Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the industry encounters substantial obstacles stemming from rigorous regulatory standards for sterilization and medical device approval. Producers are required to manage intricate compliance obligations across various jurisdictions, including the European Medical Device Regulation, which can drive up manufacturing expenses and postpone the launch of new product variations. Such regulatory pressures burden manufacturers and may limit the pace at which novel bur designs are introduced to clinical environments, consequently hindering the rapid expansion of the market.

Market Drivers

The primary catalyst for the Global Dental Burs Market is the increasing prevalence of dental caries and periodontal diseases. As oral health issues become more common, there is a corresponding rise in endodontic, restorative, and periodontic treatments, creating a constant need to replace rotary cutting tools. This uptick in clinical activity is highlighted by data from the NHS Business Services Authority's August 2024 report, 'NHS Dental Statistics for England 2023/24', which notes that 34 million dental treatment courses were administered, a 4.3% increase over the prior year. This elevated procedural volume supports demand for various bur types, ranging from aggressive diamond abrasives to finishing tungsten carbide burs, thereby securing consistent revenue for suppliers serving both private practices and public health systems.Simultaneously, market dynamics are being reshaped by the integration of Computer-Aided Design and Manufacturing (CAD/CAM) systems and advances in bur materials. Companies are increasingly investing in R&D to create high-precision tools suitable for milling lithium disilicate and zirconia, materials critical to contemporary digital dentistry. This dedication to innovation is illustrated by Dentsply Sirona's '2023 Sustainability Report' from March 2024, which detailed an R&D investment exceeding $184 million - a 6% year-over-year increase - focused largely on digital advancements. Additionally, the commercial success of these sophisticated instruments drives broader market performance; the Straumann Group reported CHF 2.4 billion in full-year revenue for 2023 in 2024, largely attributed to the worldwide uptake of implantology solutions and digital workflows.

Market Challenges

The Global Dental Burs Market currently faces significant headwinds due to increasingly rigorous regulatory frameworks, specifically regarding sterilization protocols and medical device authorization. Manufacturers are compelled to navigate complex compliance landscapes, such as the European Medical Device Regulation, which necessitate comprehensive clinical proof and strict documentation. These regulatory demands considerably raise operational expenses and shift vital resources away from research and development efforts, directly slowing the introduction of new bur geometries and materials to the market.Consequently, companies suffer from extended approval periods, postponing the commercialization of product variations and limiting their agility in addressing clinical requirements. The gravity of this situation is underscored by 2024 data from MedTech Europe, which indicates that certification and maintenance expenses under the MDR have surged by 100% or more relative to earlier directives, while the selection of the EU as a primary launch region by major medical device firms has declined by 40%. These obstacles not only drive up costs for end-users but also establish barriers to entry for smaller entities, effectively hindering the broader growth of the global market.

Market Trends

The Global Dental Burs Market is undergoing a decisive transformation driven by advancements in minimally invasive micro-preparation tools, a trend accelerated by the global regulatory phase-out of dental amalgam. With the European Union enforcing a total ban on amalgam starting in January 2025, clinicians are compelled to adopt composite and glass-hybrid restoratives that require distinct cavity preparation protocols compared to traditional metal fillings. Unlike the aggressive cutting required for amalgam retention, modern adhesive materials demand ultra-conservative, high-precision burs designed to preserve maximum healthy tooth structure. This transition toward conservative dentistry is quantitatively reflected in the financial results of key manufacturers; Coltene Holding AG's March 2025 'Annual Report 2024' noted a 7.3% sales increase in local currencies within its Dental Preservation & Improvement division, highlighting the rising clinical demand for consumables supporting these preservation techniques.At the same time, the market is being reshaped by the proliferation of specialized zirconia-cutting diamond instruments, a direct response to the widespread use of monolithic zirconia in implant and restorative dentistry. Although zirconia provides excellent durability and aesthetics, its extreme hardness makes adjustment and removal difficult, often destroying standard diamond burs and creating excess heat that risks pulp damage. In response, manufacturers are developing specialized instruments with optimized grit sizes and advanced bonding matrices designed to cut zirconia efficiently without damaging the ceramic or the bur. The expansion of the implant and zirconia ecosystem fuels this niche; the Straumann Group's 'Half-Year Report 2025' from August 2025 reported 10.2% organic revenue growth, largely due to the continued uptake of its premium restorative and implant solutions, which necessitates a parallel supply of robust, material-specific cutting tools for chairside adjustments.

Key Players Profiled in the Dental Burs Market

- Dentsply Sirona Inc.

- Coltene Holding AG

- Shofu Dental Corp

- Mani Inc.

- Brasseler U.S.A., Inc.

- Prima Dental Manufacturing Ltd.

- Diatech USA

- KOMET USA LLC

- Kerr Corp

- Ivoclar Vivadent Inc.

Report Scope

In this report, the Global Dental Burs Market has been segmented into the following categories:Dental Burs Market, by Material:

- Diamond Burs

- Stainless Steel

- Carbide

Dental Burs Market, by Application:

- Cavity Preparation

- Oral Surgery

- Implantology

- Orthodontics

- Others

Dental Burs Market, by End-Use:

- Hospitals

- Dental Clinics

- Others

Dental Burs Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Dental Burs Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Dental Burs market report include:- Dentsply Sirona Inc.

- Coltene Holding AG

- Shofu Dental Corp

- Mani Inc.

- Brasseler U.S.A., Inc.

- Prima Dental Manufacturing Ltd

- Diatech USA

- KOMET USA LLC

- Kerr Corp

- Ivoclar Vivadent Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

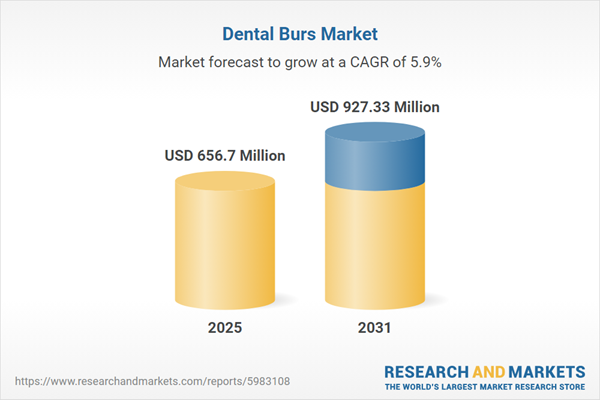

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 656.7 Million |

| Forecasted Market Value ( USD | $ 927.33 Million |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |