 2023, the Europe segment acquired 26% revenue share in the market. Europe has been at the forefront of technological innovations, particularly in the areas of telecommunications and consumer electronics.Recent Strategies Deployed in the Market

- Dec-2023: ROHM Co., Ltd. joined hands with Toshiba Electronic Devices & Storage Corporation, supplies a broad range of market-leading product lines, manufacture and increased volume production of power devices, a partnership recognized and supported by the Ministry of Economy, Trade and Industry as a measure supporting the Japanese Government’s target of secure and stable semiconductor supply. The collaboration is aimed to enhance both companies’ international competitiveness. Additionally, the companies will seek to contribute to strengthening the resilience of semiconductor supply chains in Japan.

- Dec-2023: Toshiba Corporation signed a technology licensing agreement with FDK CORPORATION, a Japan-based company mainly engaged in the manufacture and sale of batteries and other electronic-related materials and components, to promote global sales and marketing of the world’s smallest Bluetooth® Low Energy module.Built around Toshiba’s proprietary technology, the ultra-compact module will bring new capabilities to diverse applications, including wearable tech, and support for sensors and the IoT. It will utilize its global sales organization to ensure full customer support from product development and manufacture to supply, order fulfillment, and quality assurance.

- Oct-2023: Texas Instruments, Inc. came into partnership with Picocom, the 5G Open RAN baseband semiconductor and software specialist. on a complete 5G Open RAN small cell radio unit reference design to help accelerate customers’ time-to-market. he 5G small cell radio unit will meet the O-RAN Alliance specification for a 5W 4T4R 200MHz 5G outdoor radio unit (O-RU). It will feature TI’s AFE7769D quad-channel RF transceiver integrating DPD/CFR with Picocom’s PC802 5GNR/LTE PHY System-on-Chip (SoC). The reference design hardware will also be LTE compatible.

- Jun-2023: Broadcom Inc. unveiled its FBAR integrated front end module (FiFEM™) devices for Wi-Fi access point (AP) applications, spanning Wi-Fi routers, residential gateways, and enterprise APs. The FiFEM devices incorporate best-in-class FBAR filter technology to provide superior 5 GHz and 6 GHz band coexistence and low in-band insertion loss while significantly reducing the bill of materials (BOM) at the RF front end. Additionally, the devices feature state-of-the-art non-linear power amplifier (PA) design optimized for Broadcom’s Wi-Fi SoC Digital Predistortion (DPD) operation, enabling up to 40% reduction in RF front-end power.

- May-2023: Qualcomm Technologies, Inc. announced the acquisition of Autotalks, a vehicle communication solutions provider based in Israel. The acquisition adds Autotalk's V2X portfolio to Qualcomm's Snapdragon Digital Chassis portfolio.

List of Key Companies Profiled

- Fujitsu Limited

- ROHM Co., Ltd.

- Broadcom, Inc.

- Texas Instruments, Inc.

- Murata Manufacturing Co., Ltd.

- Renesas Electronics Corporation

- Toshiba Corporation

- Qualcomm Incorporated

- Mitsubishi Electric Corporation

- NXP Semiconductors N.V.

Market Report Segmentation

By Application- Consumer Electronics

- Automotive

- Military

- Wireless Communication

- Others

- Power Amplifier

- Filters

- Antenna Switches

- Modulators & Demodulators

- Duplexer

- Mixers & Synthesizers

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Fujitsu Limited

- ROHM Co., Ltd.

- Broadcom, Inc.

- Texas Instruments, Inc.

- Murata Manufacturing Co., Ltd.

- Renesas Electronics Corporation

- Toshiba Corporation

- Qualcomm Incorporated

- Mitsubishi Electric Corporation

- NXP Semiconductors N.V.