Retailers and e-commerce platforms leverage AI chipsets to provide personalized shopping experiences to customers. AI-driven recommendation engines analyze customer data, purchase history, and browsing behavior to offer tailored product recommendations, promotions, and offers. Consequently, the retail & e-commerce segment would acquire nearly 11% of the total market share by 2031. personalizing the shopping experience, retailers and e-commerce platforms can increase customer engagement, satisfaction, and conversion rates.

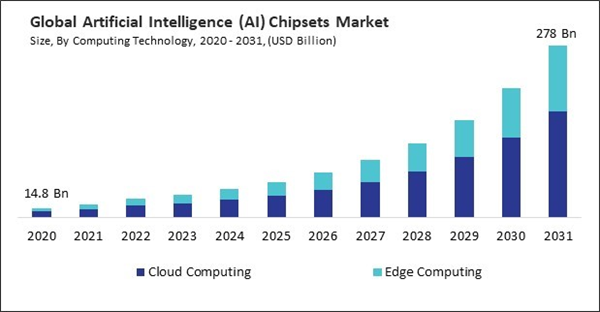

Cloud-based AI services, offered by major cloud service providers like Microsoft Azure, Amazon Web Services (AWS), and Google Cloud Platform, provide access to vast computational resources for training and deploying AI models. Cloud-based AI services support various AI workloads, including training, inference, natural language processing, computer vision, and speech recognition. Therefore, expansion of cloud-based AI services is driving the growth of the market. Additionally, Edge computing reduces latency and permits real-time decision-making by allowing data processing and analysis closer to the data source or endpoint device. Similarly, edge computing enables AI-driven applications to operate autonomously and independently of internet connectivity, ensuring continuity and resilience in offline or low-connectivity environments. Thus, the proliferation of edge computing is propelling the market's growth.

However, Developing AI chipsets requires substantial investment in research and development (R&D) activities. This includes designing and testing new chip architectures, algorithms, and hardware components tailored to AI workloads. Likewise, prototyping and testing AI chipsets involve multiple iterations of design refinement, simulation, and validation to ensure performance, reliability, and compatibility with AI algorithms and applications. Therefore, high development costs are hindering the growth of the market.

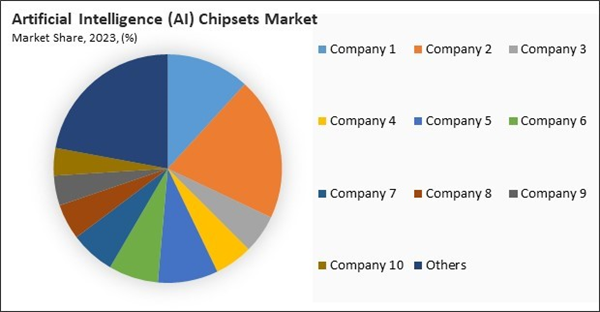

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Driving and Restraining Factors

Drivers- Expansion of cloud-based AI services

- Proliferation of edge computing

- Rapid adoption of AI technologies

- High development costs

- Complexity and integration challenges

- Government initiatives and funding

- Focus on energy efficiency and performance

- Data privacy and security concerns

- Limited availability of skilled talent

Computing Technology Outlook

By computing technology, the market is bifurcated into cloud computing and edge computing. The edge computing segment acquired 37.2% revenue share in the market in 2023. Edge computing brings computing resources closer to the location where data is generated (i.e., at the edge of the network), minimizing latency. This is critical for AI applications that require real-time or near-real-time processing, such as autonomous vehicles, industrial automation, and augmented reality/virtual reality (AR/VR) experiences.Function Outlook

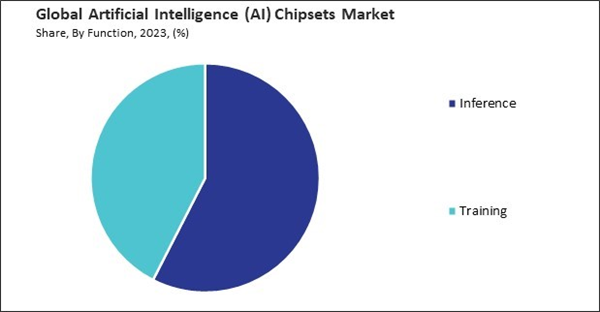

Based on function, the market is segmented into inference and training. In 2023, the training segment held 42.4% revenue share in the market. Deep learning algorithms, such as convolutional neural networks (CNNs) and recurrent neural networks (RNNs), are widely used in AI for tasks like image and speech recognition, natural language processing, and autonomous driving.Chipset Type Outlook

