North America has a growing environmental consciousness, with many parents seeking to reduce their carbon footprint. Cloth diapers are considered more sustainable than disposable diapers, which contribute significantly to landfill waste. Therefore, the North America region generated 26% revenue share in the market in 2023. In terms of volume, the region would utilize34.58 million units of cloth diaper by the year 2031. Cloth diapers, often made from natural fibers, are perceived as a healthier, gentler alternative to a baby’s skin.

Some governments offer subsidies or financial incentives to encourage using cloth diapers. These subsidies may come in direct payments, tax credits, or vouchers that offset the cost of purchasing cloth diapers. By reducing the financial barrier to entry, subsidies make cloth diapers more affordable for parents, thereby increasing their adoption rate. For example, the UK government encourages using cloth diapers through its Waste and Resources Action Programme (WRAP). WRAP provides information and resources to parents about the environmental benefits of cloth diapers In conclusion, government policies and incentives are propelling the market's growth.

Furthermore, disposable diapers contain plastic components, including polyethylene, polypropylene, and superabsorbent polymers, which contribute to plastic pollution in oceans and waterways. As people become more aware of the harm that single-use plastic pollution causes to the environment, they are looking for alternative plastics. Cloth diapers offer a plastic-free alternative, helping to mitigate the environmental impact of diapering. In conclusion, rising eco-consciousness is propelling the growth of the market.

However, the initial investment required for purchasing cloth diapers, including covers, inserts, and accessories, can be higher than disposable diapers. The higher initial cost of switching to cloth diapers may deter some parents from doing so, especially those who are struggling financially or have limited means. For many parents, the higher upfront cost of cloth diapers can present a financial barrier to adoption. Parents may perceive cloth diapers as a significant investment, especially when they compare the initial cost to the affordability of disposable diapers, typically purchased in smaller, more frequent quantities. Thus, higher upfront costs are hampering the growth of the market.

Driving and Restraining Factors

Drivers- Emerging Government Policies And Incentives

- Evolving Fashion And Customization Trends

- Increasing Environmental Consciousness

- Higher Upfront Cost

- Limited Availability Of Washing Facilities

- Rise Of Parenting Influencers

- Growing Online Communities And Support Networks

- Resistance From Caregivers Or Daycare Providers

- Concerns About Leaks Or Absorbency

Distribution Channel Outlook

By distribution channel, the market is bifurcated into online and offline. In 2023, the offline segment registered 64% revenue share in the market. In terms of volume,1.65 million units of cloth diaper were sold through offline distribution channel by the year 2031. Many parents prefer to physically examine cloth diapers before purchasing them. Feeling the fabric, checking the quality, and assessing the fit and design in person provide reassurance and confidence in their purchase decisions. Offline stores offer the advantage of immediate availability, allowing parents to purchase cloth diapers and other baby products without waiting for shipping.End-user Outlook

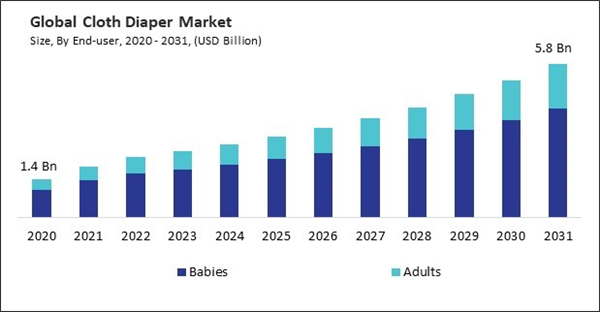

Based on end-user, the market is divided into babies and adults. The adult segment procured 28% revenue share in the market in 2023. In terms of volume,12.73 million units of adult cloth diapers is expected to be utilized by the year 2031. Adult cloth diapers empower individuals with incontinence to maintain their dignity and independence. By providing reliable and discreet protection, cloth diapers allow users to confidently engage in daily activities without fear of embarrassment or discomfort. Online communities, forums, and support groups are dedicated to adult cloth diaper users, providing valuable resources, advice, and peer support.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region witnessed 48% revenue share in the market in 2022. In terms of volume, The Asia Pacific region is expected to utilize79.02 million units of cloth diaper by the year 2031. The Asia Pacific region is home to some of the world’s most populous countries, including China and India. The number of babies born in these countries creates a substantial market for all baby products, including cloth diapers. Economic growth in many Asia Pacific countries has led to rising disposable incomes.List of Key Companies Profiled

- The Procter and Gamble Company

- Nicki’s Diapers, LLC

- Johnson & Johnson

- Bumpadum Manufacturing and Traders Private Limited

- bumGenius (Cotton Babies, Inc.)

- GroVia

- Kanga Care LLC

- Gerber Childrenswear LLC

- SuperBottoms (Navashya Consumer Products Pvt Ltd)

- Bumkins Finer Baby Products, Inc

Market Report Segmentation

By End-user (Volume, Thousand Units, USD Billion, 2020-2031)- Babies

- Adults

- Offline

- Online

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- The Procter and Gamble Company

- Nicki’s Diapers, LLC

- Johnson & Johnson

- Bumpadum Manufacturing and Traders Private Limited

- bumGenius (Cotton Babies, Inc.)

- GroVia

- Kanga Care LLC

- Gerber Childrenswear LLC

- SuperBottoms (Navashya Consumer Products Pvt Ltd)

- Bumkins Finer Baby Products, Inc