Canada invests in infrastructure development projects to improve transportation networks, upgrade public facilities, and address infrastructure deficiencies. According to Statistics Canada, building construction investments increased 1.7% to $19.8 billion in November 2023. Investment in the non-residential sector rose 0.4% to $6.0 billion, while the residential sector expanded 2.2% to $13.7 billion. Also, Canada is experiencing a boom in residential construction fueled by population growth, urbanization, and housing demand. Thus, North America region captured more than 1/4th share in the market in 2023. In terms of volume, the region is expected to utilize 166.35 thousand units of concrete saw by the year 2031.

Renting concrete saws instead of purchasing them outright can be more cost-effective for contractors and construction firms, especially for occasional or short-term projects. Rather than investing in expensive equipment that may not be used frequently, renting allows businesses to access the necessary tools at a fraction of the cost, conserving capital for other investments or operational expenses. Moreover, rental companies often invest in updating their equipment fleets with the latest technology and models. Thus, rising demand for rental services is driving the market’s growth.

Furthermore, Smart city initiatives often involve extensive infrastructure development projects to improve urban mobility, connectivity, and sustainability. These projects may include constructing or renovating roads, bridges, sidewalks, utility networks, and other public infrastructure. Concrete saws are essential for cutting and modifying concrete structures, pavements, and utility installations, making them integral to smart city infrastructure projects. As cities modernize their utility networks to support smart technologies and improve service delivery, the demand for concrete saws for utility construction and upgrades grows. Thus, the expansion of smart city initiatives is propelling the market’s growth.

However, operators and adjacent workers may have negative health and safety effects from extended exposure to excessive noise and vibration. Concrete saw operators risk developing hearing loss, musculoskeletal disorders, and hand-arm vibration syndrome (HAVS) due to the repetitive nature of their work and exposure to high noise and vibration levels. Community opposition to noisy and disruptive construction activities may lead to project delays, additional regulatory hurdles, and negative publicity for businesses involved in concrete cutting. In conclusion, noise and vibration concerns are hindering the market’s growth.

Driving and Restraining Factors

Drivers- Increasing Demand For High-Performance Cutting Solutions

- Rising Demand From The Demolition Sector

- Expansion In Construction Activities

- High Initial Investment Costs

- Noise And Vibration Concerns

- Rising Demand For Rental Services

- Expansion Of Smart Cities Initiatives

- Substitution By Alternative Materials And Technologies

- Limited Availability Of Skilled Labor

Type Outlook

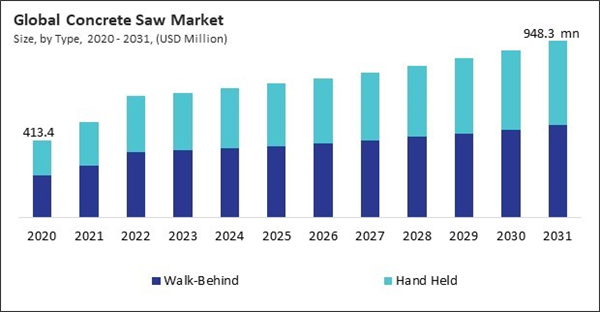

On the basis of type, the market is segmented into hand held and walk-behind. The walk-behind segment recorded 54% revenue share in the market in 2023. In terms of volume, 110.09 thousand units of Walk-behind concrete saws were utilized in 2023. Walk-behind concrete saws offer versatility and adaptability for various cutting applications. They are designed to handle various cutting tasks, including flat sawing, highway and road construction, joint widening, and trenching.Application Outlook

By application, the market is segmented into commercial, residential, and industrial. The residential segment procured 33% revenue share in the market in 2023. In terms of volume, 132.50 thousand units of Concrete saw were utilized in residential in the year 2023. The residential segment experiences significant demand for concrete saws due to increasing home renovation and remodeling projects. Homeowners often undertake renovation projects to upgrade their properties, enhance aesthetics, and increase resale value.Power Source Outlook

Based on power source, the market is divided into hydraulic-powered, electric powered, and gasoline-powered. The gasoline-powered segment garnered 39% revenue share in the market in 2023. In terms of volume, 143.06 thousand units of gasoline-powered concrete saw were used in the year 2023. Gasoline-powered concrete saws typically offer higher power output and cutting performance than electric-powered models. They can easily handle tougher materials, thicker concrete, and heavier duty cutting applications. Gasoline engines provide greater torque and horsepower, allowing operators to tackle challenging cutting tasks more efficiently and effectively.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region witnessed 38% revenue share in the market in 2023. In terms of volume, the Aisa Pacific region utilized 150.58 thousand units of concrete saw in 2023. Due to factors such as urban migration, economic growth, and population growth, the Asia-Pacific area is rapidly developing its infrastructure and urbanization. As cities expand and infrastructure projects multiply, there is a significant demand for concrete saws to support construction activities such as road building, bridge construction, high-rise building projects, and urban development initiatives.List of Key Companies Profiled

- Husqvarna Group

- Robert Bosch GmbH (Bosch Power Tool)

- Tyrolit Schleifmittelwerke Swarovski AG & Co KG

- Saint-Gobain Group (Norton)

- Hilti AG

- Wacker Neuson SE

- Makita Corporation

- Techtronic Industries Co., Ltd.

- Stanley Black and Decker, Inc.

- Andreas Stihl AG and Co KG

Market Report Segmentation

By Type (Volume, Thousand Units, USD Million, 2020-2031)- Walk-Behind

- Hand Held

- Commercial

- Residential

- Industrial

- Gasoline Powered

- Electric Powered

- Hydraulic Powered

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Husqvarna Group

- Robert Bosch GmbH (Bosch Power Tool)

- Tyrolit Schleifmittelwerke Swarovski AG & Co KG

- Saint-Gobain Group (Norton)

- Hilti AG

- Wacker Neuson SE

- Makita Corporation

- Techtronic Industries Co., Ltd.

- Stanley Black and Decker, Inc.

- Andreas Stihl AG and Co KG