Based on chipset type, the market is divided into FPGA, ASIC, CPU, and GPU. The CPU segment attained 23.3% revenue share in the market in 2023. CPUs are widely used for general-purpose computing tasks in AI applications, including data preprocessing, feature extraction, and post-processing tasks. While specialized AI accelerators such as GPUs and TPUs excel in parallel processing and AI-specific workloads, CPUs offer versatility and compatibility with various software frameworks and programming languages, making them essential for running AI algorithms in diverse computing environments.Vertical Outlookk

On the basis of vertical, the market is segmented into consumer electronics, BFSI, manufacturing, government, retail & e-commerce, healthcare, automotive, marketing, and others. The automotive segment acquired 17.6% revenue share in the market in 2023. The development of autonomous vehicles relies heavily on AI technologies to perceive the environment, make real-time decisions, and navigate safely. AI chipsets power the perception systems, sensor fusion algorithms, and decision-making modules in autonomous vehicles.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region witnessed 39.2% revenue share in the market in 2023. North America is a global center for technical innovation and entrepreneurship, especially in Silicon Valley, the United States. The region is home to many leading AI chip manufacturers, technology giants, startups, research institutions, and venture capital firms that drive innovation and investment in AI hardware technologies.Recent Strategies Deployed in the Market

- May-2024: Quest Diagnostics Incorporated took over PathAI Diagnostics, a leading laboratory services company based in Memphis, TN. Through this acquisition, Quest Diagnostics would expedite the uptake of digital and AI pathology advancements for enhancing the quality, speed, and efficiency of diagnosing cancer and other illnesses.

- Feb-2024: Abbott Laboratories came into partnership with Fujirebio, a Japanese multinational biotechnology company. Through this partnership, Abbott Laboratories would create a research-only neurofilament-light chain (Nf-L) neurology biomarker assay for use with Abbott’s Alinity® i.

- Jan-2024: Neogenomics, Inc. came into partnership with ConcertAI LLC, a biotechnology research company. Through this partnership, Neogenomics, Inc. would advance broad-scale hematological research solutions for exploring real-world clinical practices and outcomes in hematological malignancies.

- Oct-2023: Qiagen N.V. came into partnership with Myriad Genetics, an American genetic testing and precision medicine company. Through this partnership, provide inventive services and products to pharmaceutical firms, facilitating the creation and launch of exclusive cancer tests for the U.S. clinical market, and supplying distributable companion diagnostic test kits worldwide.

- Feb-2023: Siemens Healthineers AG came into partnership with Unilabs, a leading diagnostic services provider. Through this partnership, Siemens Healthineers would improve Unilabs' laboratory operations, and throughput, and ensure clinical equivalence throughout its testing network.

List of Key Companies Profiled

- Intel Corporation

- NVIDIA Corporation

- IBM Corporation

- Micron Technology, Inc.

- Qualcomm Incorporated (Qualcomm Technologies, Inc.)

- Samsung Electronics Co., Ltd. (Samsung Group)

- Apple, Inc.

- Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.)

- Texas Instruments, Inc.

- NXP Semiconductors N.V.

Market Report Segmentation

By Computing Technology- Cloud Computing

- Edge Computing

- Inference

- Training

- GPU

- CPU

- FPGA

- ASIC

- Others

- Consumer Electronics

- Automotive

- Healthcare

- Manufacturing

- Retail & E-Commerce

- BFSI

- Marketing

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Intel Corporation

- NVIDIA Corporation

- IBM Corporation

- Micron Technology, Inc.

- Qualcomm Incorporated (Qualcomm Technologies, Inc.)

- Samsung Electronics Co., Ltd. (Samsung Group)

- Apple, Inc.

- Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.)

- Texas Instruments, Inc.

- NXP Semiconductors N.V.