Lift trucks play a crucial role in optimizing material handling processes within logistics operations. Consequently, the logistics segment would acquire nearly 19.1% revenue share by 2031. Also, the logistics operations in Russia would consume 18.36 thousand units of lift trucks by 2031. They enable moving and storing palletized cargo within warehouses and distribution centers and efficiently loading and unloading goods from vehicles and containers. Lift trucks help streamline logistics operations, reduce manual labor, and improve material handling efficiency.

The growing demand for material handling equipment drives market growth. Manufacturers respond to the increased need for these trucks by ramping up production and expanding their product offerings. In addition, the buoyant market conditions prompt companies to invest in expanding their lift truck fleets to meet growing demand. Therefore, increasing demand for material handling equipment drives the market's growth. Additionally, Cold chain logistics involves storing, handling, and transporting temperature-sensitive goods, including perishable foods, pharmaceuticals, biologics, and chemicals, within controlled temperature environments. Lift trucks play a crucial role in these operations by facilitating the movement of goods within cold storage warehouses, refrigerated distribution centers, and temperature-controlled trucks. In conclusion, demand for cold chain logistics is driving the market's growth.

However, Lift trucks represent a substantial capital investment due to their relatively high purchase price compared to other equipment used in material handling. Furthermore, high initial investment in lift trucks may force businesses to prioritize other operational expenses over equipment purchases. Thus, high initial investment is hampering the growth of the market.

Driving and Restraining Factors

Drivers- Increasing demand for material handling equipment

- Demand for cold chain logistics

- Expansion of E-commerce and Warehousing

- High initial investment

- Complexity of integration with automation

- Focus on workplace safety and efficiency

- Rise of subscription-based models

- Shortage of skilled labor

- Increasing competition from alternative solutions

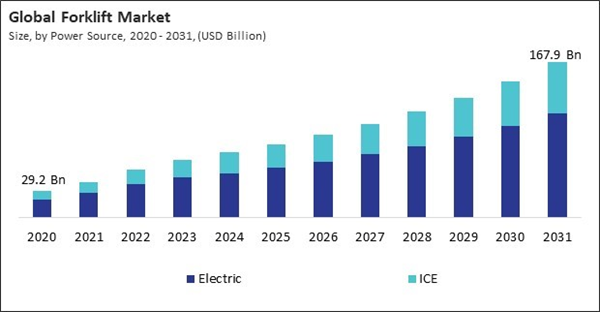

Power Source Outlook

On the basis of power source, the market is segmented into ICE and electric. In 2023, the ICE segment attained a 31.1% revenue share in the market. In terms of volume, the ICE segment recorded 353.8 thousand units in 2023. ICE forklifts typically offer higher power and performance than electric forklifts, particularly in lifting capacity, acceleration, and speed. They are well-suited for heavy-duty applications and demanding tasks. ICE forklifts provide greater flexibility and versatility regarding refueling options and operating hours.Load Capacity Outlook

Based on load capacity, the market is categorized into below 5 ton, 5-15 ton, and above 16 ton. The below 5 ton segment witnessed 32.8% revenue share in the market in 2023. Lift trucks in the below 5-ton segment are typically smaller and more compact, making them ideal for use in confined spaces such as narrow aisles, tight corners, and congested warehouses.Modality Outlook

By modality, the market is divided into li-ion and lead acid. The li-ion segment procured 37.2% revenue share in the market in 2023. In terms of Volume, the li-ion segment recorded 413.4 thousand units in 2023. Li-ion batteries offer longer operating hours compared to traditional lead-acid batteries. Lift trucks can run constantly with less recharging downtime due to faster charging speeds and higher energy density.End-use Outlook

Based on end use, the market is divided into industrial, logistics, chemical, food & beverage, retail & e-commerce, and others. In 2023, the retail and e-commerce segment procured 21.4% revenue share in the market. Due to the expansion of e-commerce, the need for warehouse space to hold and process orders has significantly increased. Retailers and e-commerce companies need efficient material handling equipment like lift trucks to manage their expanding warehouse operations, including loading and unloading goods, organizing inventory, and picking and packing orders for shipment.Class Outlook

Based on class, the market is divided into class 3, class 2, class 1, and class 4/5. The class 1 segment attained a 23% revenue share in the market in 2023. In terms of volume, the class 1 segment registered 247.3 thousand units in 2023. With growing concerns about environmental sustainability and carbon emissions, businesses are increasingly seeking electric-powered alternatives to traditional internal combustion engine (ICE) forklifts.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2023, the Asia Pacific region generated 45.3% revenue share in the market. The Asia Pacific region is home to some of the world's fastest-growing e-commerce and retail markets. E-commerce companies and retailers require extensive warehousing and logistics infrastructure to meet the growing demand for online shopping. Lift trucks play a crucial role in these operations, facilitating the movement of goods within warehouses and distribution centers, driving demand for lift trucks in the region.List of Key Companies Profiled

- Crown Equipment Corporation

- Doosan Corporation

- Balyo

- Hyster-Yale Materials Handling, Inc.

- Jungheinrich AG

- KION GROUP AG

- Komatsu Ltd.

- Cargotec Corporation

- Mitsubishi Logisnext Co., Ltd.

Market Report Segmentation

By Power Source (Volume, Thousand Units, USD Billion, 2020-2031)- Electric

- ICE

- 5-15 Ton

- Below 5 Ton

- Above 16 Ton

- Lead Acid

- Li-ion

- Industrial

- Retail & E-Commerce

- Logistics

- Food & Beverage

- Chemical

- Others

- Class 3

- Class 4/5

- Class 1

- Class 2

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Crown Equipment Corporation

- Doosan Corporation

- Balyo

- Hyster-Yale Materials Handling, Inc.

- Jungheinrich AG

- KION GROUP AG

- Komatsu Ltd.

- Cargotec Corporation

- Mitsubishi Logisnext Co., Ltd.