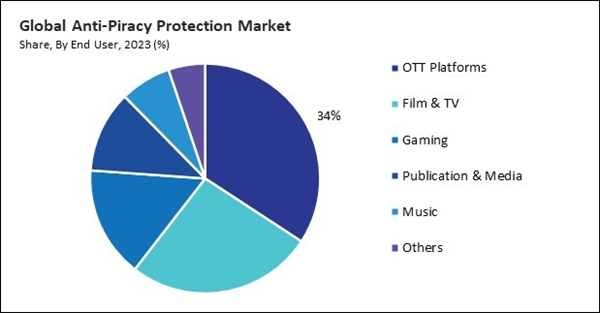

OTT platforms operate on subscription-based revenue models, generating revenue from subscriber fees rather than individual content purchases. OTT platforms and streaming services offer a vast array of digital content, including TV shows, movies, music, and original programming. According to Chartmasters, Spotify’s subscriber base is strong, with 236 million paid users from a total market of 667 million. Spotify claims 60% of top hits’ global streams. Hence, the OTT platforms segment procured 34% revenue in the market in 2023. As consumers increasingly shift towards digital content consumption, the demand for effective anti-piracy protection grows to safeguard the valuable intellectual property on these platforms. Piracy undermines these revenue streams by providing free or unauthorized access to premium content, leading to potential subscriber churn and revenue loss.

With the rise of digital content consumption, there’s a corresponding increase in the volume and variety of online content. This expanded target surface provides more opportunities for pirates to exploit, necessitating robust anti-piracy measures to protect digital assets across various formats, including music, movies, ebooks, software, and video games. Piracy undermines these revenue streams by offering unauthorized access to content for free or at a significantly reduced cost. Therefore, increasing digital content consumption is driving the growth of the market.

Additionally, Consumers increasingly value high-quality content, including movies, music, software, games, and literature. Legal content distribution platforms ensure that consumers have access to content that meets industry standards for quality, reliability, and authenticity. Anti-piracy protection helps maintain the integrity of legitimate content by preventing the unauthorized distribution of low-quality or altered versions of copyrighted material. Anti-piracy protection ensures that consumers who obtain content legally can fully enjoy these additional benefits without the risks associated with pirated material. Hence, consumer demand for quality and legal content propels the market's growth.

However, implementing advanced anti-piracy technologies, such as digital rights management (DRM), encryption, and watermarking, requires substantial initial investment. This includes purchasing software licenses and hardware and integrating these systems into existing infrastructure. For SMEs with limited budgets, these upfront costs can be prohibitively expensive. Beyond initial costs, maintaining and updating anti-piracy systems involves continuous expenses. This includes software updates, renewing licenses, and employing technical staff to manage and operate the systems. For smaller companies, these recurring costs can strain financial resources. In conclusion, high implementation costs are impeding the growth of the market.

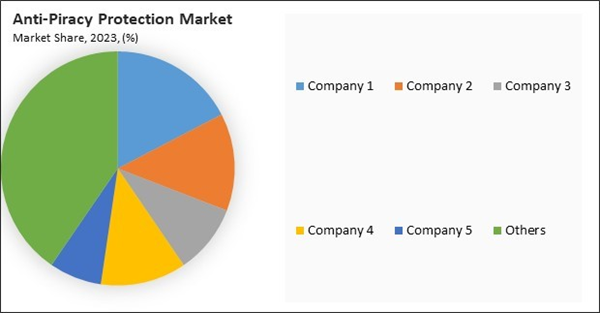

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Driving and Restraining Factors

Drivers- Increasing Digital Content Consumption

- Rising Consumer Demand For Quality And Legal Content

- Rise Of Ott Platforms And Streaming Services

- High Implementation Costs

- Limited Awareness And Perceived Necessity

- Expansion Of The Online Gaming Industry

- Growth In Demand For The Adoption Of Cloud-Based Solutions

- Evolving Piracy Techniques

- Resistance From Consumers And Distributors

End Users Outlook

On the basis of end users, the market is segmented into film & TV, OTT platforms, publications & media, gaming, music, and others. In 2023, the film & TV segment procured 26% revenue share in the market. Film and TV content represents high-value intellectual property with significant production, distribution, and marketing investments. Piracy of movies and TV shows leads to substantial revenue losses for production studios, distributors, and content creators. Protecting this valuable content from unauthorized copying, distribution, and viewing is a top priority for film and TV industry stakeholders.Component Outlook

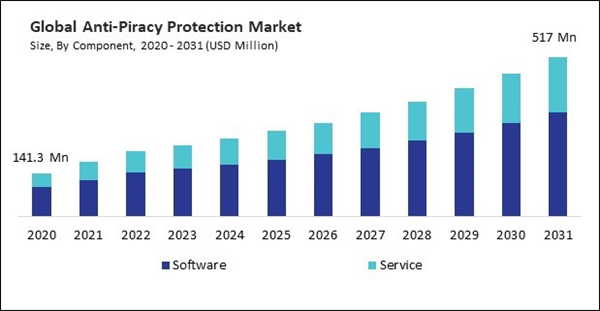

Based on component, the market is divided into service and software. The service segment attained 33% revenue share in the market in 2023. Anti-piracy services are provided by specialized firms with expertise in identifying and combating piracy. These firms employ professionals who are well-versed in the latest piracy trends, technologies, and legal frameworks. Service providers offer comprehensive solutions that go beyond simple software tools, including legal support, forensic analysis, and strategic advice.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region witnessed 37% revenue share in the market in 2023. North America is home to a large market for digital content, including movies, TV shows, music, software, video games, and ebooks. The high level of digital content consumption in North America creates a significant demand for anti-piracy protection to safeguard intellectual property rights and revenue streams for content creators, distributors, and rights holders.List of Key Companies Profiled

- Akamai Technologies, Inc.

- Cisco Systems, Inc.

- Digimarc Corporation

- Irdeto B.V. (Naspers)

- Red Points Solutions S.L.

- Synamedia

- Castlabs GmbH

- Friend MTS Limited

- Kudelski Group

- Brightcove, Inc.

Market Report Segmentation

By Component- Software

- Service

- OTT Platforms

- Film & TV

- Gaming

- Publication & Media

- Music

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Akamai Technologies, Inc.

- Cisco Systems, Inc.

- Digimarc Corporation

- Irdeto B.V. (Naspers)

- Red Points Solutions S.L.

- Synamedia

- Castlabs GmbH

- Friend MTS Limited

- Kudelski Group

- Brightcove, Inc.