Healthcare organizations experience varying demands for computing resources, storage capacity, and processing power based on factors such as patient volumes, clinical workflows, and research activities. Thus, the healthcare segment acquired 21.6% revenue share in the market 2023. Community clouds offer scalability and elasticity to accommodate these dynamic workloads, allowing healthcare providers to scale their infrastructure on-demand without overprovisioning or underutilization. Thus, they optimize operational efficiency, reduce IT costs, and enhance performance.

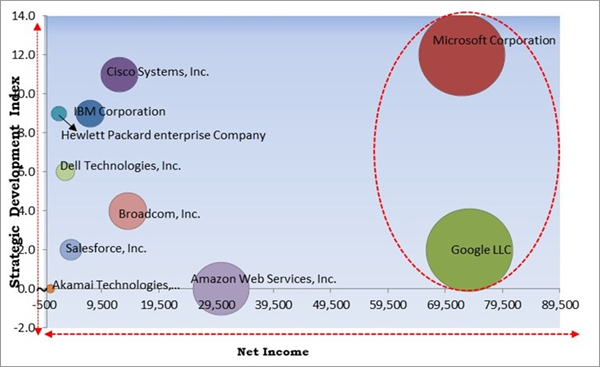

The major strategies followed by the market participants are Mergers & Acquisitions as the key developmental strategy to keep pace with the changing demands of end users. For instance, in 2024 April, Cisco Systems, Inc. acquired Isovalent GmbH, a provider of open-source cloud-native networking and security. Under this acquisition, Isovalent will be integrated into Cisco Security Cloud Vision, an AI-driven, cloud-delivered, integrated security platform. Additionally, the acquisition offers IT and platform engineering with robust networking capabilities and improved visibility into cloud-native interactions. Additionally, In January 2023, Microsoft Corporation took over Fungible Inc., a technology company based in California. Under this acquisition, the Fungible team will become a part of Microsoft's datacenter infrastructure engineering teams and will focus on providing multiple DPU solutions, network innovation, and hardware system advancements. Additionally, the acquisition further enhances a wide range of technologies and offerings, including offloading, improving latency, increasing datacenter server density, optimizing energy efficiency, and reducing costs.

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal Matrix; Microsoft Corporation and Google LLC are the forerunners in the Community Cloud Market. In April 2024, Cisco Systems, Inc. acquired Isovalent GmbH, a provider of open-source cloud-native networking and security. Under this acquisition, Isovalent will be integrated into Cisco Security Cloud Vision, an AI-driven, cloud-delivered, integrated security platform. Additionally, the acquisition offers IT and platform engineering with robust networking capabilities and improved visibility into cloud-native interactions. Companies such as Cisco Systems, Inc., Broadcom, Inc. and Amazon Web Services, Inc. are some of the key innovators in Community Cloud Market.Market Growth Factors

Community cloud providers implement security and privacy controls to safeguard private information and make sure that data protection laws, including GDPR, HIPAA, and PCI DSS. By offering features such as encryption, data masking, and anonymization, community cloud platforms enable organizations to safeguard their data privacy and confidentiality while sharing resources and collaborating with other community members.Additionally, Digital transformation initiatives vary across industries and sectors, each with unique requirements and regulatory considerations. Community clouds offer industry-specific cloud solutions tailored to the requirements of several vertical markets, including the medical field, finance, government, and education.

Market Restraining Factors

Some industries may exhibit a higher degree of risk aversion and cultural resistance to change, making them hesitant to adopt community cloud solutions. Traditional industries with conservative business practices, such as manufacturing and construction, may prioritize stability and reliability over innovation and agility, leading to slower adoption of cloud technologies. Hence, limited and slow adoption in certain industries can hinder the growth of the market.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Mergers & Acquisition.

Driving and Restraining Factors

Drivers- Rise in adherence to stringent compliances and security

- Increasing initiatives of digital transformation

- Growing adoption of information technology (IT) by businesses

- Limited and slow adoption in certain Industries

- Rising concerns regarding security and privacy

- Expansion of global reach of connectivity

- Growing small and medium-sized enterprise sector

- Considerations of cost and financial models

- Challenges of limited customization and flexibility

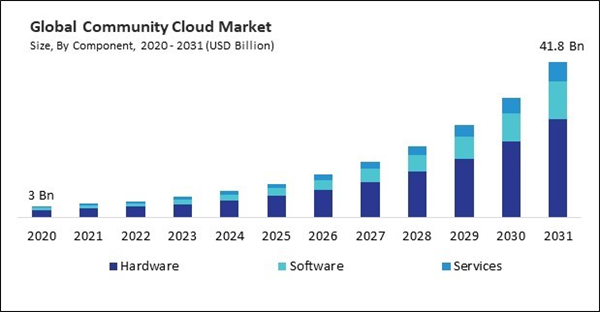

Hardware Outlook

The hardware segment is further divided into networking, storage, and server. The networking subsegment acquired 43% revenue share in the market in 2023. Hardware used in networks, including switches, routers, and access points, forms the backbone of cloud computing infrastructure.Software Outlook

