LDTs encompass a wide range of genetic tests designed to diagnose various types of inherited diseases, including single-gene disorders, chromosomal abnormalities, mitochondrial disorders, and complex genetic conditions. Consequently, the genetic disorders/ inherited disease segment would acquire nearly 10% of the total market share by 2031. These tests can identify disease-causing mutations in genes associated with conditions such as cystic fibrosis, muscular dystrophy, inherited cancers, and rare genetic syndromes.

As healthcare expenditure rises, there is often a corresponding increase in demand for advanced diagnostic tests. In addition, with greater investment in healthcare, there’s usually more funding available for research and development of new diagnostic technologies. Hence, increasing healthcare expenditure is driving the growth of the market. Additionally, POCT enables rapid testing and decision-making at or near the point of patient care, leading to quicker diagnosis and treatment initiation. Moreover, POCT facilitates rapid and on-demand testing, which aligns with personalized medicine principles. Hence, the expansion of point-of-care testing drives the market’s growth.

The pandemic disrupted global supply chains, affecting the availability of reagents, consumables, and equipment necessary for LDT development and testing. Laboratories faced challenges in sourcing essential materials, leading to test development and implementation delays. However, the pandemic accelerated the development and deployment of COVID-19 tests, including LDTs, to meet the urgent need for diagnostic testing. Thus, the COVID-19 pandemic had a moderate impact on the market.

However, Multimodal testing often involves integrating multiple testing modalities, such as genomics, proteomics, metabolomics, and imaging, to provide comprehensive diagnostic information. Furthermore, multimodal testing generates large volumes of heterogeneous data from multiple sources, including genomic sequences, protein expression profiles, metabolic pathways, and imaging scans. Therefore, the complexity of multimodal testing is hampering the market’s growth.

Driving and Restraining Factors

Drivers- Increasing healthcare expenditure

- Expansion of point-of-care testing (POCT)

- Growing prevalence of chronic diseases worldwide

- Complexity of multimodal testing

- Fluctuating and intricate regulatory environment

- Integration with digital health platforms

- Expansion in veterinary diagnostics and animal health

- Rising data privacy concerns in genetic testing

- Increasing competition from commercial diagnostics

Technology Outlook

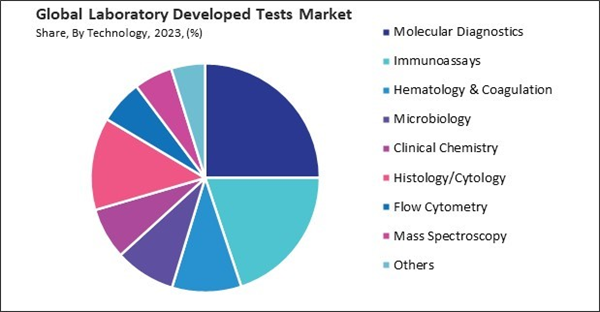

Based on technology, the market is divided into immunoassays, hematology & coagulation, molecular diagnostics, microbiology, clinical chemistry, histology/cytology, flow cytometry, mass spectroscopy, and others. The immunoassays segment attained 19.9% revenue share in the market in 2023. Immunoassays offer high sensitivity and specificity, allowing for accurate detection and quantification of biomarkers even at low concentrations. This capability is crucial for diagnosing conditions early, monitoring disease progression, evaluating treatment efficacy, and detecting relapse or recurrence.Application Outlook

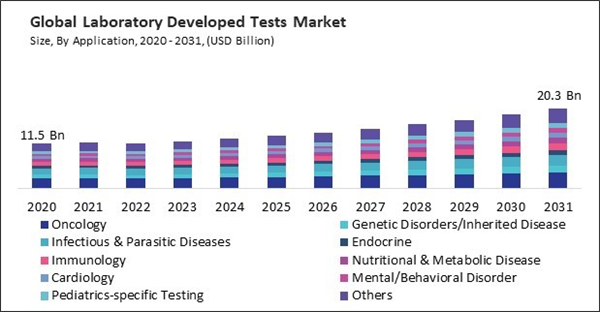

On the basis of application, the market is segmented into oncology, genetic disorders/inherited disease, infectious & parasitic diseases, immunology, endocrine, nutritional & metabolic disease, cardiology, mental/behavioral disorder, pediatrics-specific testing, and others. The infectious & parasitic diseases segment attained a 14% revenue share in the market in 2023. LDTs for infectious and parasitic diseases encompass a wide range of tests designed to detect and identify various pathogens, including bacteria, viruses, fungi, and parasites.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2023, the North America region witnessed 38% revenue share in the market. The region is a global leader in technological innovation, particularly in the fields of molecular diagnostics, genomics, and personalized medicine. Technological advancements enable the development of sophisticated LDTs that utilize next-generation sequencing, PCR-based assays, microarray technologies, and digital pathology systems.Recent Strategies Deployed in the Market

- May-2024: Quest Diagnostics Incorporated took over PathAI Diagnostics, a leading laboratory services company based in Memphis, TN. Through this acquisition, Quest Diagnostics would expedite the uptake of digital and AI pathology advancements for enhancing the quality, speed, and efficiency of diagnosing cancer and other illnesses.

- Feb-2024: Abbott Laboratories came into partnership with Fujirebio, a Japanese multinational biotechnology company. Through this partnership, Abbott Laboratories would create a research-only neurofilament-light chain (Nf-L) neurology biomarker assay for use with Abbott’s Alinity® i.

- Jan-2024: Neogenomics, Inc. came into partnership with ConcertAI LLC, a biotechnology research company. Through this partnership, Neogenomics, Inc. would advance broad-scale hematological research solutions for exploring real-world clinical practices and outcomes in hematological malignancies.

- Jan-2023: Qiagen N.V introduced "EZ2 Connect MDx" for use in diagnostic laboratories. EZ2 Connect MDx brings standardized and efficient nucleic acid purification within reach of any clinical laboratory, paired with the QIAsphere digital system enabling remote instrument management.

- Jul-2022: Guardant Health, Inc. came into partnership with Adicon Holdings Limited, a leading independent clinical laboratory company based in China. Through this partnership, Guardant Health, Inc. would provide biopharmaceutical companies conducting clinical trials in China with Guardant Health's comprehensive genomic profiling (CGP) tests.

List of Key Companies Profiled

- Neogenomics, Inc.

- Guardant Health, Inc.

- Qiagen N.V

- Quest Diagnostics Incorporated

- Abbott Laboratories

- Siemens Healthineers AG (Siemens AG)

- Illumina, Inc.

- Bio-Rad Laboratories, Inc.

- F.Hoffmann-La Roche Ltd.

- Eurofins Scientific SE

Market Report Segmentation

By Application- Oncology

- Genetic Disorders/Inherited Disease

- Infectious & Parasitic Diseases

- Endocrine

- Immunology

- Nutritional & Metabolic Disease

- Cardiology

- Mental/Behavioral Disorder

- Pediatrics-specific Testing

- Others

- Molecular Diagnostics

- Immunoassays

- Hematology & Coagulation

- Microbiology

- Clinical Chemistry

- Histology/Cytology

- Flow Cytometry

- Mass Spectroscopy

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Neogenomics, Inc.

- Guardant Health, Inc.

- Qiagen N.V

- Quest Diagnostics Incorporated

- Abbott Laboratories

- Siemens Healthineers AG (Siemens AG)

- Illumina, Inc.

- Bio-Rad Laboratories, Inc.

- F. Hoffmann-La Roche Ltd.

- Eurofins Scientific SE