The software segment is subdivided into enterprise applications software, business intelligence & dashboard, and collaboration tool software. In 2023, the business intelligence and dashboard subsegment procured 29.7% revenue share in the software segment. Community cloud-based business intelligence platforms serve as centralized data repositories, aggregating data from disparate sources across the organization.Application Outlook

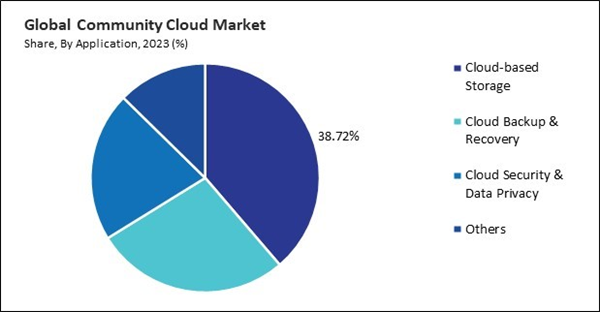

On the basis of application, the market is classified into cloud-based storage, cloud backup & recovery, cloud security & data privacy, and others. The cloud backup & recovery segment recorded 27.4% revenue share in the market in 2023. Industries such as healthcare, finance, and government often have stringent regulatory compliance requirements regarding data protection and retention.Component Outlook

Based on component, the market is characterized into hardware, software, and services. The hardware segment garnered 65.2% revenue share in the market in 2023. Hardware, such as networking hardware, servers, and storage devices, forms the backbone of community cloud environments.End-Use Outlook

By end-use, the market is fragmented into BFSI, healthcare, education, government, IT & telecommunication, and others. The BFSI segment procured 27.8% revenue share in the market in 2023. Community clouds serve as catalysts for innovation and digital transformation initiatives within the BFSI sector by providing a collaborative platform for ecosystem partners, fintech startups, and developers to co-create and deploy innovative financial products, services, and applications.By Regional Analysis

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment held 26.4% revenue share in the market in 2023. There are numerous prospects in the Asia-Pacific region for the market to expand and thrive, driven by rapid digital transformation, growing SME sector, government initiatives, industry-specific regulations, emerging markets, and strategic partnerships.Recent Strategies Deployed in the Market

- Apr-2024: IBM Corporation inked a definitive agreement to acquire HashiCorp, Inc., a multi-cloud infrastructure automation company. Through this acquisition, IBM will combine its range of offerings and knowledge with HashiCorp's capabilities and talent to develop a complete hybrid cloud platform designed for the AI era.

- January-2024: Hewlett-Packard Enterprise Company entered an agreement to acquire Juniper Networks, Inc., an AI Networking, Cloud, and Connected Security Solutions provider. Through this acquisition, HPE will double its networking business and broaden its suite with AI-native networking offerings from Juniper. Additionally, the expertise of Juniper in cloud-delivered networking solutions, software, and services complements HPE’s Aruba Networking and purposefully designed AI interconnect fabric.

- November-2023: Broadcom Inc. completed the acquisition of VMware, Inc., an American cloud computing and virtualization technology company. Through this acquisition, the Broadcom Software portfolio was combined with the VMware platform to provide critical infrastructure solutions to customers.

- January-2024: Microsoft Corporation took over Fungible Inc., a technology company based in California. Under this acquisition, the Fungible team will become a part of Microsoft's datacenter infrastructure engineering teams and will focus on providing multiple DPU solutions, network innovation, and hardware system advancements. Additionally, the acquisition further enhances a wide range of technologies and offerings, including offloading, improving latency, increasing datacenter server density, optimizing energy efficiency, and reducing costs.

- January-2023: Dell Technologies, Inc. completed the acquisition of Cloudify Ltd., an open-source cloud orchestration framework. Through this acquisition, Cloudify will further strengthen Dell's private and public cloud service businesses.

List of Key Companies Profiled

- Cisco Systems, Inc.

- Hewlett Packard enterprise Company

- IBM Corporation

- Microsoft Corporation

- Salesforce, Inc.

- Akamai Technologies, Inc.

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- Broadcom, Inc.

- Google LLC (Alphabet Inc.)

- Dell Technologies, Inc.

Market Report Segmentation

By Component- Hardware

- Networking

- Storage

- Server

- Software

- Enterprise Application Software

- Business Intelligence & Dashboard

- Collaboration Tool Software

- Services

- Cloud-based Storage

- Cloud Backup & Recovery

- Cloud Security & Data Privacy

- Others

- BFSI

- Government

- Healthcare

- IT & Telecommunication

- Education

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Cisco Systems, Inc.

- Hewlett Packard enterprise Company

- IBM Corporation

- Microsoft Corporation

- Salesforce, Inc.

- Akamai Technologies, Inc.

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- Broadcom, Inc.

- Google LLC (Alphabet Inc.)

- Dell Technologies, Inc.